Pyth Price Prediction: 10% correction likely for PYTH as bears make a comeback

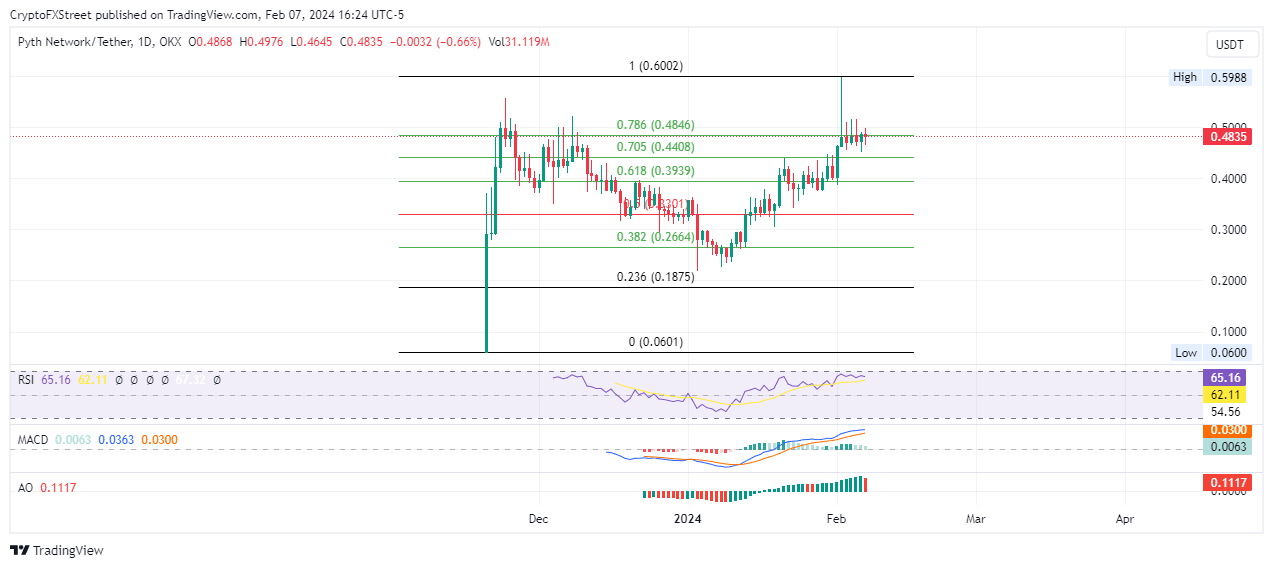

- Pyth price has completed a V-shaped recovery rally; next directional bias to present soon.

- PYTH could drop 10%, retracing to the 70.5% Fibonacci level at $0.4408 as bearish momentum gains strength.

- Invalidation of the bearish thesis will occur if the price clears the $0.5988 range high and records a higher local top.

Pyth (PYTH) price has been on a recovery rally, recording a full cycle swing to the 78.6% Fibonacci level at $0.4846. The altcoin is working out its next directional bias with a clear tug between bulls and bears.

Also Read: Pyth Network could enter price discovery mode if PYTH bulls defend $0.427

Pyth price risks 10% correction

Pyth (PYTH) price could drop 10% to find support around the 70.5% Fibonacci level at $0.4408 as the bears steadily gain ground over the bulls. This is seen in the subdued Relative Strength Index (RSI), which is moving horizontally. The histogram bars of the Moving Average Convergence Divergence (MACD) are also losing their green feel, paling out as those of the Awesome Oscillator (AO) indicator turn red.

If the bears have their way, Pyth price could slip below the 70.5% Fibonacci level at $0.4408, extending the fall to the most critical retracement level, 61.8% at $0.3939. If this level fails to hold as support, the altcoins market value could roll over, potentially retesting the 50% Fibonacci level at $0.3301.

PYTH/USDT 1-day chart

Conversely, increased buying pressure among the bulls could see the Pyth price overcome resistance due to the 78.6% Fibonacci. For the bearish supposition to be invalidated, however, the price of the cryptocurrency must clear the range high of $0.5988, and record a new local top above it.

This is plausible, considering the RSI position at 65 shows there is still more room to the north before PYTH was considered overbought. The position of the MACD and AO indicators in positive territory also accentuates the bullish outlook, showing the bulls continue to maintain a strong presence in the PYTH market.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.