Popular NFT collections take massive price hit in 2023

Some of the most sought-after nonfungible tokens (NFTs) of 2022 have taken a massive hit in value over the past year. The trend mirrors the depreciating value of metaverse properties in 2023, which were considered top virtual lands for investment in 2022.

Investments in top NFT projects, including Doodles, Invisible Friends, Moonbirds and Goblintown, have lost up to 95% of their value in Ether (ETH $1,916). The value of blue-chip NFT collections alone has fallen down by over 40% on average.

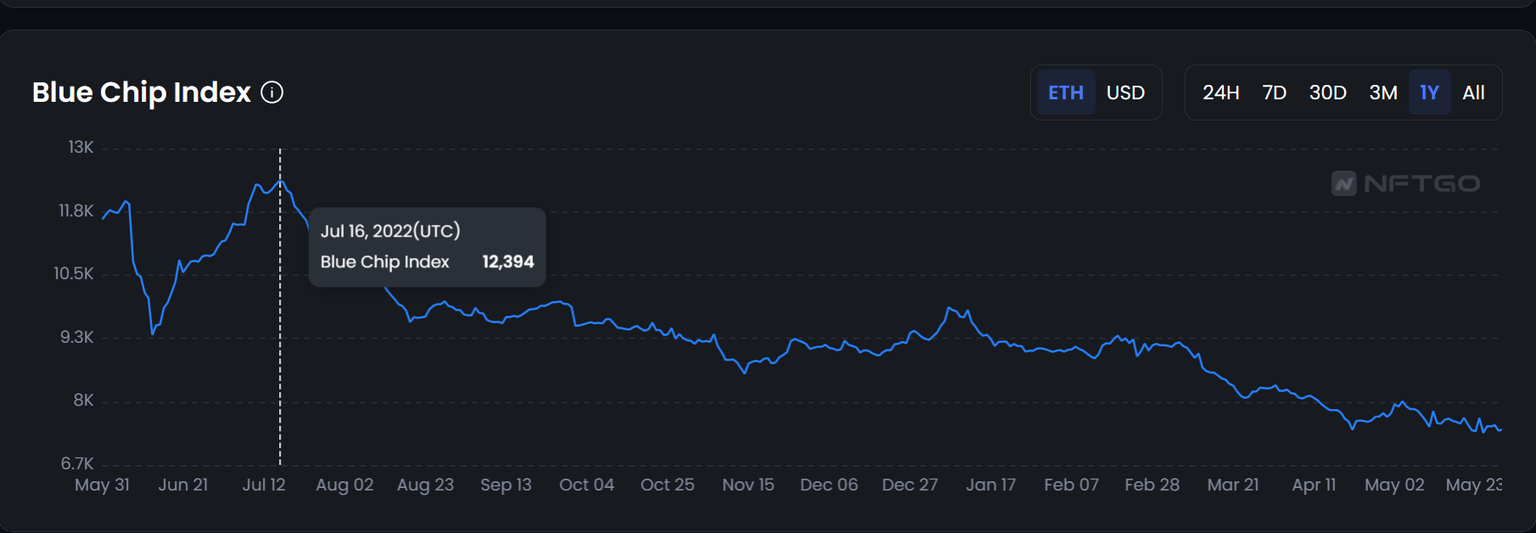

Data from NFTGo shows that the Blue Chip Index went down to 7,446 ETH from its yearly high of 12,394 ETH back in July 2022.

Blue Chip Index calculated by weighting the market cap (ETH/USD) of blue chip collections. Source: NFTGo

Surprisingly, NFT investors remain unfazed by the ongoing decline in value. While some expect further and prolonged depreciation of NFT prices, a handful of investors believe it’s the right time to invest, as they anticipate a comeback.

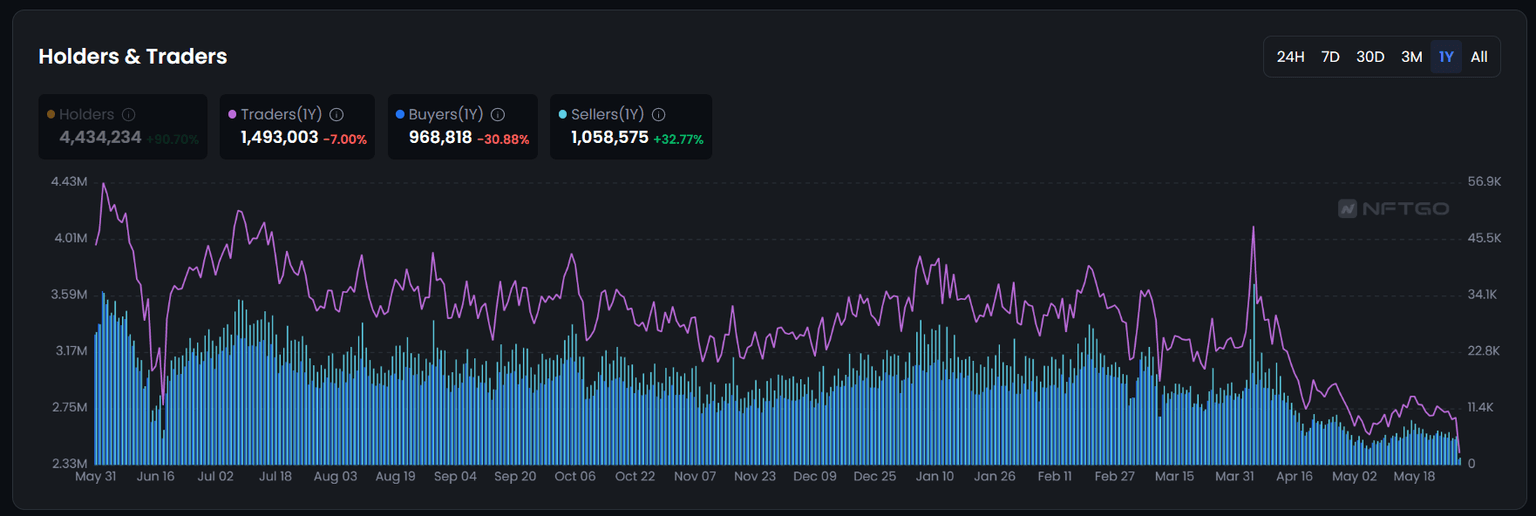

Holders and traders of blue-chip NFTs. Source: NFTGo

On the contrary, the number of blue chip NFT holders over the past year has increased by more than 90%. During this time, sellers increased by 32% while buyers decreased by 30%.

Despite the financial setbacks, the NFT ecosystem continues to draw the attention of new investors. On May 27, crypto skeptic Peter Schiff launched an NFT project on the Bitcoin blockchain via Ordinals.

Schiff unveiled the “Golden Triumph” NFT collection, depicting a human hand holding a bar of gold. The collectibles will be sold via a two-part auction starting on June 2 and ending on June 9.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.