Polkadot price soars 37% after coinbase pro DOT listing, first parachain auction

Polkadot emerged as one of the best-performing tokens week-to-date as traders' focus shifted on DOT's listing at Coinbase Pro and Kusama's first-ever parachain auction, set to go live on Tuesday.

Polkadot (DOT) witnessed massive upside moves in the previous daily sessions as traders assessed the cryptocurrency's entry into the United States-based digital assets trading platform, Coinbase Pro, and the upcoming auctioning of parachain slots atop Polkadot network's testbed version, Kusama, this Tuesday.

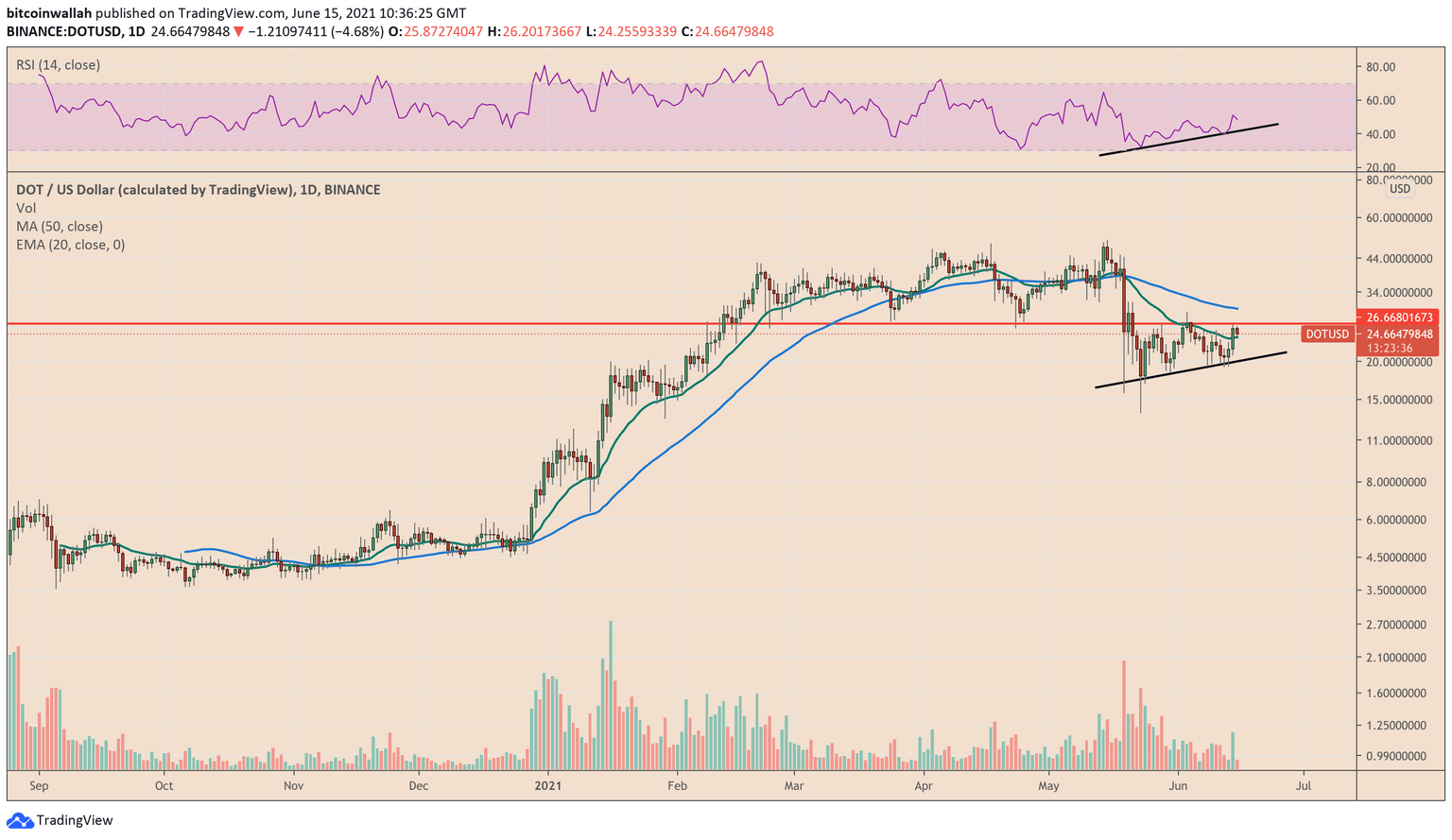

The DOT/USD exchange rate reached $26.44 during the Monday session, following a roughly 37% upside move that started in the previous daily session. Nevertheless, entering the Asia-Pacific and Europea trading hours on Tuesday, the pair corrected lower by more than 4.5%, hitting an intraday low of $24.25.

Polkadot pulls back after testing technical resistance near $26.668. Source: TradingView

Initial upside moves in the Polkadot market surfaced in the wake of the Bitcoin (BTC) price rally on Sunday. Billionaire investor Elon Musk on Sunday commented that he would reinstate accepting Bitcoin payments for Tesla’s electric vehicles if the cryptocurrency's fresh supply comes from power supplied by renewables.

The BTC/USD exchange rate jumped from as low as $34,780 to above $40,000 after Musk's comments. Meanwhile, top altcoins, which heavily tail Bitcoin trends, followed suit, taking DOT prices higher alongside.

Nevertheless, the scale at which the Polkadot token rose dwarfed the retracement rallies of most of its top crypto rivals. DOT's heightened move uphill coincided with Coinbase Pro's announcement of adding DOT-enabled trading instruments to its platform.

Kusama parachain auction

More bullish cues for traders came from Parallel Finance. The startup raised $2 million to onramp its lending and staking features on the Polkadot and Kusama blockchains.

In retrospect, Kusama works as a sandbox for projects with aspirations to launch a parachain on Polkadot. Therefore, the testbed blockchain comes with real economic benefits and consequences, enabling other blockchains and apps to launch with forkless upgrades, governance structure, and scalability.

That said, projects harness Kusama's inter-parachain network to communicate with other apps having their separate parachains.

But to win a parachain slot projects like Parallel Finance must participate in a parachain auction. In doing so, they would need to submit the bid amount (in DOT or Kusama's native token KSM) alongside the slot duration (6 to 24 months). That expects to effectively lock away DOT and KSM tokens for the duration of the slot, thereby reducing the tokens' circulating supply.

Meanwhile, observers believe that DOT and KSM's demand would keep on rising based on their competitive auctioning process.

Projects who win a parachain auction will do a lot to provide value to their community and backers, according to Alex Siman, the founder of Subsocial, a Polkadot-based decentralized social network.

"On the Polkadot parachain, the slots for projects to build on the chain is limited to 100, making the auction process notably competitive," he explained. "A non-innovative project may not be able to win such auctions, and those who do will not want to waste the opportunity to go down in history.

The first parachain auction went live on the Kusama network around 1100 GMT on Tuesday. KSM fell by 2.77% in the early European trading session.

On the other hand, Polkadot has still to announce the auctioning of its parachain slots. Mira Christanto, a researcher at crypto data analytics firm Messari, noted that 65% of DOT's active supply has already been staked since May. Only 30% of DOT now remain in circulation—and the upcoming parachain auction would take more of those tokens out of supply.

"After the parachain launch, 40% of DOT could be bonded in parachains, hence reducing effective circulating supply to only 15%," she added.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.