Polygon Networks' MATIC price presents a profitable opportunity

- Polygon price may have printed a secure low.

- Polygon price shows reasons to buy on the Relative Strength Index.

- Invalidation of the uptrend thesis is a breach at $0.55.

MATIC price hints at a rally in the coming days as the Polygon Network may have bottomed over the weekend.

MATIC price is following the technicals

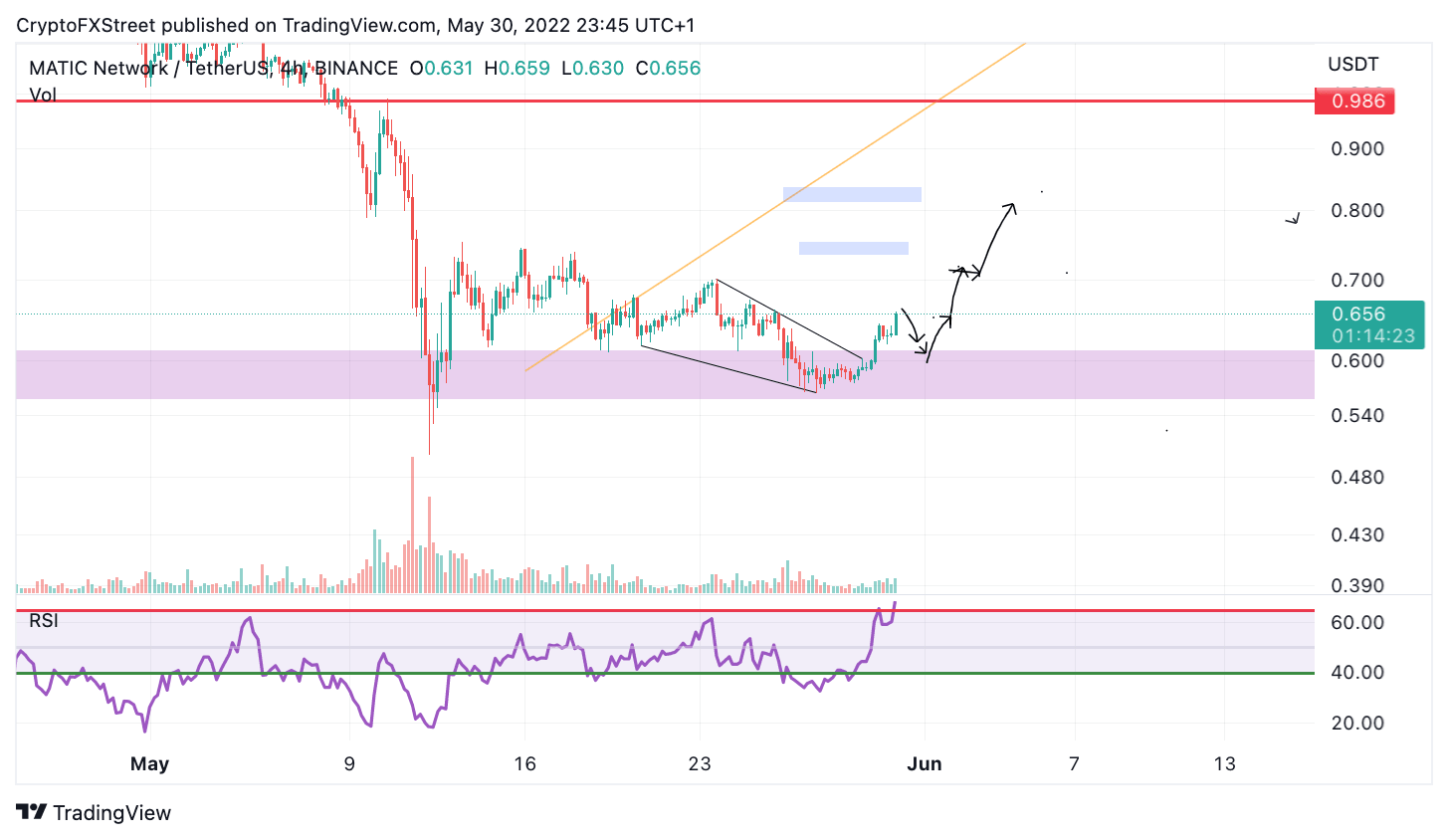

MATIC price is displaying reasons to believe in a 30% bull run in the coming days. The self-proclaimed Ethereum transaction solution coin may have printed its final bottom over the weekend at $0.55. Since the speculative low occured, the Polygon price has seen a resurgence of bulls into the market as price has already rallied 10%.

MATIC price currently trades at $0.62. The favorable trade setup will be to retest the $0.60 zone and then continue rallying with strong bullish engulfing candles. The Relative Strength Index has also climbed back into a buyers' zone which warrants the idea that a definitive low may be in.

MATIC/USDT 4-Hour Chart

Still, an invalidation level for the bullish thesis is necessary for investors looking to partake in an early gamble. A safe invalidation for the uptrend thesis will be a breach below $0.55. If the bears can manage to close below $0.55, they could induce a decline into $0.45, resulting in a 30% decrease from the current MATIC price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.