Polkadot price favors the bulls with incoming 40% breakout

- Polkadot price action is getting squeezed in from both sides.

- Buyers have the upper hand as a few technical resistances have been broken.

- The first price target is 22% up. After that, another 18% of profit is just around the corner.

Polkadot (DOT) is on the verge of jumping higher as buyers attack, breaking a few resistances to the upside. Price is getting squeezed in and is ready for the break out toward the next profit level higher at $45.22.

Polkadot price is ready for the pop higher with 22% profit in sight

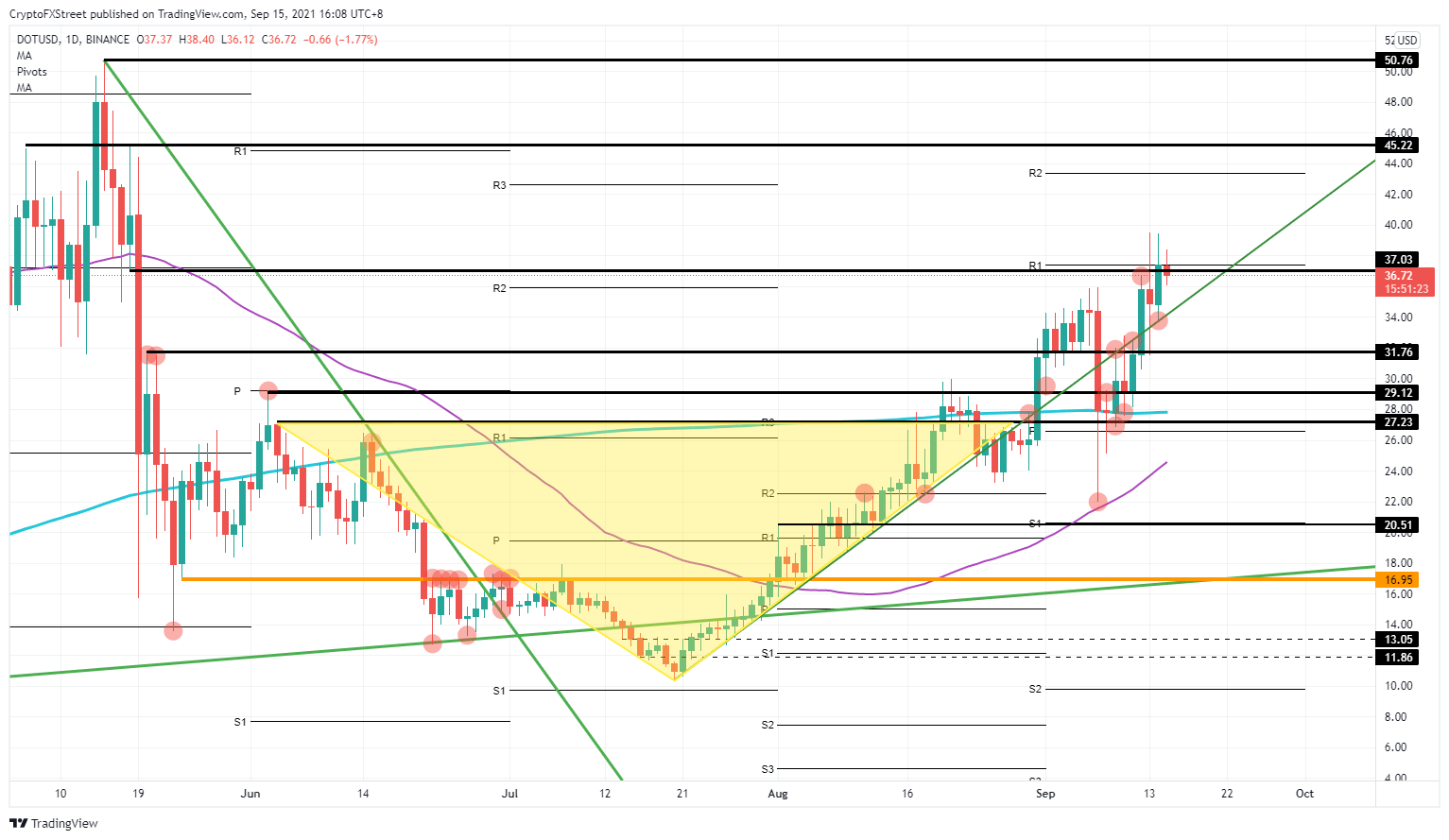

Polkadot price price action is hovering around $37.03 and $37.41 – two important resistance levels that sellers have defended heavily the past few weeks. The first resistance, $37.03, was the low on May 18. The day after, DOT broke below that level and has not been back up since this week. It holds a certain value and will act as resistance for now. Add to that the monthly R1 resistance level at $37.41, and you get a double top resistance zone where buyers will step up to the plate in order to get it broken.

Proof of that fight going on is to be found in the price reaction and behaviour of Polkadot. Monday, DOT averaged a 20% move between the high and low price of the day. Tuesday, it only averaged 13% of a range between the high and low of the day. Today, Wednesday, DOT is only at 6%. Price is consolidating and ready for the break higher as buyers and sellers are getting pulled toward each other.

DOT/USD daily chart

Polkadot has buyers written all over its price action in the elements that the green ascending trend line is again a force to reckon with. On Tuesday, the low of the session bounced exactly off that green ascending trend line. The week before, that ascending trend line got tested three times but failed each time to break to the upside. As price action in DOT is elevated, buyers have no other option than to push price action above $37.

It will be critical to see if buyers can close above today. If that succeeds, expect a rally toward $45.22, a double top since May 6. Once from there, it is not far toward $50. The psychological element is essential, but it was the daily high from May 15 as well. Hence, those are two reasons for buyers to do a retest.

Should sellers take over price action, expect a retest first of the green ascending trend line followed by a push back to $31.76.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.