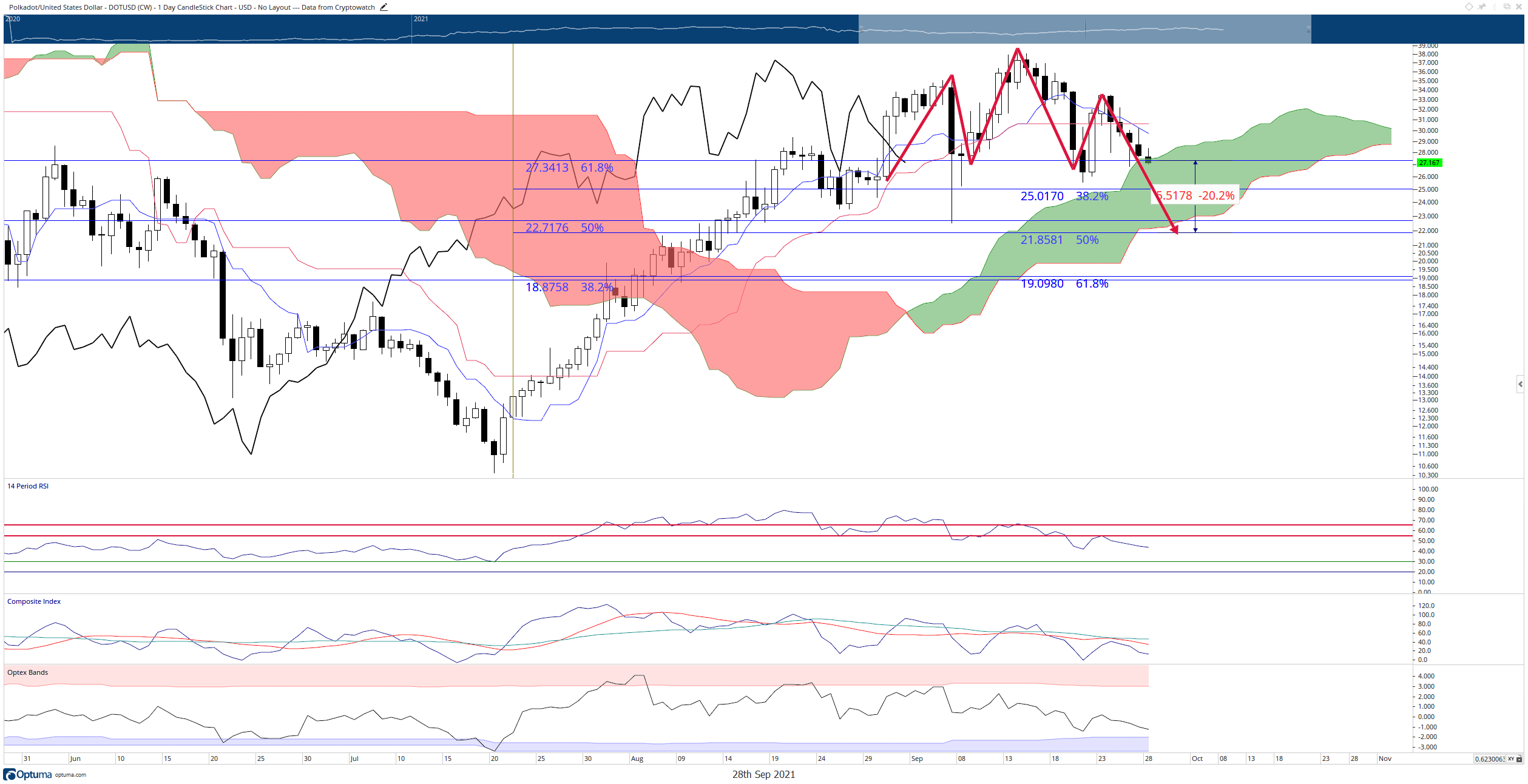

- Polkadot price approaching neckline break of a head-and-shoulders pattern.

- Chikou span below the candlesticks signals substantial and imminent price collapse soon.

- Oscillator levels support sustained selling pressure.

Polkadot price remains a laggard for how little it has moved from its recent swing highs compared to its peers. As a result, steep retracements towards the low $20 range are likely.

Polkadot price falls below 61.8% Fibonacci retracement and enters the Cloud

Polkadot price is currently under extremely bearish trading conditions within the Ichimoku Kinko Hyo system. Polkadot bulls failed to support Polkadot enough to maintain the Chikou Span above the candlesticks and instead have allowed the Chikou Span to drift well below the candlesticks.

The neckline of a head-and-shoulder pattern shares the same 27.34 value area as the 61.8% Fibonacci retracement level – a level that Polkadot price is currently trading below. The projected target zone for sellers is a zone that buyers may also find extremely attractive: $22. There is a collection of some massive support levels at the $22 value area.

There are two 50% Fibonacci retracement levels near the $22 level. The first 50% Fibonacci level is from the swing of May 15 to July 20th, while the second is from July 20th to September 14th. Between those 50% levels is the most substantial support/resistance within the Ichimoku system: Senkou Span B. Additionally, there is a high volume node at $22 as well.

DOT/USD Daily Ichimoku Chart

Buyers anticipating a discount should be aware that as bearish as Polkadot price current is, it is not hard for Polkadot to return to a bull market. If buyers can elevate the Chikou Span to above the candlesticks ($35), nearly all conditions with the Ichimoku system for a solid bullish breakout could be met. Evidence of invalidation of any move south would be consistent daily support against Senkou Span A.

Like this article? Help us with some feedback by answering this survey:

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EOS 22% pump steals the show unveiling Vaulta’s web3 banking ecosystem

EOS, the token behind the recently rebranded Vaulta network, has increased by a staggering 22% in the last 24 hours.

Curve DAO Price Forecast: CRV bulls could aim for double-digit gains above key resistance

Curve DAO (CRV) price is in the green, up 8%, trading above $0.53 on Thursday after rallying nearly 15% so far this week.

Bitcoin price reacts as Gold sets fresh record highs after Trump’s reciprocal tariffs announcement

Bitcoin price plunges towards $82,000 as Gold soars past $3,150 after US President Donald Trump imposed new tariffs on Israel and UK, triggering global markets turbulence.

Bitcoin and top altcoins slide as Trump kicks off reciprocal tariffs

Bitcoin (BTC) and the entire crypto market saw a quick correction on Wednesday following President Donald Trump's reciprocal tariff announcements based on half of each country's respective rates.

Bitcoin: BTC remains calm before a storm

Bitcoin's price has been consolidating between $85,000 and $88,000 this week. A K33 report explains how the markets are relatively calm and shaping up for volatility as traders absorb the tariff announcements. PlanB’s S2F model shows that Bitcoin looks extremely undervalued compared to Gold and the housing market.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.