- Polkadot price dips below the bear flag.

- The risk of downside pressure remains, but dips continue to get bought.

- Oscillators warn of a strong sell-off unless bulls close above $40

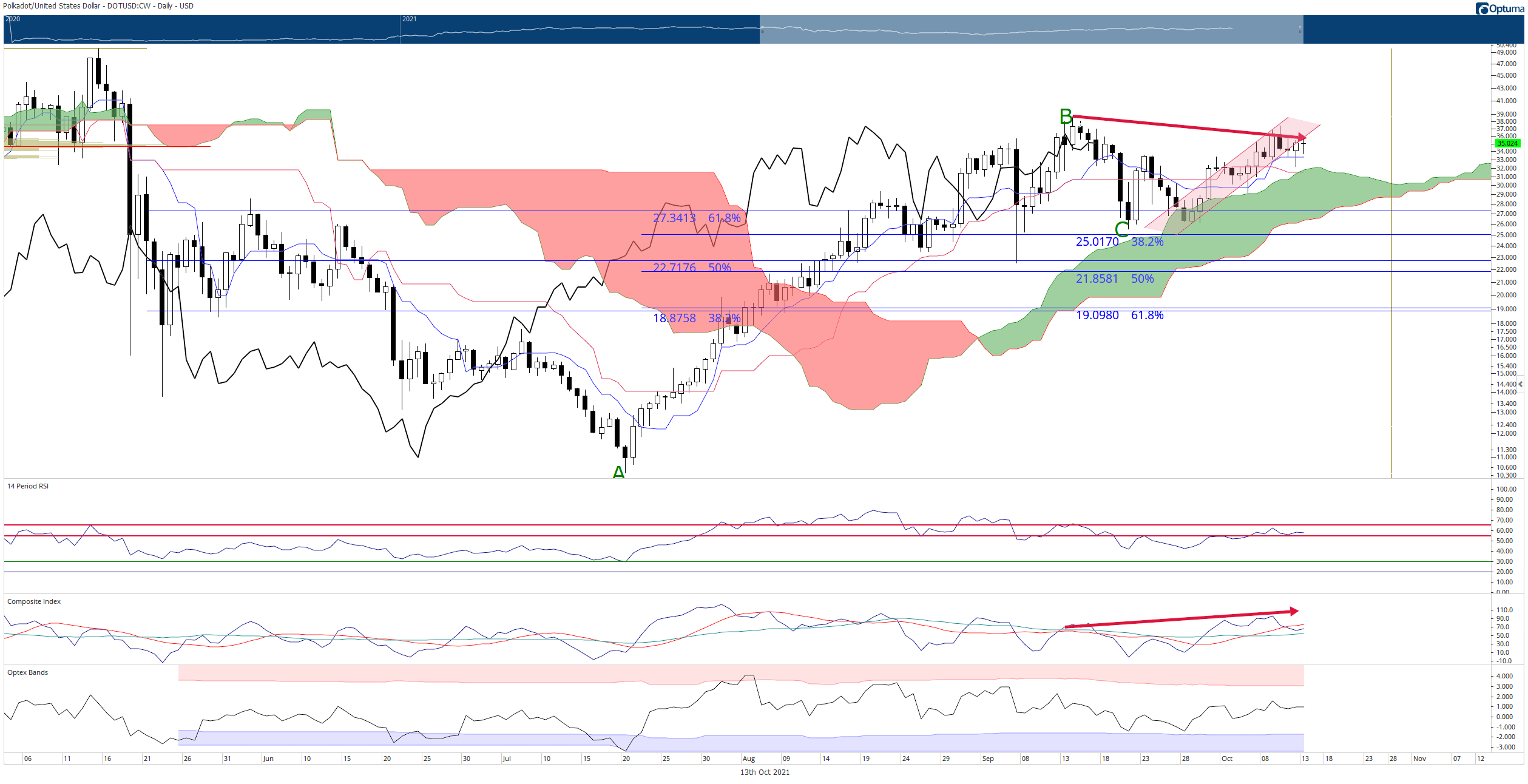

Polkadot price has formed a double-top with the highs formed near $38 precisely one month ago. It is now trending lower with significant selling pressure over the past three trading days – but buyers have stepped in to keep the bodies of the daily candlesticks above the Tenkan-Sen.

Polkadot price has significant support beneath it; bulls will be tested

Polkadot price is at an inflection point that will likely dictate the trend over the next thirty days. It has broken out below the bear flag and appears to be testing that initial break as resistance. If it holds, then bulls will need to hold the Tenkan-Sen at $33.66. Failing that, there is a triple support zone at $32.25 with the 78.6% Fibonacci retracement, Kijun-Sen and Senkou Span A.

Polkadot is better positioned than most altcoins to experience a new and sustained bullish breakout. The Relative Strength Index has flattened out considerably, and the Composite Index may curl higher to cross above its fast-moving average. The level that bulls need to target as a close for Polkadot price is just above the 88.6% Fibonacci retracement at $37.75.

DOT/USD Daily Ichimoku Chart

However, Polkadot could fall under increased selling pressure if the aggregate market starts to sell off. The $25 value area is likely the next primary support zone as it includes the 61.8% Fibonacci retracement, and it is the same level where the Chikou Span would find support against Senkou Span B.

Bulls and bears will want to monitor Polkadot price if it re-enters the bear flag. If that were to occur, it could generate a flash move higher.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

XRP chart signals 27% jump after SEC-Ripple appeals pause and $50 million settlement

Ripple (XRP) stabilized above $2.00 exemplifying a similar pattern to the largest cryptocurrency by market capitalization, Bitcoin (BTC), which holds firmly above $84,000 at the time of writing on Thursday.

Bitwise lists four crypto ETPs on London Stock Exchange

Bitwise announced on Wednesday that it had listed four of its Germany-issued crypto Exchange-Traded products (ETPs) on the London Stock Exchange. It aims to expand access to its products for Bitcoin (BTC) and Ethereum (ETH) investors and widen its footprint across European markets.

RAY sees double-digit gains as Raydium unveils new Pumpfun competitor

RAY surged 10% on Wednesday as Raydium revealed its new meme coin launchpad, LaunchLab, a potential competitor to Pump.fun — which also recently unveiled its decentralized exchange (DEX) PumpSwap.

Ethereum Price Forecast: ETH face value- accrual risks due to data availability roadmap

Ethereum (ETH) declined 1%, trading just below $1,600 in the early Asian session on Thursday, as Binance Research's latest report suggests that the data availability roadmap has been hampering its value accrual.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.