Polymesh up nearly 80% after BlackRock's tokenized asset fund announcement

- The real-world assets narrative is heating up as the entire category soars by 35%.

- Polymesh leads the way with impressive gains on Thursday.

- Tokenized treasury products saw a 641% growth in 2023.

Polymesh (POLYX) — the tokenized, asset-trading, blockchain platform — saw a whopping 80% boost in price on Thursday, following BlackRock's foray into the real-world asset (RWA) sector. This has caused crypto tokens in the RWA sector to rise as they look to be the next bullish narrative.

BlackRock kickstart RWA narrative

Polymesh and a host of real word asset tokens have skyrocketed after BlackRock's announcement of launching a tokenized asset fund on Ethereum. The BlackRock USD Institutional Digital Liquidity Fund (BUIDL), set to go live soon, fueled the RWA narrative as many in the crypto community began shilling projects that they feel may become the next big thing. As a result, the market cap of the RWA category went up by 35% (reaching $5.7 billion) in the last 24 hours, according to data from CoinGecko.

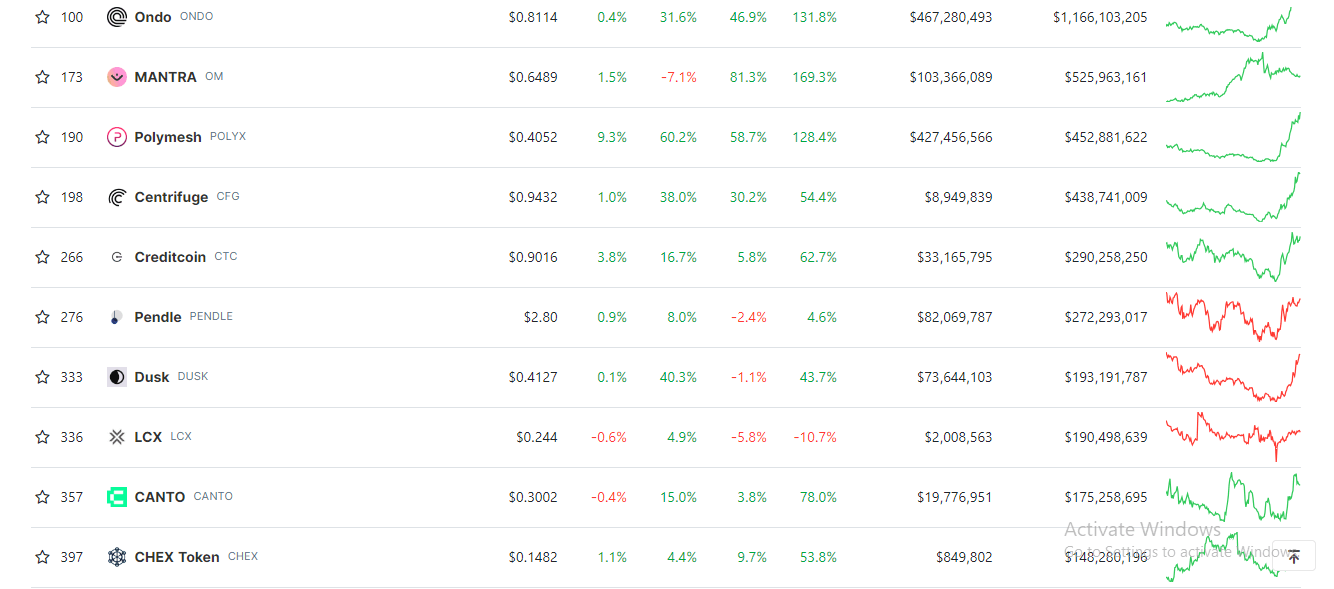

Top RWA coins

Read more: AI, RWA: Two token classes to watch next after meme coin and staking market drive rally

Tokenized RWAs are blockchain-based tokens representing physical and traditional assets like cash, commodities, equities, bonds, real estate, IP, etc. With an institution like BlackRock entering the space, folks in the crypto community have said it would bring explosive growth to RWA tokens, similar to its effect on Bitcoin.

Polymesh soars amid RWA boom

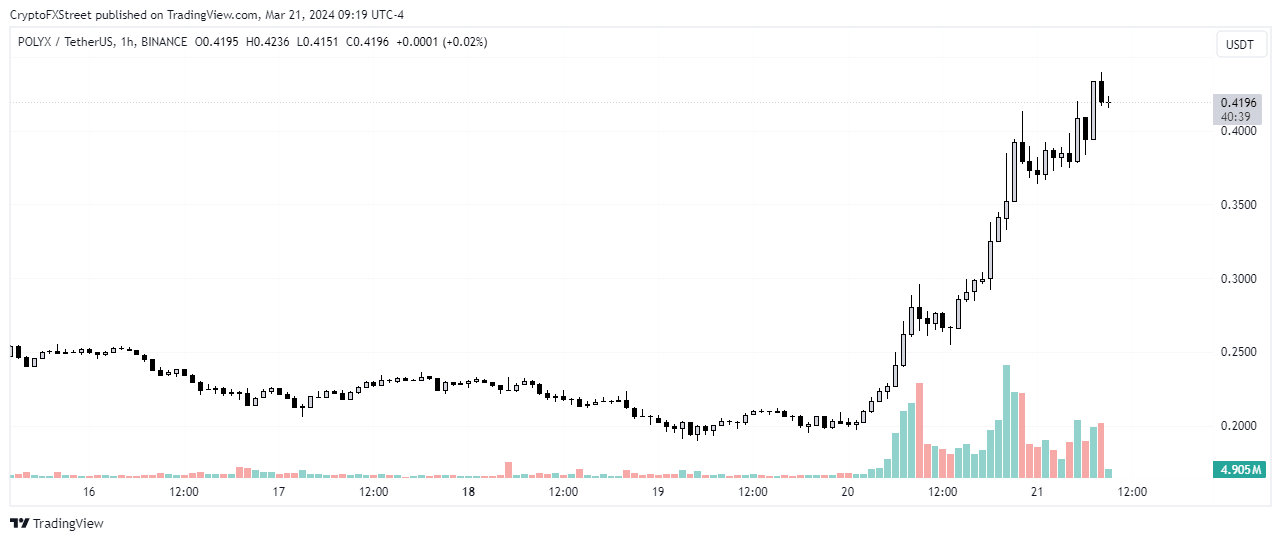

For example, Polymesh, one such RWA blockchain, saw significant growth on Thursday following the announcement. Polymesh is a permissioned blockchain network for trading tokenized regulated securities. Its underlying token, POLYX, posted gains of about 80% on Thursday and may see more price growth in the future.

POLYX/USDT 1-hour chart

Also read: Dogecoin soars nearly 20% after Coinbase announces listing of DOGE derivatives

A few hours after RWA tokens started pumping, Coingecko released its RWA report, "Rise of Real-World Assets." The report's key highlights include tokenized treasury products growing to 641% in 2023 and commodity-backed tokens reaching $1.1 billion in market capitalization — all indicating bullishness for the RWA sector.

Author

FXStreet Team

FXStreet