Polkadot price targets $20.51 as market sentiment improves

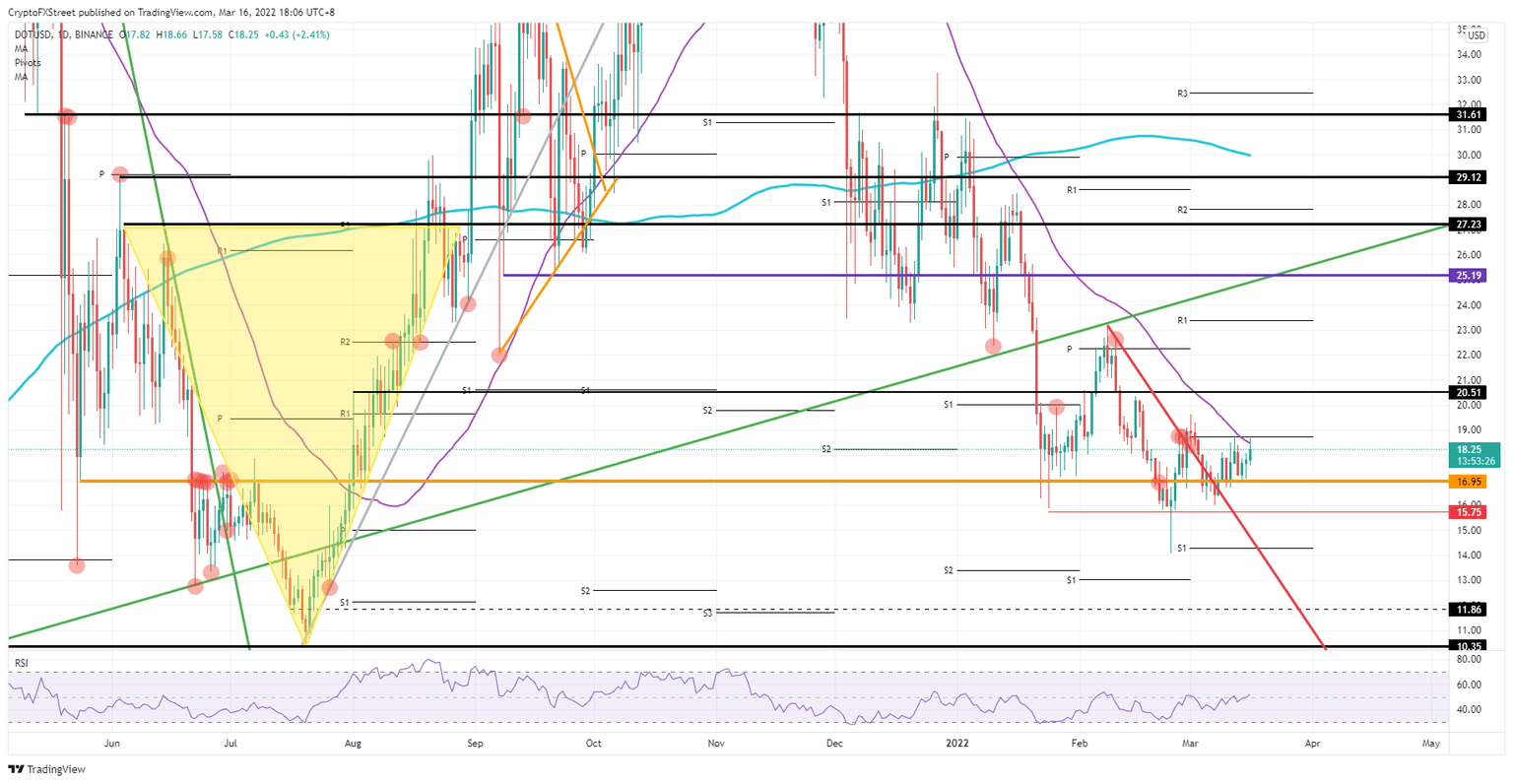

- Polkadot price action performs bounce off the $16.95 handle.

- DOT price action, for now, gets capped by 55-day SMA and technical pivot.

- Expect to see a breakthrough as the US gets underway, adding momentum to break through the above-mentioned elements.

Polkadot (DOT) price action is on the cusp of breaking above $19.00 as markets signal a shift in sentiment, with tailwinds provided by the Chinese authorities and global markets. Investors are further starting to look beyond the current dire situation in Ukraine that is seeing some clarity with positive signals from both sides on peace talks. Expect to see an additional pickup in sentiment as the US session gets underway and needs to be added into the mix. This will trigger a strong demand for cryptocurrencies, with Polkadot price action set to jump as much as 15% by Friday.

Polkadot price action is set to finish the week with at least 15% gains

Polkadot price action is set to jump above the monthly pivot near $19.00 and, in the process, turn the 55-day Simple Moving Average at $18.50 from resistance into support. As the Relative Strength Index (RSI) pops above 50, bulls are overpopulating the Polkadot trade and squeezing out bears who have been in the trade since December of 2021. With the first signs of a turnaround, the background will need to improve much more before it can be called an uptrend, but the first growth ports are there.

DOT price action bounced off $16.95 earlier last week and finally found enough ground and bulls to start a lift off in price action. Since yesterday, with global equity markets on the front foot, additional tailwinds have been spinning favour for DOT price action. Expect that in the US session price pops and closes above the monthly pivot setting the perfect scene for another jump into Thursday and Friday towards $20.51.

DOT/USD daily chart

With another round of peace talks underway, should one of the parties walk away from the negotiating table, expect to see a plunge back to $16.95. Depending on further reports with possibly more tactical moves from the Russian military, expect to see $15.75 in the backdrop if the situation should worsen. Depending on what the FED will communicate going forward, the positive sentiment could be broken again for another week.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.