SEC vs. Ripple lawsuit ruling could come out as early as July 13, according to this pro-crypto attorney

- Ripple could see the end of the SEC’s lawsuit against the firm as early as July 13, according to Attorney Fred Rispoli.

- Whales distributed their XRP holdings while retail traders accumulated, buying the recent dip in the altcoin.

- XRP is hovering close to $0.42 on Monday.

The Securities and Exchange Commission (SEC) vs. Ripple (XRP) lawsuit could end as early as July 13 or by July 31, according to pro-crypto attorney Fred Rispoli. The lawsuit has been one of the key market movers for the altcoin’s price since 2020. On-chain metrics show whales are distributing their XRP holdings while small wallet investors buy the altcoin.

XRP trades above the $0.42 support on Monday, July 8.

Daily Digest Market Movers: Ripple lawsuit could end soon, according to Attorney Fred Rispoli

- Attorney Fred Rispoli commented on the recent SEC vs. Ripple lawsuit filing, in which the payment remittance firm filed a supplemental authority letter referring to the Binance lawsuit.

- Judge Amy Berman Jackson cited Judge Torres's SEC vs. Ripple ruling on the secondary market sales of cryptocurrencies.

- The SEC responded to Ripple’s letter, and XRP holders are awaiting a ruling on the lawsuit.

- Attorney Rispoli believes that the SEC vs. Ripple lawsuit could end as early as July 13, with Judge Analisa Torres’ ruling.

July 31, although I could see her doing July 13 to be poetic.

— Fred Rispoli (@freddyriz) July 2, 2024

- Alternatively, the ruling could come by July 31.

Just got a notice of a filing in #SECvsRipple and my heart skipped a beat...but don't worry, no ruling just yet. It was @Ripple's notice to Judge Torres of the Binance decision last week.

— Fred Rispoli (@freddyriz) July 2, 2024

- The ruling is expected to address the issue of a settlement/ fine to be imposed on Ripple for its alleged securities law violation and whether XRP is a security or not.

- On-chain metrics show that XRP supply distribution has changed since July 1, with whales shedding their holdings while small investors buy the dip, as seen on Santiment.

XRP supply distribution

- Accumulation by retail investors could help Ripple resist a mass sell-off.

Technical analysis: XRP hovers around $0.42

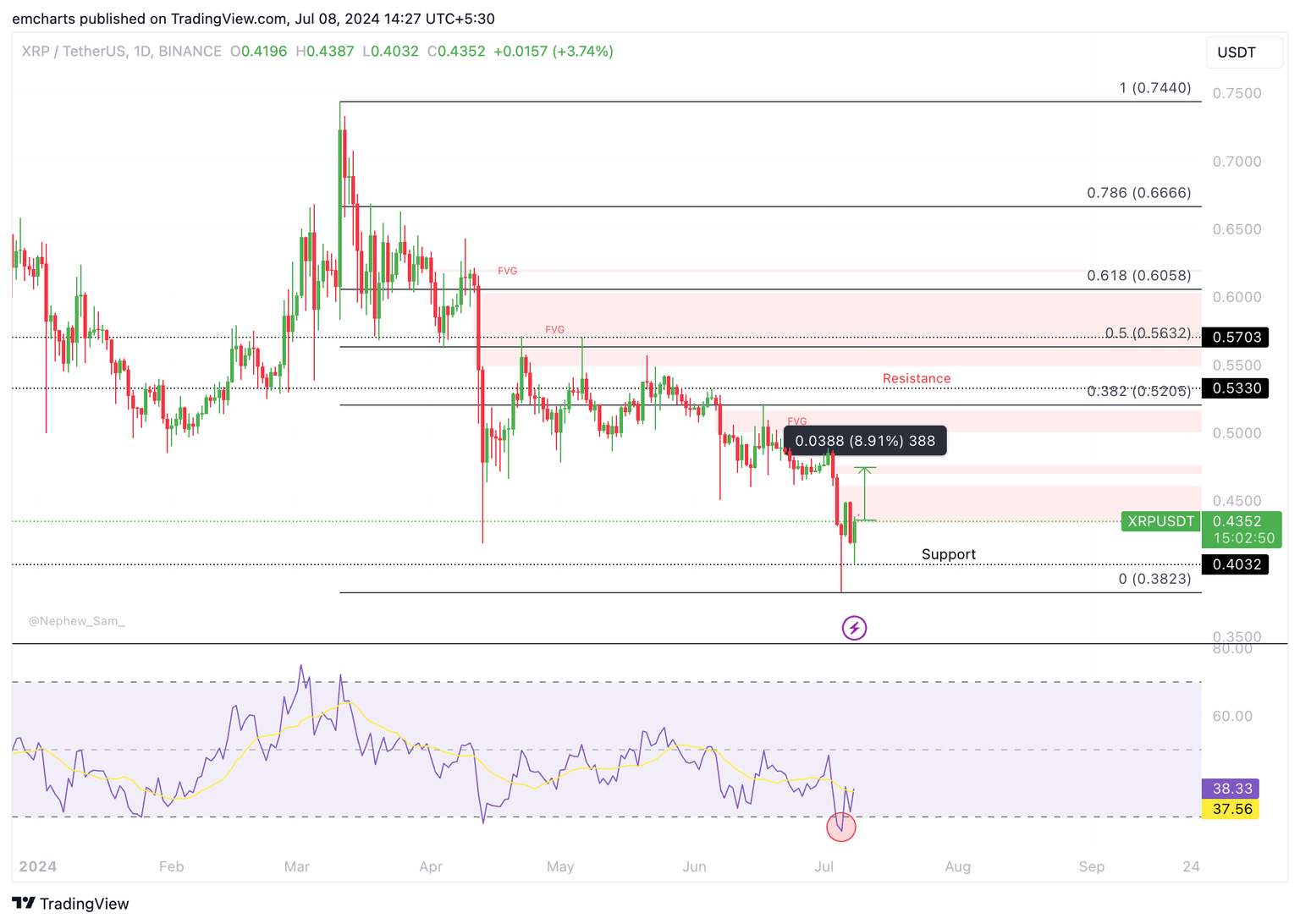

Ripple has been in a state of decline since March 11, dropping from its local peak of $0.7440 to its July 5 low of $0.3823 in its downward trend. Ripple has since recovered from the decline, up to $0.4352 on Monday.

The Relative Strength Index (RSI) reads 38.33. After briefly dipping into the oversold region under 30, XRP has recovered. XRP could rally toward the Fair Value Gap (FVG) between $0.4697 and $0.4760, as seen in the XRP/USDT daily chart below.

XRP/USDT daily chart

In case of a daily candlestick close below $0.4335, the bullish thesis could be invalidated. XRP could then sweep liquidity at the July 5 low of $0.3823.

SEC vs Ripple lawsuit FAQs

It depends on the transaction, according to a court ruling released on July 14: For institutional investors or over-the-counter sales, XRP is a security. For retail investors who bought the token via programmatic sales on exchanges, on-demand liquidity services and other platforms, XRP is not a security.

The United States Securities & Exchange Commission (SEC) accused Ripple and its executives of raising more than $1.3 billion through an unregistered asset offering of the XRP token. While the judge ruled that programmatic sales aren’t considered securities, sales of XRP tokens to institutional investors are indeed investment contracts. In this last case, Ripple did breach the US securities law and will need to keep litigating over the around $729 million it received under written contracts.

The ruling offers a partial win for both Ripple and the SEC, depending on what one looks at. Ripple gets a big win over the fact that programmatic sales aren’t considered securities, and this could bode well for the broader crypto sector as most of the assets eyed by the SEC’s crackdown are handled by decentralized entities that sold their tokens mostly to retail investors via exchange platforms, experts say. Still, the ruling doesn’t help much to answer the key question of what makes a digital asset a security, so it isn’t clear yet if this lawsuit will set precedent for other open cases that affect dozens of digital assets. Topics such as which is the right degree of decentralization to avoid the “security” label or where to draw the line between institutional and programmatic sales are likely to persist.

The SEC has stepped up its enforcement actions toward the blockchain and digital assets industry, filing charges against platforms such as Coinbase or Binance for allegedly violating the US Securities law. The SEC claims that the majority of crypto assets are securities and thus subject to strict regulation. While defendants can use parts of Ripple’s ruling in their favor, the SEC can also find reasons in it to keep its current strategy of regulation by enforcement.

The court decision is a partial summary judgment. The ruling can be appealed once a final judgment is issued or if the judge allows it before then. The case is in a pretrial phase, in which both Ripple and the SEC still have the chance to settle.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.

%2520%5B13.21.52%2C%252008%2520Jul%2C%25202024%5D-638560357346309655.png&w=1536&q=95)