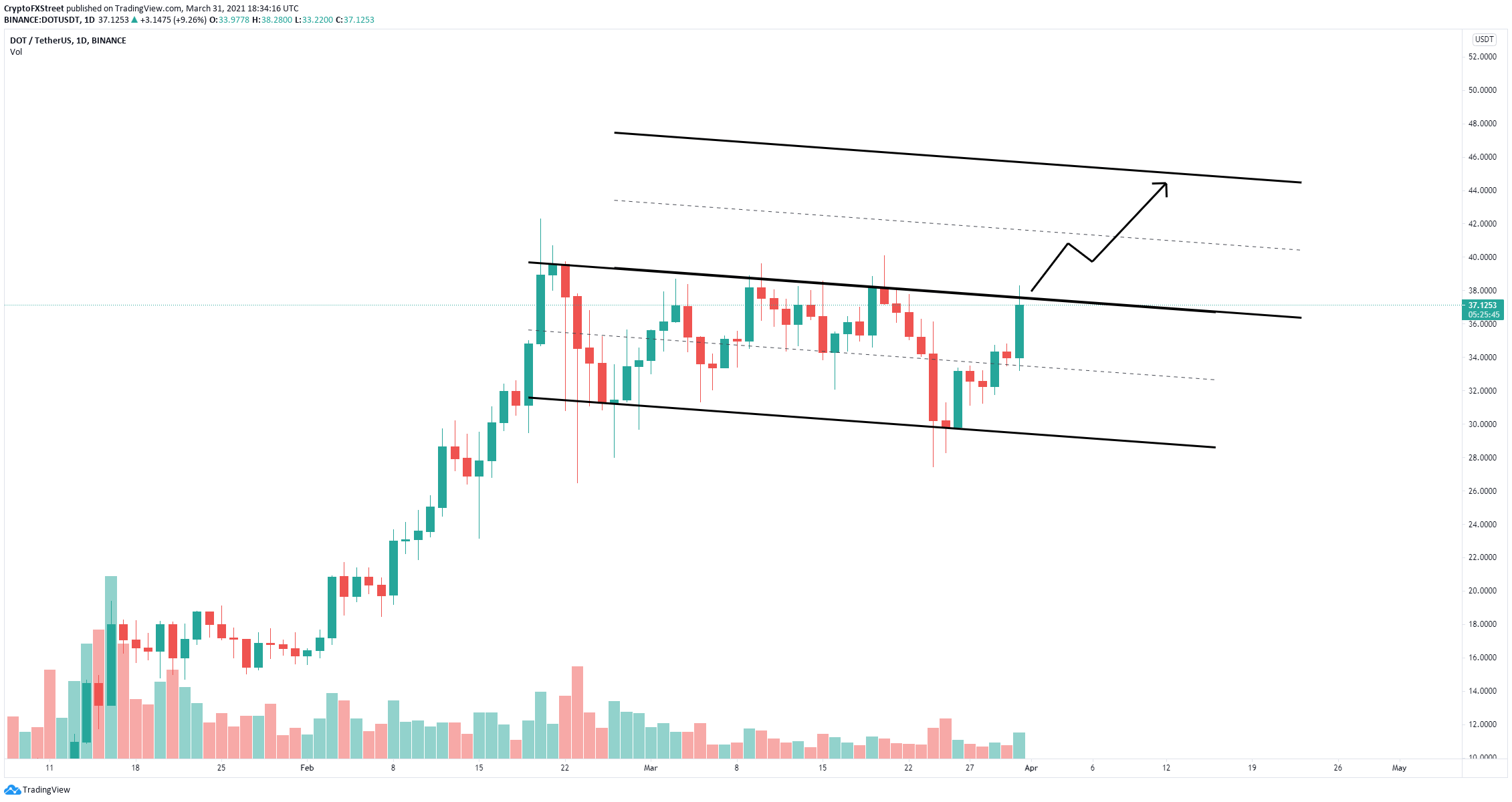

- Polkadot price is contained inside a descending parallel channel on the daily chart.

- The digital asset faces one critical resistance level before a potential 20% breakout.

- DOT is only 10% away from new all-time highs above $42.2 as the entire market turns green.

Polkadot had several significant breakouts in the past week, gaining 40% since March 24. The digital asset is on the path of new all-time highs with just one key resistance level ahead.

Polkadot price must climb above this trendline to see $40

On the daily chart, Polkadot has established a descending parallel channel with the upper boundary established at about $37.5. The digital asset is on the verge of cracking this point after forming a new daily uptrend.

DOT/USD daily chart

As there aren't other essential resistance levels ahead, a breakout above $37.5 should quickly drive Polkadot price towards the previous all-time high of $42.28 and as high as $45 in the longer-term.

Nonetheless, a rejection from the upper trendline resistance of the parallel channel would be notable, with the potential to push Polkadot price down to at least the middle trendline at $33.3 and as low as $29.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Why AAVE is rallying even as Bitcoin, Ethereum, XRP lag

AAVE gains nearly 8% on Wednesday as crypto traders digest Bitcoin’s return above $87,000 after the flash crash. Crypto market capitalization is back above $2.9 trillion, even as institutional traders slowly lose appetite for risk assets.

Bitcoin Price Forecast: BTC expects volatility around White House Crypto summit

Bitcoin price hovers around $87,600 on Wednesday after finding support around $85,000 the previous day. US spot Exchange Traded Funds continued their outflows this week, totaling $217.7 million until Tuesday and signaling institutional demand weakness.

Bitcoin Cash Price Forecast: BCH rallies as transaction rate reaches a new all-time high

Bitcoin Cash’s price rallies more than 7% on Wednesday after retesting its key support the previous day. On-chain metrics paint a bullish picture as BCH’s transaction rate reaches a new high, and open interest is also rising.

BTC, ETH and XRP signal recovery ahead of White House Crypto Summit

Bitcoin price faced rejection around the $95,000 level on Sunday and declined 8.54% the next day. However, on Tuesday, BTC dipped below the daily support level at $85,000 but bounces and closes above it.

Bitcoin: BTC bloodbath continues, near 30% down from its ATH

Bitcoin (BTC) price extends its decline and trades below $80,000 at the time of writing on Friday, falling over 15% so far this week. This price correction wiped $660 billion of market capitalization from the overall crypto market and saw $3.68 billion in total liquidations this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.