Polkadot price eyes retest of $7.5 amid increasing headwinds

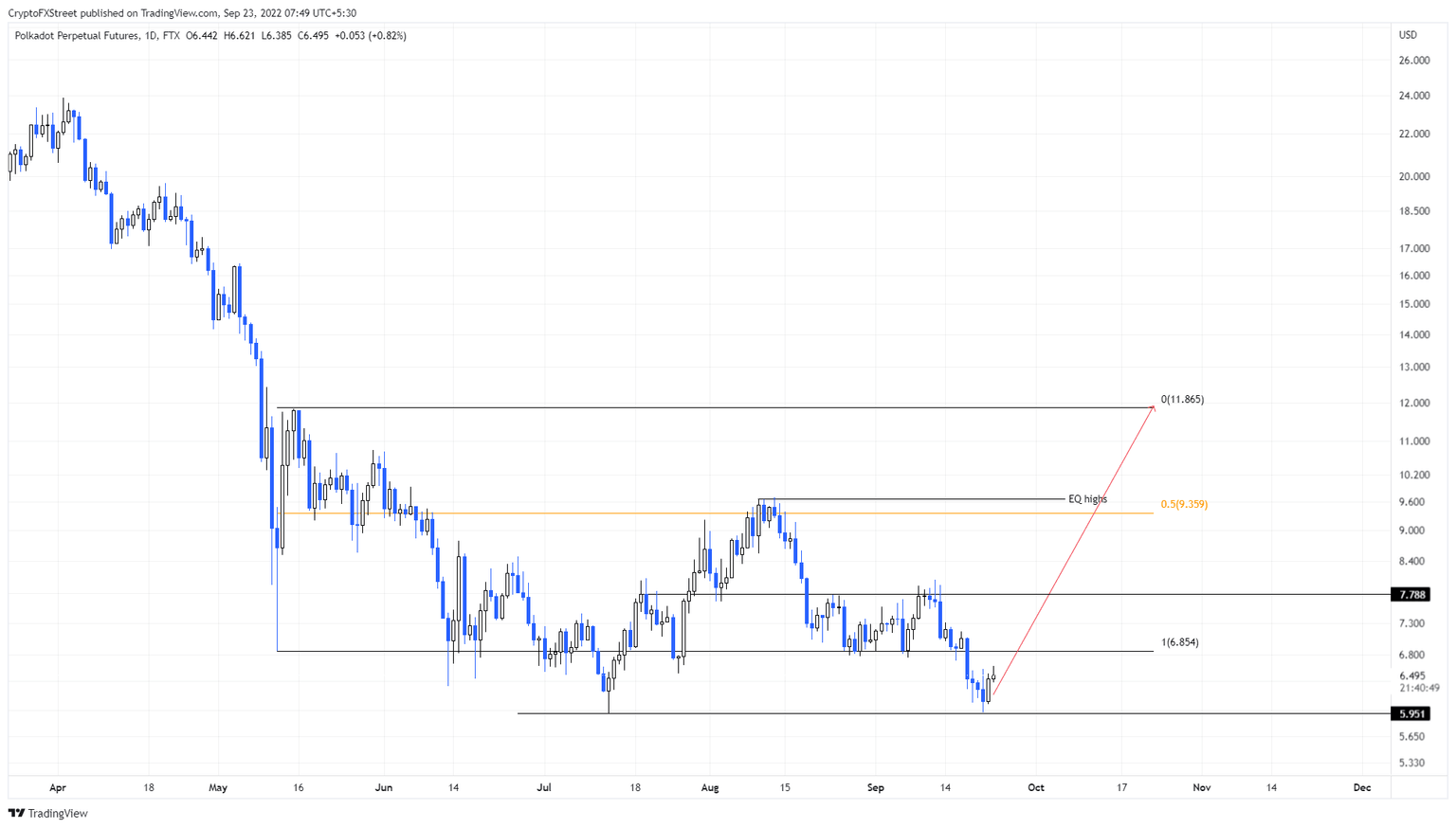

- Polkadot price shows double bottom formation at $5.95, suggesting a bottom reversal setup.

- Investors can expect DOT to reach the $7.78 hurdle and higher levels if it can overcome the $6.85 blockade.

- A daily candlestick close below $5.95 will invalidate the bullish thesis.

Polkadot price hints at a bottom reversal pattern that could trigger a run-up soon. However, this outlook is far from being confirmed as DOT needs to overcome plenty of hurdles to kick-start its run-up.

Polkadot price is ready to struggle

Polkadot price crashed 38% between August 10 and September 21, which resulted in a swing low at $5.95. This development makes it the second swing low to form at the same level, indicating a double bottom.

This technical formation is a bottom reversal pattern and forecasts a shift in trend favoring the bulls. However, Polkadot price will need to reclaim the $6.85 to $11.86 range and stay in there. Once this short-term target is achieved, investors can expect DOT to move to the $7.78 hurdle, denoting a 20% run-up from the current position.

Even after this move, Polkadot price needs to overcome the $7.78 resistance level to confirm the shift in trend favoring bulls. This move will allow DOT to retest the aforementioned range’s midpoint at $9.35 and potentially extend this rally to $11.86.

DOT/USDT 1-day chart

On the other hand, if Polkadot price fails to recover above the range low at $6.85, it will indicate a lack of buying pressure. If sellers take over, investors can expect DOT to slide lower.

If Polkadot price produces a daily candlestick close below $5.95, it will create a lower low and invalidate the double bottom’s bullish potential. This development could see DOT crash to $5.5.

Note:

The video attached below talks about Bitcoin price and its potential outlook, which could influence Polkadot price.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.