- Polygon price action has red lights flashing as a potential death cross lurks.

- MATIC bulls see their efforts cut short for a fifth consecutive week of losses.

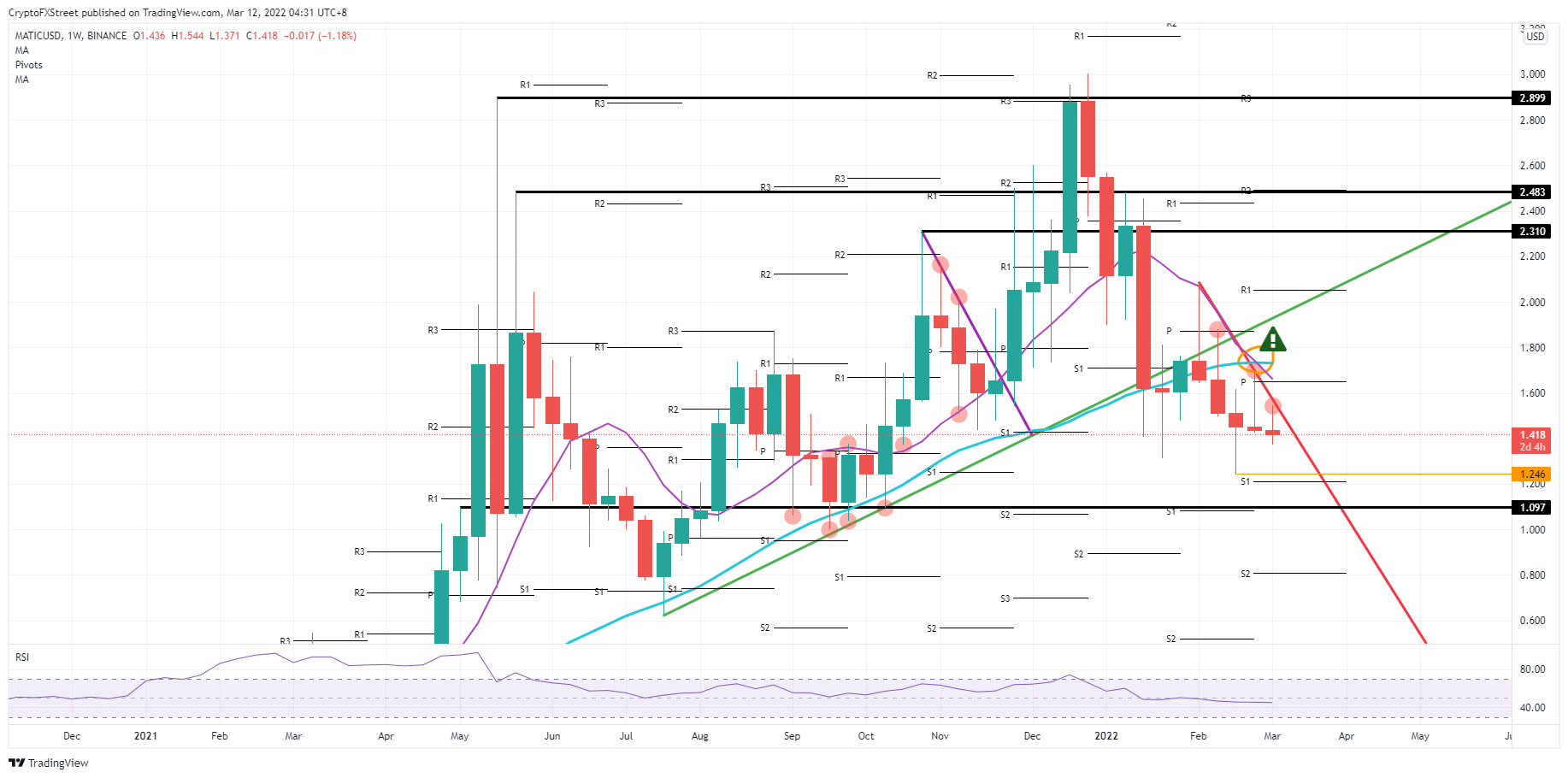

- With a third rejection against the red descending trend line, the price target looks to be set at $1.246 or $1.097 short-term.

Polygon (MATIC) price action is set to close out the week with another red candle, the fifth already in a row. MATIC has many technical elements against it from making any upward moves, even without talking about geopolitics or the dollar strength. With this fifth negative close in a row, the 55-day Simple Moving Average (SMA) is moving below the 200-day SMA, performing the dreaded death cross that will scare investors away for a long time. Expect to see continuous descending price pressure until a significant positive catalyst can change the tide, but for now, more downturns will come.

MATIC joins the club of cryptocurrencies carrying a death cross

Polygon price action was one of the most promising cryptocurrencies, holding good cards against some other cryptocurrencies and was ready to book massive gains at the start of 2022. But into the third month of this year, that sentiment has completely evaporated, and it looks hard to find bulls and investors wanting to engage in a longer-term trade. Expect this current negativeness to hang over MATIC as the death cross will weigh on sentiment and not attract any investors soon.

MATIC price action got rejected this week against the red descending trend line, showing that the red trend line is confirmed and needs to be considered going forward. Expect price action now to trade lower in search of support, which could come from the low of February at $1.246. If dollar strength and more negative headlines keep persisting, expect to see a break lower towards $1.097 with the pivotal historical level to hold some importance and slow down the downtrend as investors await further developments out of Russia and Ukraine.

MATIC/USD weekly chart

Luckily there is still a wait of all this, as a significant catalyst would be enough to trigger a breakout trade in the first phase, with a sharp and large rally to the upside, and in this process, undoing the death cross that is currently dictating sentiment in MATIC price action. That catalyst could come from a global coordinated central bank action to support the economy or peace talks that provide some relief and soften the situation in Ukraine. Expect once that happens, to see a break above the red descending trendline, triggering a massive inflow of investors that will rally price up to the green ascending trend line near $2.000, and in the move tilt the 55-day SMA back above the 200-day SMA.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

TRUMP token leads $906 million in unlocks this week with over $330 million release

According to Tokenomist, 15 altcoins will unlock more than $5 million each in the next 7 days. Wu Blockchain data shows that the total unlocked value exceeds $906 million, of which the TRUMP token will unlock more than $330 million.

Why Mantra token’s dramatic 90% crash wiped out $5.2B market share

Mantra price hovered at $0.83 during the Asian session on Monday, following a massive 90% crash from $6.33 on Sunday. The crash wiped out $5.2 billion in the token’s market capitalization, quickly drawing comparisons to the infamous collapse of Terra LUNA and FTX in 2022.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC is on the verge of a breakout while ETH and XRP stabilize

Bitcoin price approaches its key resistance level at $85,000 on Monday; a breakout indicates a bullish trend ahead. Ethereum and Ripple found support around their key levels last week, suggesting a recovery is in the cards.

Bitcoin and crypto market sees recovery as Fed official says agency ready to stabilize market if necessary

Bitcoin rallied 5% on Friday, trading just below $84,000 following Susan Collins, head of the Boston Federal Reserve (Fed), hinting that the agency could stabilize markets with "various tools" if needed.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.