Pre-halving rally? Litecoin surges 43% to 6-month high

Litecoin (LTC) is shining brightly amid the FTX-induced chaos in the crypto market. And the cryptocurrency's outperformance perhaps stems from an impending positive change in its supply dynamics.

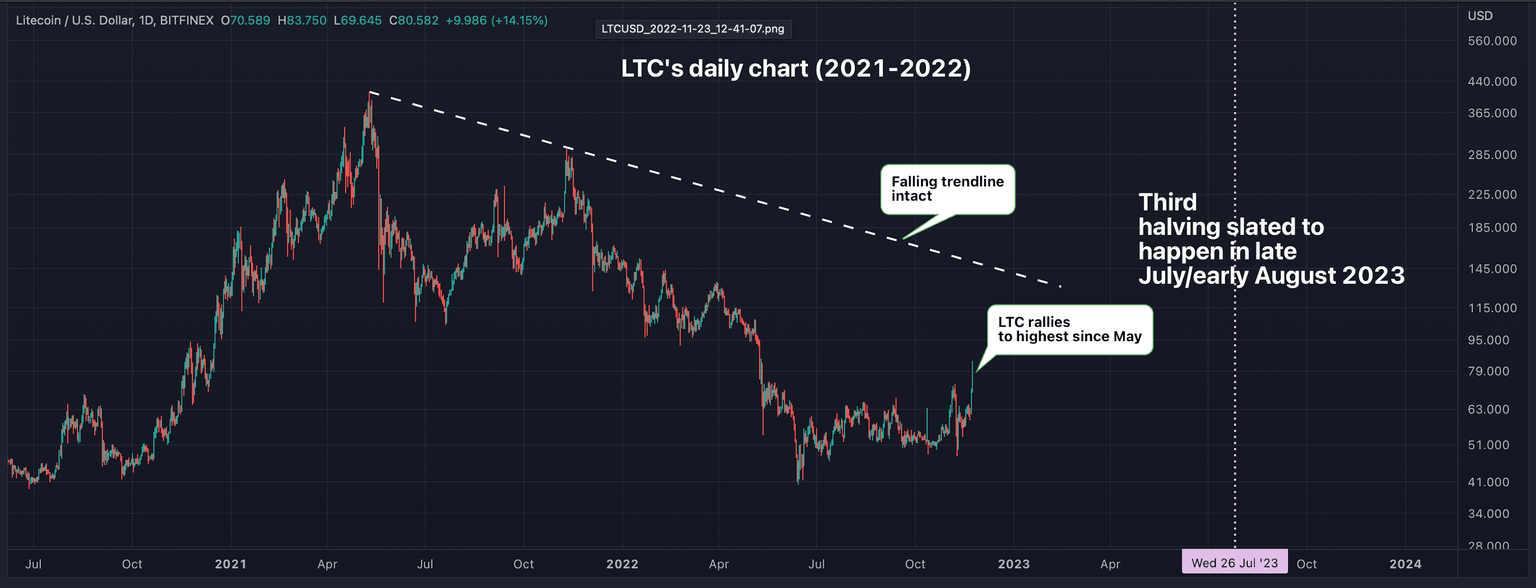

CoinDesk data show LTC has rallied over 43% from $55 to $79 this month, with prices rising 28% in the past 24 hours alone. Market leaders bitcoin and ether have dropped 19% and 26% this month.

LTC's bullish turn comes eight months ahead of Litecoin's third mining reward halving – a programmed code that will reduce rewards or LTC paid to miners for recording transactions on Litecoin's blockchain from 12.5 LTC per block to 6.25 LTC per block.

To crypto natives, LTC's latest rally may be reminiscent of the bearish-to-bullish trend change seen in the months leading up to the previous halvings, dated Aug. 26, 2015, and Aug. 5, 2019.

Historically, litecoin has seen a bearish-to-bullish trend change in months leading up to the mining reward halving. (TradingView, CoinDesk) (TradingView, CoinDesk)

LTC bottomed out, broke out of prolonged downtrends and led bitcoin higher in the run-up to the 2015 and 2019 halvings. Traders in crypto and traditional markets typically tend to be forward-looking and price in bullish/bearish events in advance.

And they might be at it again.

LTC is again showing signs of life in months ahead of the third halving. (TradingView, CoinDesk) (TradingView, CoinDesk)

While LTC has rallied to its highest since May, it's yet to cross above the trendline characterizing the bear market that began in April 2021.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.