- With risk-off across the board, both the U.S. central bank and Congress are looking into regulations for cryptocurrencies.

- The positive side-effect from sanctions against Russia is declining against regulation uncertainty.

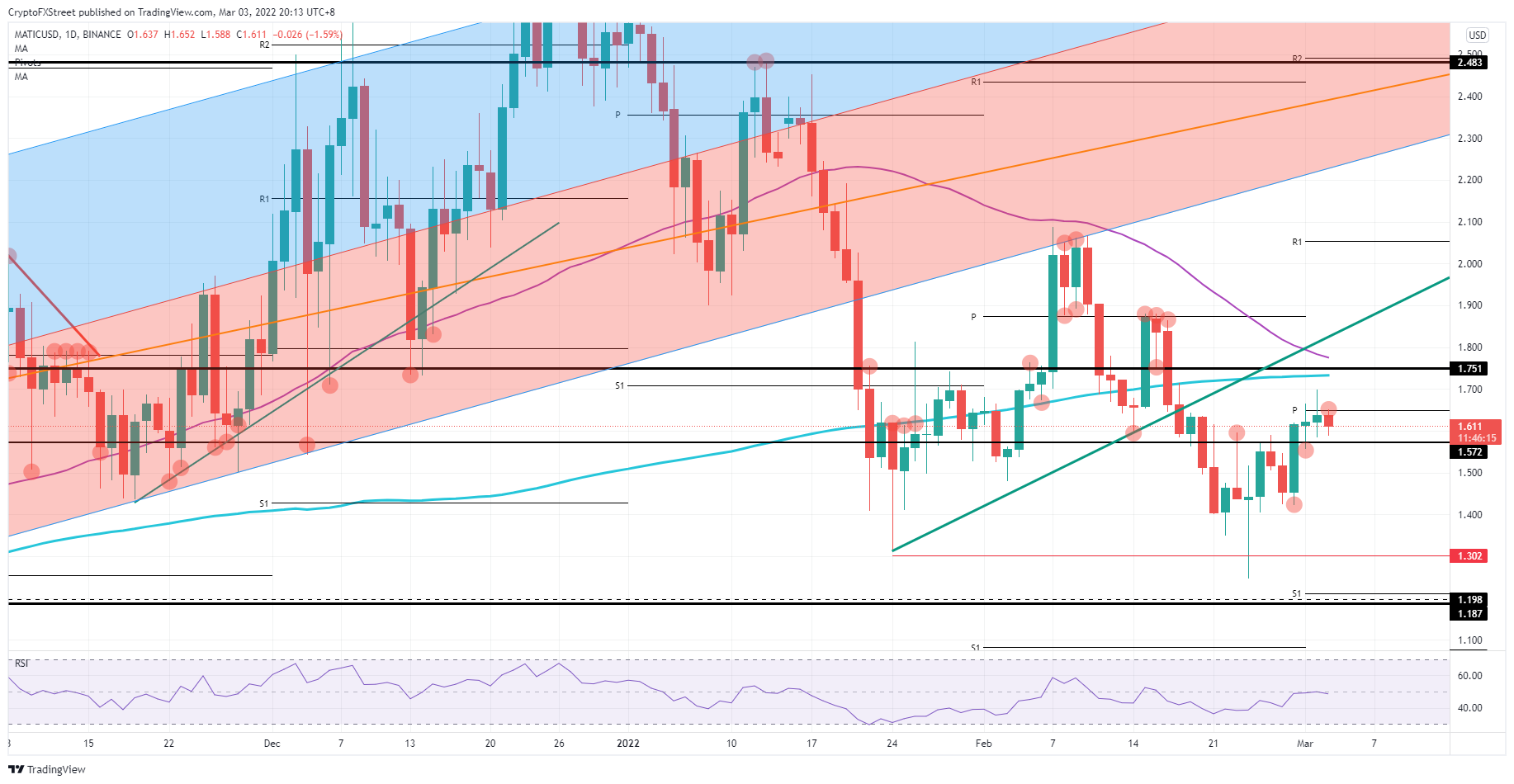

- Expect MATIC price action to slip below $1.57, looking for lower-level support.

Polygon (MATIC) price action is under scrutiny by the US Federal Reserve and the White House after comments that the US is looking into greater regulation for cryptocurrencies. After several major cryptocurrency exchanges ignored demands from Biden to ban operations by Russian participants, the US is now looking into seizing control of cryptocurrencies. The comments sparked a drop in MATIC price, set to fall below the critical support at $1.57 with more losses to come.

MATIC looks heavy as regulations outweigh side-effects

Polygon price was on the cusp of breaking above $1.75 after a three-day winning streak as investors enjoyed favourable tailwinds coming from buying by people in both Ukraine and Russia using cryptocurrencies as an alternative method of payment. With the improvement of sanctions, Biden was quick to ask several crypto exchanges to exclude Russian clients, but all exchanges came out with a joint statement that cryptocurrencies are not bound by the law of any country and are there to provide free movement. In a countermove, Biden drilled down on cryptocurrencies in his State of the Union speech, and Powell asked for regulations to be imposed in his seasonal Senate hearing on monetary policy.

MATIC price is shedding near 3% intraday with bulls jumping in to support the $1.57 pivotal level. Although it looks to hold – for now – the Relative Strength Index (RSI) is taking a nudge lower and dipping back below 50, revealing that bears are again taking over control of the price action. A break below $1.57 later in the session or tomorrow could see a sharp drop lower towards either $1.40 or $1.30.

MATIC/USD daily chart

Should investors withstand current selling pressure, more upside is to be had as regulations will take months to be passed by both the House and the Senate and would still be limited to only the US borders. Investors would quickly shake off any downturn, and MATIC would see more buying towards $1.75. With that, the 200-day Simple Moving Average (SMA) will be broken to the upside, and a return to $2.00 in the near term would be feasible.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

XRP chart signals 27% jump after SEC-Ripple appeals pause and $50 million settlement

Ripple (XRP) stabilized above $2.00 exemplifying a similar pattern to the largest cryptocurrency by market capitalization, Bitcoin (BTC), which holds firmly above $84,000 at the time of writing on Thursday.

Bitwise lists four crypto ETPs on London Stock Exchange

Bitwise announced on Wednesday that it had listed four of its Germany-issued crypto Exchange-Traded products (ETPs) on the London Stock Exchange. It aims to expand access to its products for Bitcoin (BTC) and Ethereum (ETH) investors and widen its footprint across European markets.

RAY sees double-digit gains as Raydium unveils new Pumpfun competitor

RAY surged 10% on Wednesday as Raydium revealed its new meme coin launchpad, LaunchLab, a potential competitor to Pump.fun — which also recently unveiled its decentralized exchange (DEX) PumpSwap.

Ethereum Price Forecast: ETH face value- accrual risks due to data availability roadmap

Ethereum (ETH) declined 1%, trading just below $1,600 in the early Asian session on Thursday, as Binance Research's latest report suggests that the data availability roadmap has been hampering its value accrual.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.