Pro-XRP attorney suggests SEC could potentially lose trial against individual defendants

- Pro-XRP attorney Jeremy Hogan's analysis suggests that the SEC faces limited strategic options in the Ripple lawsuit.

- XRP's price remains sluggish amid broader market trends despite rejection of SEC's appeal.

- The SEC may still appeal the decision after the trial, according to legal expert John Reed Stark.

In the ongoing legal battle between Ripple Labs and the U.S. Securities & Exchange Commission (SEC), attorney Jeremy Hogan – who is known for supporting Ripple in its legal battle against the regulator – has raised questions about the SEC's strategic choices. Hogan's analysis indicates that the federal agency may have limited options in the Ripple case, even if they achieve success in an appeal.

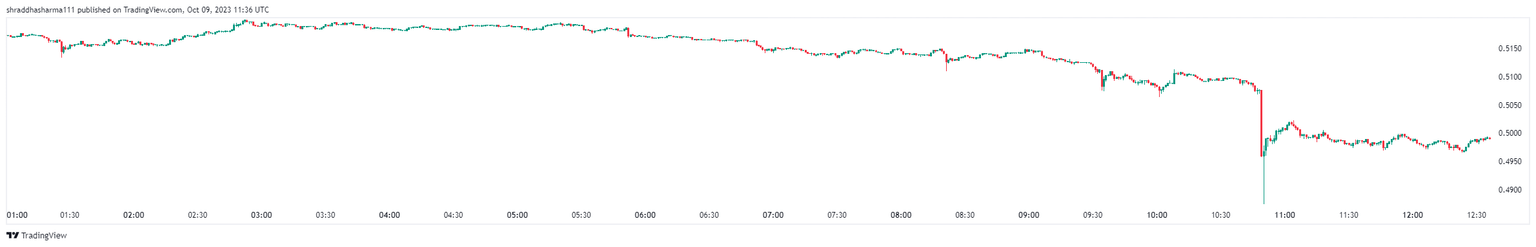

The statement comes in the wake of Judge Torres's refusal to grant the SEC an interlocutory appeal. However, the decision hasn’t helped to propel XRP price, which has fallen around 4% in the last 24 hours amid a broadly bearish market trend.

SEC has limited options after Ripple verdict

American attorney Jeremy Hogan, known for his commentary around the Ripple vs. SEC lawsuit, recently shared his thoughts on X (formerly Twitter), on the potential road ahead for the SEC. Hogan explained that if the SEC proceeds with the trial against individual defendants next April, it would lose with a chance of success standing at close to 40%.

"If the SEC goes to trial, an appeal of the case won't be filed until 2025. That means an appellate ruling likely won't come out until 2026," he said.

Hogan said that the case could be sent back to Judge Torres for further litigation even if the SEC wins the appeal.

Hogan explained that if the SEC settles the case against individual defendants and appeals only after the final judgment against Ripple has an associated chance of around 32%. However, the attorney explained that this could expedite the appeal process by around 9-12 months, potentially reaching a resolution by August 2026.

Another option as per the lawyer is the SEC settles all litigation against Ripple and the individual defendants. "Settlement is a good option for the SEC," Hogan said.

Lastly, Hogan acknowledged the possibility of unforeseen developments but assigned it a relatively low chance of happening, at around 9%. He emphasized that this could be a potentially unfavorable option for the SEC, adding, "The Summary Judgment is the law of the land and that can't even possibly change until...2026 at earliest."

Attorney John E. Deaton, who represented XRP holders in the lawsuit, also expressed scepticism about the SEC's chances of winning a trial in the past. He suggested in an interview recently that the agency's options primarily involve dismissal or settlement negotiations.

XRP price does not lift with the verdict

The rejection of an interlocutory appeal in the Ripple SEC lawsuit has had no positive impact on XRP's price. Over the last 24 hours, XRP (XRP) has experienced at least a 4% decline, based on CoinGecko analysis. In the past week, the value decline of 4% to 5% is in line with broader crypto market trends.

XRP/USDT hourly price chart

At the time of writing, XRP is trading under $0.5, with a 24-hour trading volume of $763 million.

Meanwhile, John Reed Stark, President of John Reed Stark Consulting LLC, pointed out that Judge Torres's order noted not to cite her summary judgment decision as precedent. He emphasised, "Judge Torres has specifically deemed her decision as NOT precedent for the rest cryptoverse."

This could be a limited victory for the XRP team, which was unable to lift the price amid the stagnation in crypto prices. Investors will have to wait for the XRP price reaction to future appeals.

Author

Shraddha Sharma

FXStreet

With an educational background in Investment Banking and Finance, Shraddha has about four years of experience as a financial journalist, covering business, markets, and cryptocurrencies.