Bitcoin (BTC) starts a new week in familiar territory as markets move into the United States’ 2020 elections — where could it go next?

Cointelegraph takes a look at five factors that could influence BTC price action in the week ahead.

US macro: Elections vs. stimulus

The U.S. is the firm focal point when it comes to macro markets this week. The Nov. 3 elections promise to set the mood as it becomes more apparent which side will control the White House.

Analysts have warned that a Democrat win would dent the dollar, the long-term prospects for which are already shaky. Donald Trump’s reelection, however, would not be enough to keep the greenback out of danger, Goldman Sachs said last week.

By extension, calls are coming for safe-haven gold to make serious progress upwards after November — regardless of the election outcome. For others, however, it is Bitcoin that will profit more impressively.

The dollar’s strength remains on the radar of Bitcoiners thanks to the inverse correlation between BTC/USD and the U.S. dollar currency index (DXY). Despite this correlation becoming less apparent in recent weeks, a sudden weakening of USD has the potential to be a boon for the largest cryptocurrency.

U.S. dollar currency index 6-month chart. Source: TradingView

Not only elections, meanwhile, but what comes before is a topic of interest. Specifically, fresh hints have come over a Coronavirus stimulus deal being done before polling day.

Should this occur, several trillion dollars of liquidity will add to the burgeoning U.S. debt pile, with Americans seeing perks such as another $1,200 stimulus check.

Europe hints at more intervention

In Europe, the picture revolves around the European Central Bank’s (ECB) own response to the Coronavirus, which continues to tighten its grip across the continent.

Speaking to French newspaper Le Monde on Monday, ECB president Christine Lagarde said that more financial tools were left to be deployed to support the eurozone if necessary. In addition, the ECB’s $878 billion recovery fund should become a permanent feature.

The bank’s Coronavirus stimulus program amounted to €1.5 trillion in asset purchases.

“The options in our toolbox have not been exhausted,” she said.

“If more has to be done, we will do more. On taking up my position, I was told that there was nothing left for me to do, that everything had been done. But that was clearly not the case!”

The potential for instability in the eurozone is compounded by Brexit, which is increasingly heading towards the “no deal” walk out of the bloc by the United Kingdom.

When prime minister Boris Johnson announced the likely outcome of the process last week, however, markets barely reacted to the news.

Bitcoin fundamentals hit new records

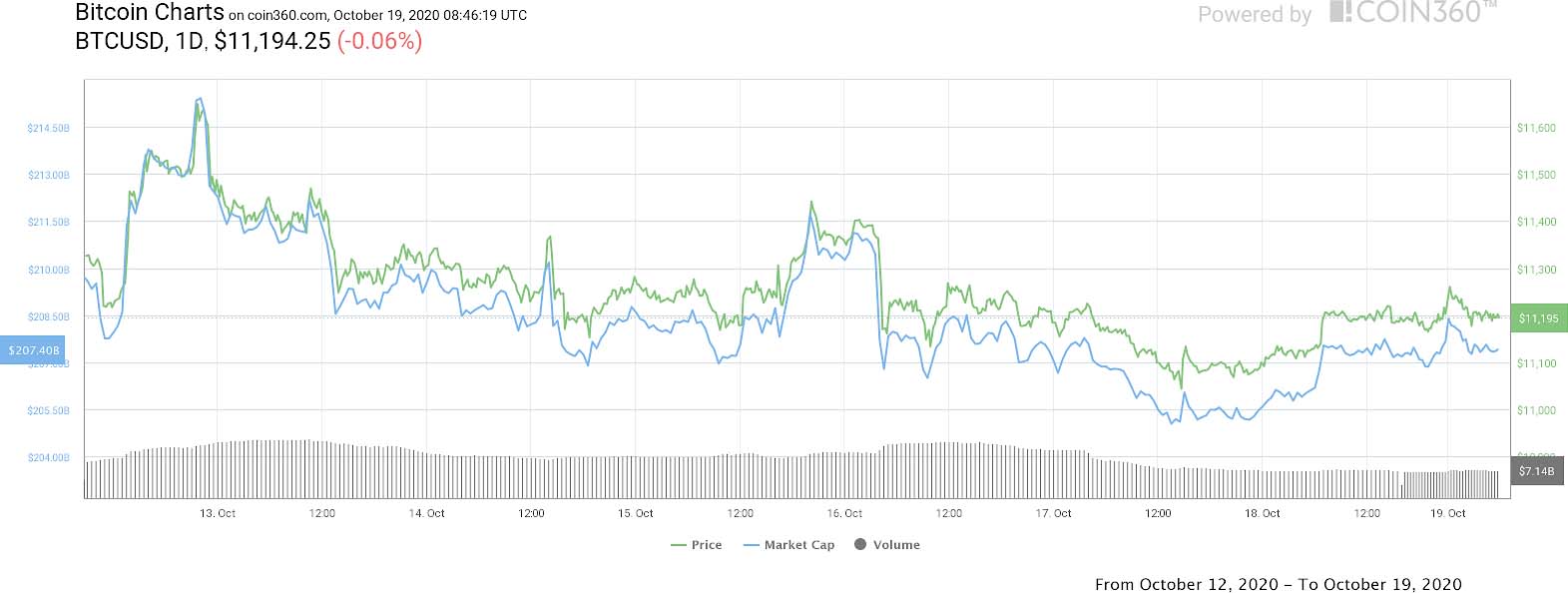

Bitcoin stayed practically rangebound over the weekend, with only a brief spike above $11,500 contrasting the flat activity.

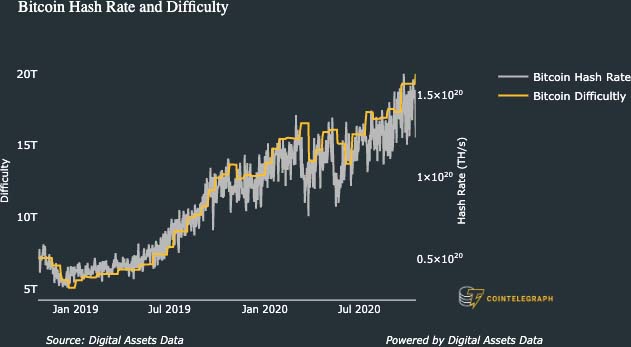

Despite this, on a technical level, signs of record strength continue pouring in this month. The difficulty, which provides an estimate of miner competition and network security, is now back at all-time highs.

Two days ago, the latest readjustment saw difficulty increase by a larger-than-expected 3.5%.

At the same time, the hash rate also climbed to a new average all-time high on Monday. At press time, the estimated computing power dedicated to mining stood at 146 exahashes per second (EH/s).

As Cointelegraph often reports, the popular theory that price follows hash rate remains firmly in force as miners are more bullish than ever on Bitcoin as a long-term investment prospect.

Bitcoin 7-day average hash rate 1-month chart

Analyst eyes $12,000 BTC price breakout

For Cointelegraph Markets analyst Michaël van de Poppe, a pivotal price transformation for Bitcoin is becoming more and more plausible.

In his latest video update on Sunday, he highlighted that several years of weekly closes below the significant resistance level of $12,000 should soon come to an end.

Since the start of the bear market in early 2018, $12,000 has formed a rejection point for the weekly chart, but consolidation below cannot last forever, Van de Poppe argued.

“It’s very likely that we’re going to make a rally towards the area of $16,000 to $17,000 as that’s the obvious level and the final hurdle for Bitcoin to start breaking all-time highs,” he summarized.

Such a move would be followed by another consolidation period which could well be longer in duration than the current one. Nonetheless, if a bull market materializes, it will be Bitcoin-fuelled.

“The main driver of the next bull market will still be Bitcoin,” Van de Poppe added, recommending that viewers make an effort to accumulate BTC even in the $16,000 range.

“$11,400 is still a very cheap price per Bitcoin,” he added in a tweet.

BTC/USD 7-day price chart. Source: Coin360

Greed is back on the menu

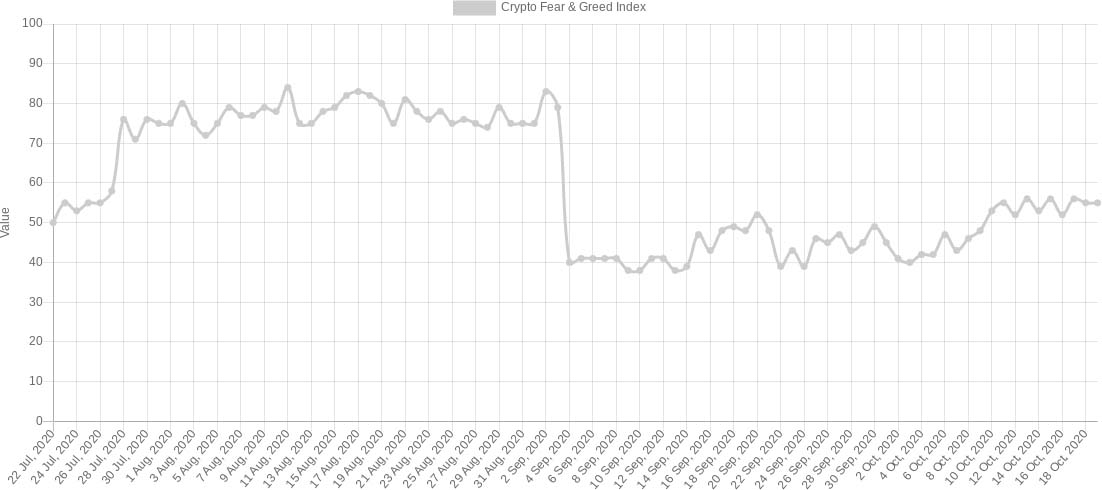

In line with gradually increasing price strength comes investors sentiment, which according to one indicator is getting greedier.

In its latest market reading, the Crypto Fear & Greed Index is back in “greed” territory, having edged up from “neutral” over the past week.

This suggests that sentiment among Bitcoin investors is anticipating a bullish advance, but there’s a caveat — if price increases too fast, “greed” will become “extreme greed,” under which circumstances the Index says a correction is much more likely.

Crypto Fear & Greed Index as of Oct. 19. Source: Alternative.me

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Shiba Inu eyes positive returns in April as SHIB price inches towards $0.000015

Shiba Inu's on-chain metrics reveal robust adoption, as addresses with balances surge to 1.4 million. Shiba Inu's returns stand at a solid 14.4% so far in April, poised to snap a three-month bearish trend from earlier this year.

AI tokens TAO, FET, AI16Z surge despite NVIDIA excluding crypto-related projects from its Inception program

AI tokens, including Bittensor and Artificial Superintelligence Alliance, climbed this week, with ai16z still extending gains at the time of writing on Friday. The uptick in prices of AI tokens reflects a broader bullish sentiment across the cryptocurrency market.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week. This week’s rally was supported by strong institutional demand, as US spot ETFs recorded a total inflow of $2.68 billion until Thursday.

XRP price could renew 25% breakout bid on surging institutional and retail adoption

Ripple price consolidates, trading at $2.18 at the time of writing on Friday, following mid-week gains to $2.30. The rejection from this weekly high led to the price of XRP dropping to the previous day’s low at $2.11, followed by a minor reversal.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.