Reasons why XRP’s green candle for this week means nothing inside Ripple’s bear cycle

- Ripple price action sees bulls trying a final bounce off the monthly S1 from August.

- XRP price rather set to close in nomads land as bearish elements stay untouched.

- Expect to see more downturns to come as the bear cycle starts to catch a second breath.

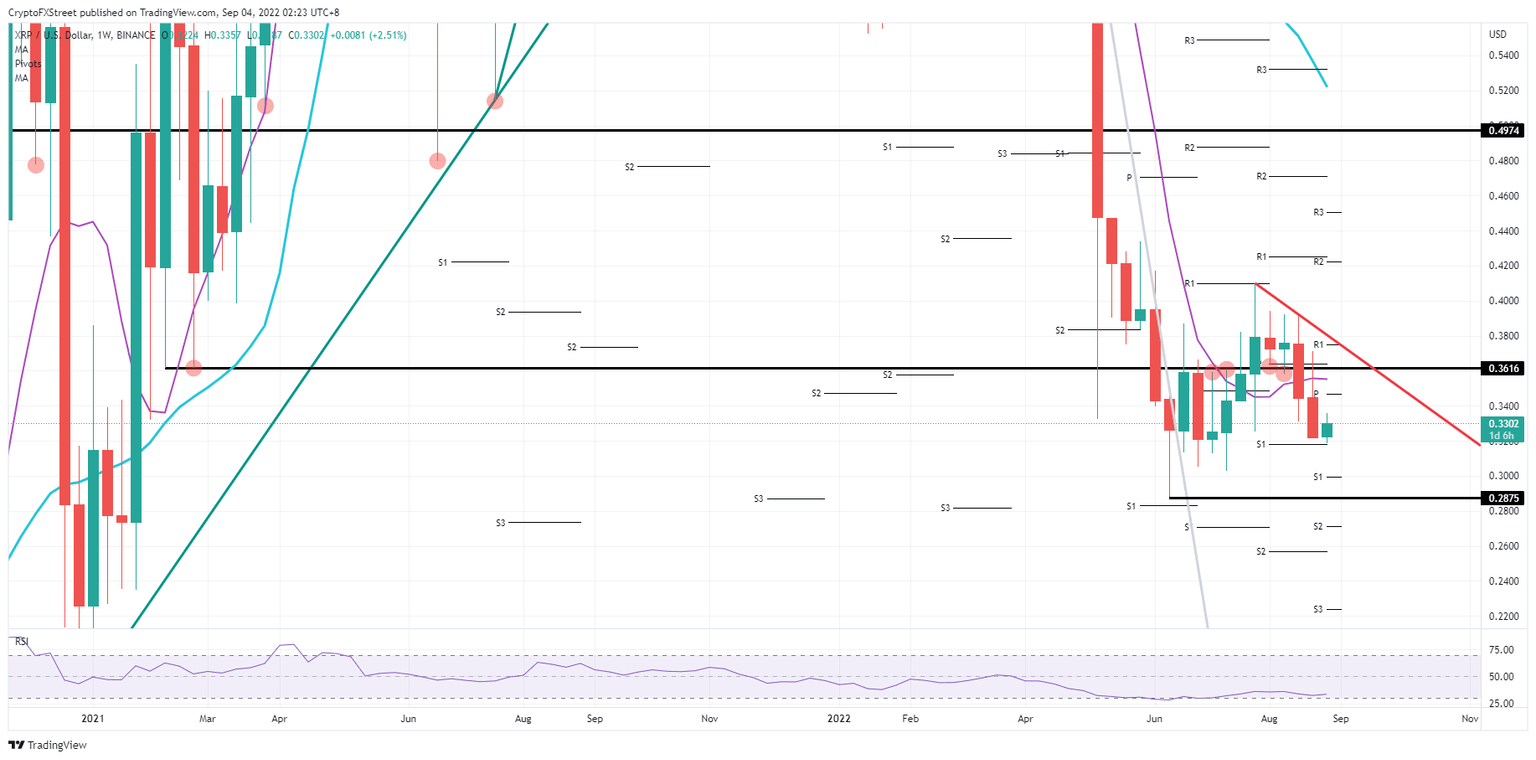

Ripple (XRP) price is set to tank substantially lower in the coming weeks as price action sees bulls trying to make a fist against the bear cycle. Although courageous, it does not seem to be going anywhere, and it offers bears a window of opportunity to add more short positions. Expect a full paring back of the rally from June and price action to tick back at $0.2875 in the coming two or three weeks.

XRP price set to drop 14%

Ripple price sees bulls trying to perform a bounce off the monthly S1 support from August that looks to be turning into a short-term success as the close of Sunday nears. Unfortunately, bulls have not played this very well, and XRP price action is at risk of closing in nomads land, nowhere near any important hurdles or levels that could see a follow-through into next week. Should markets open on the back foot on Monday morning in the ASIA PAC session, the rally from this week could easily be beheaded and see a full paring back of the current gains.

XRP price at risk of slipping a leg lower towards the new S1 for September near $0.3. From there already, most of the rally since June will have evaporated into thin air. Only a few percentages to hit that $0.2875 and having performed a swing trade back to its origin as the bear cycle remains in place with the red descending trend line and the 55-day Simple Moving Average as nearby and short-term caps.

XRP/USD Weekly chart

The only thing that could salvage this bullish signal is some outside help. That means that global markets would need to come in and save the day, with investors buying in large sizes risk assets like equities and cryptocurrencies. For that, look for equity markets to be on the front foot, preferably Nasdaq up multiple percentages for the trading day and by this creating a tailwind for cryptocurrencies, to see XRP price rally towards $0.3616.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.