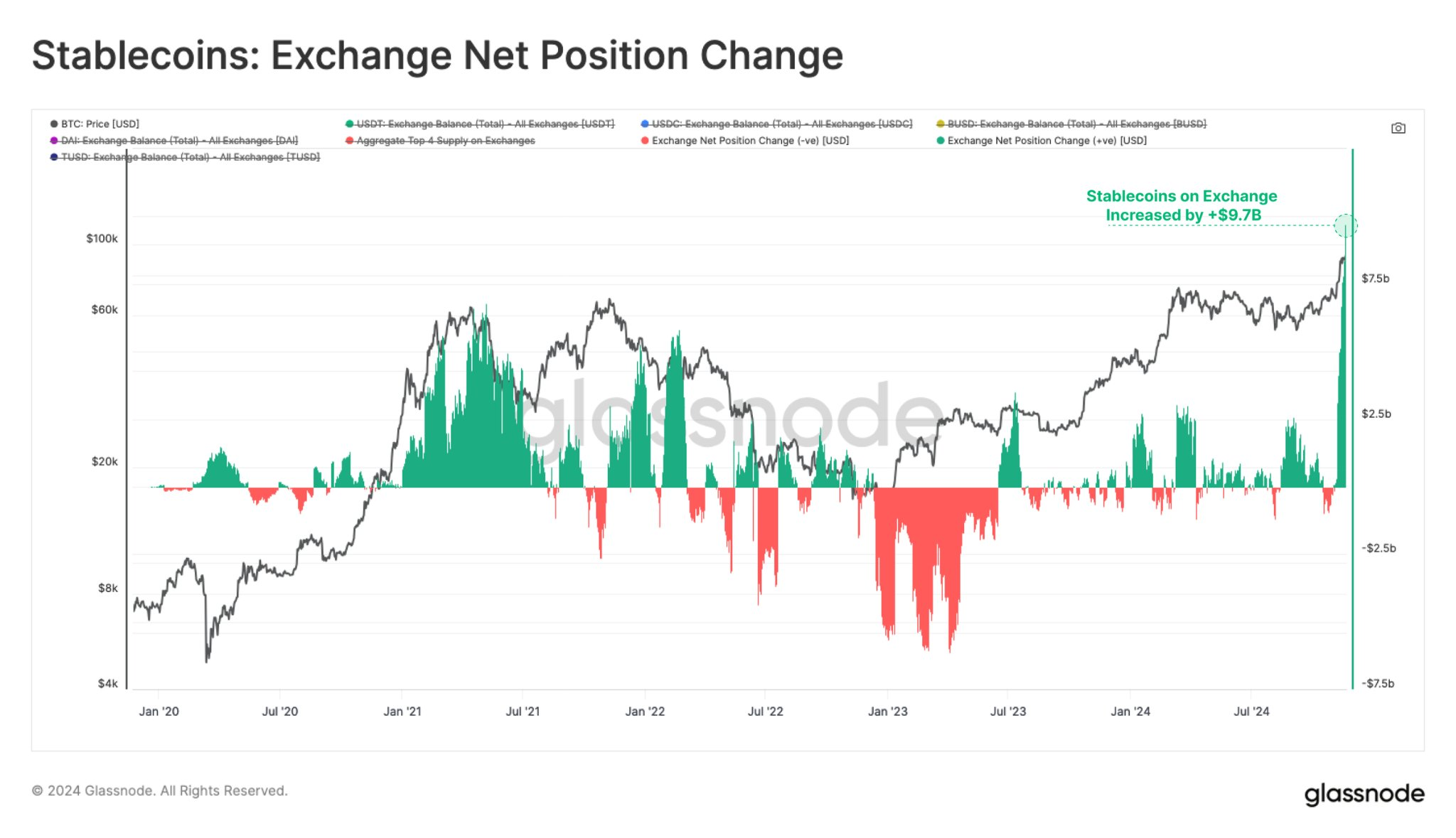

Stablecoin flows to crypto exchanges reached a record monthly high, signaling increased investor interest in the market. The surge may position Bitcoin to reach the $100,000 milestone before the end of November.

Stablecoin inflows to crypto exchanges hit a new monthly high of more than $9.7 billion.

This may signal an uptick in crypto investor demand, according to Leon Waidmann, head of research at The Onchain Foundation, who said in a Nov. 21 X post:

Stablecoin inflows to exchanges hit $9.7B in 30 days! The LARGEST monthly inflow EVER. Stablecoin liquidity is back. Speculative demand continues to explode!

Stablecoin net inflows to exchanges. Source: Leon Waidmann

The record monthly stablecoin inflows may put Bitcoin (BTC $97,343) on track to $100,000 before the end of November, historically the most bullish month for BTC returns.

Increasing stablecoin inflows to crypto exchanges can signal incoming buying pressure and growing investor appetite, as stablecoins are the main investor on-ramp from fiat to the crypto world.

Related: MicroStrategy increases note sales to $2.6B for Bitcoin purchases

Can record stablecoin inflows push Bitcoin beyond $100,000?

Increasing stablecoin inflows can significantly impact the price of the world’s first cryptocurrency.

Tether minted $1.3 billion worth of USDT (USDT $1.00) from Aug. 5-9 as Bitcoin bottomed at a five-month low of $49,500 before starting to recover. Bitcoin staged a 21% recovery to $60,200 by Aug. 9, bolstered by Tether.

Some analysts expect Bitcoin to reach $100,000 before the end of the month, including Ryan Lee, chief analyst at Bitget Research, who told Cointelegraph:

If history repeats itself and Bitcoin prices grow as projected, a 14.7% from the current price level will push the coin well above the $100,000 target for the month. The post-halving cycle trend is also very positive when projecting the future of Bitcoin.

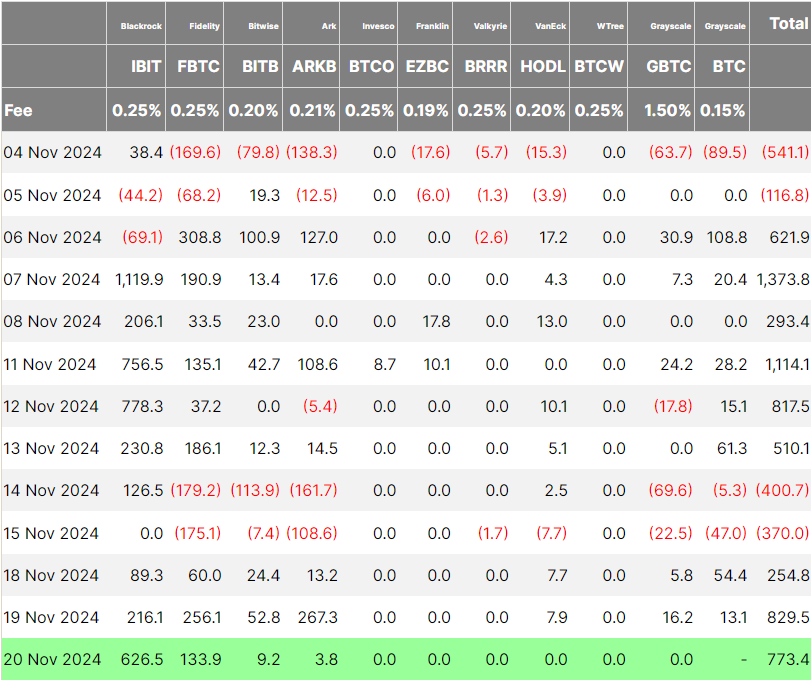

Bitcoin ETF Flow (USD, million) Source: Farside Investors

Spot Bitcoin exchange-traded fund (ETF) inflows also continue supporting Bitcoin’s price appreciation. The US Bitcoin ETFs amassed over $773 million worth of cumulative net positive inflows on Nov. 20, marking the third green day in a row, Farside Investors data shows.

The US spot Bitcoin ETFs recorded their sixth consecutive week of net positive inflows after amassing over $1.67 billion in the trading week of Nov. 11–15.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Crypto Today: Metaplanet raises $10M to buy BTC, ETH price moves below $1,600 as Tron gains signals panic

The cryptocurrency aggregate market capitalization stabilized around $2.7 trillion on Wednesday, with Bitcoin’s $84,000 support momentarily anchoring the market against external bearish discourses.

Chainlink active addresses drop as whale selling spikes, could LINK crash below $10?

Chainlink active addresses slide dramatically to 3,200 from February’s peak of 9,400. The downtrend in network activity coincides with increasing selling activity among whales with between 10 million and 100 million LINK.

Bitcoin stabilizes around $83,000 as China opens trade talks with President Trump’s administration

Bitcoin is stabilizing around $83,500 at the time of writing on Wednesday after facing multiple rejections around the 200-day EMA at $85,000 since Saturday. A breakout of this strong level would indicate a bullish trend ahead.

Binance Chain completes $914M BNB token burn, hinting at a potential rally

Binance Chain has finalized its programmed 31st quarterly BNB token burn, potentially setting the stage for the world’s fifth-largest cryptocurrency, with a market capitalization of $81.45 billion, to rally in the coming weeks.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.