Cryptocurrency exchange Bitget has reported a 683% increase in its Gen Z users since Donald Trump’s election victory. At the same time, crypto startups have raised more than $1 billion in venture funding, underscoring growing optimism about the industry’s future under the new administration.

Key takeaways:

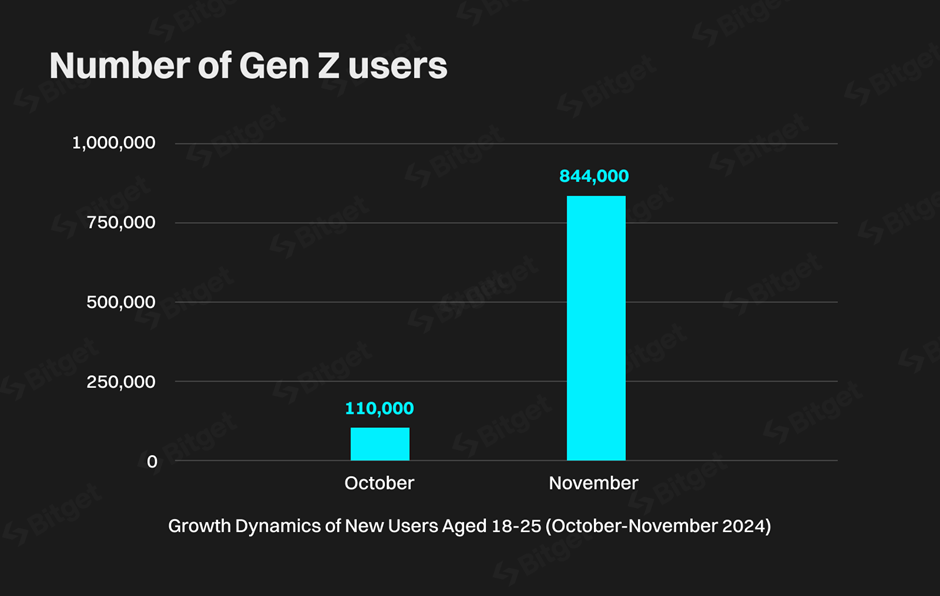

- Record User Growth: Bitget’s new Gen Z users grew 683% in November to 844,000.

- Investment Boom: Crypto startups have raised $1.3 billion since the election, including $796 million in November and $511 million in December.

- Political Momentum: Pro-Trump promises of a national Bitcoin reserve and clear regulations are boosting confidence in the market.

Trump's impact on the Crypto market

The crypto market has responded positively to Trump's victory, with Bitcoin reaching a yearly high of $90,000 in November. Altcoins such as Avalanche (AVAX) and Monero (XMR) have also seen significant gains. The Avalanche Foundation raised $250 million through a private token sale to support a major network upgrade, Avalanche9000, aimed at improving scalability and reducing transaction costs.

Youth as a driver of growth

Generation Z, which demonstrates high-tech literacy and a desire for financial independence, has become one of the key groups of crypto users. According to Bitget, almost half of the platform's users are now aged 18-30.

This audience has actively responded to Trump's promises to make the United States the "crypto capital of the world" and simplify access to digital assets. Pro-Trump appointments such as Paul Atkins as SEC Chairman and David Sacks as the White House’s first crypto coordinator have bolstered confidence in a friendly regulatory environment.

Record Venture capital funding

Since the election, startups have raised nearly $1.3 billion in funding, highlighting VC interest in the sector. Some of the largest deals include:

- $250 million for Avalanche Foundation

- $40 million for infrastructure project Zero Gravity Labs

- $45 million for DeFi startup USDX Money

Global implications for the Crypto industry

These developments mark a new era for the crypto industry. Pro-Trump initiatives aimed at removing barriers for institutional investors are creating a platform for further growth. Venture capital, fueled by positive market sentiment, is helping to drive innovation and new users.

Thus, political changes in the US, coupled with a demographic shift among users, are setting the stage for a new phase of development in the cryptocurrency industry, with young people and venture capitalists playing a leading role.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC, ETH and XRP crash, wiping $1.17 billion from the market

Bitcoin price trades below $98,000 on Friday after declining more than 6% this week. Ethereum and Ripple followed BTC’s footsteps, closing below their key support and declining 12% and 4.5%, respectively, this week.

Bitcoin's trajectory shows similarities with previous cycles as long-term holders book profits of $2.1 billion

Glassnode's Week on Chain report revealed the similarities between the current Bitcoin uptrend and previous cycles amid changing market conditions. Meanwhile, long-term investors began distributing their tokens at the $100K level.

Crypto Today: Hawkish Fed triggers $400B sell-off as meme coins mirror ETH, SOL price dip

The cryptocurrency sector valuation fell below the $3.5 trillion mark on Thursday, with a 10.7% decline reflecting $390 billion worth of outflows. The crypto market dip has been linked to the US Federal Reserve hinting at a hawkish stance for 2025.

Ethereum Price Forecast: ETH may not sustain recent 10% decline despite panic selling from short-term holders

Ethereum declined below the $3,550 key support level on Thursday following bearish pressure from the Federal Reserve's rate cut decision. However, on-chain analysis shows that the price decline may not last long as long-term holders have stayed quiet despite the bearish sentiment.

Bitcoin: BTC reclaims $100K mark

Bitcoin briefly dipped below $94,000 earlier this week but recovered strongly, stabilizing around the $100,000 mark by Friday. Despite these mixed sentiments this week, institutional demand remained strong, adding $1.72 billion until Thursday.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.