Polkadot price counts on the Nasdaq for an uplift

- Polkadot price set to complete the swing trade from January 21st.

- DOT price faces strong resistance from $20.50-level and needs additional tailwinds to cross above it.

- Expect another lift in Nasdaq to filter through to DOT price and lead to $25 in the process.

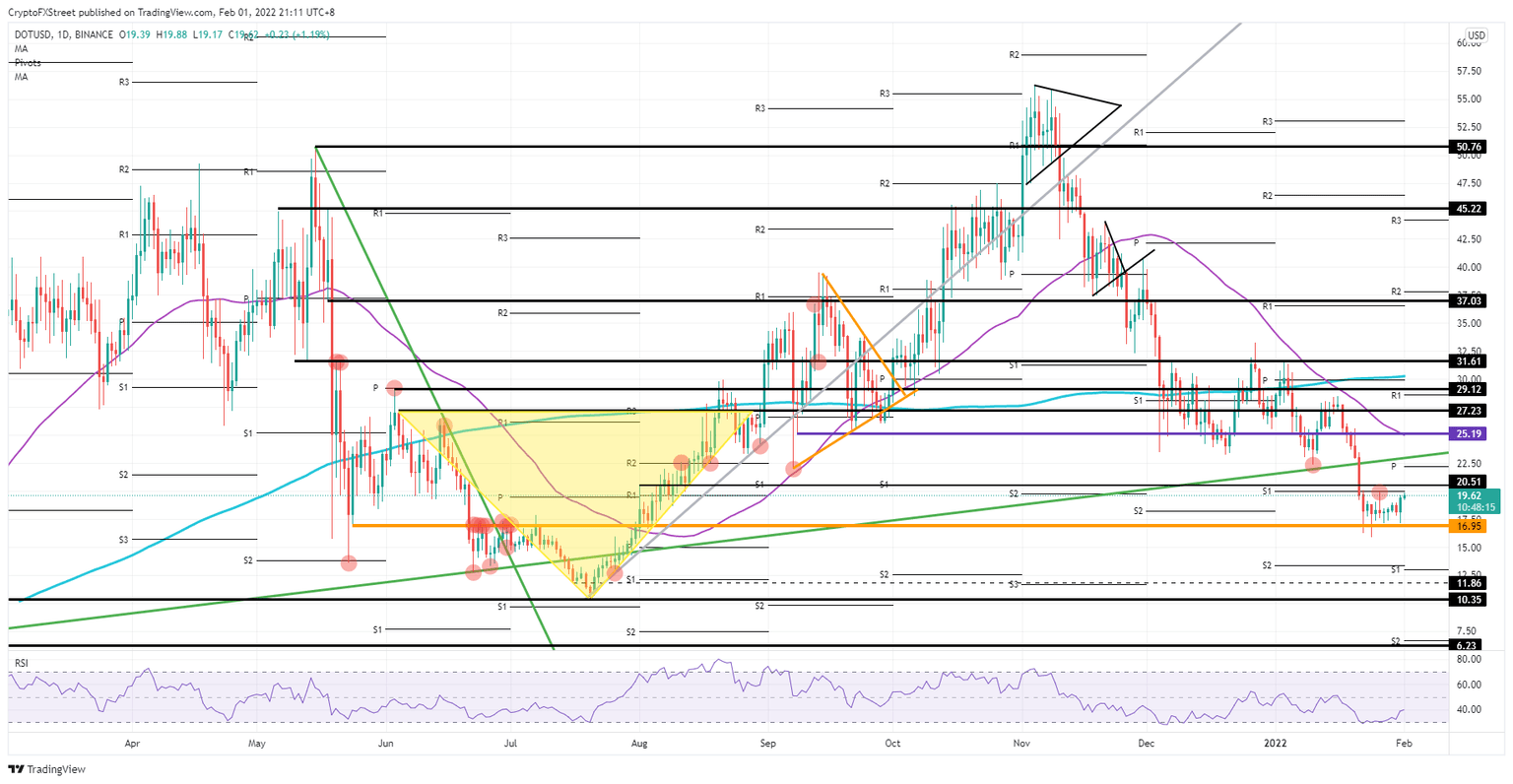

Polkadot (DOT) price returns to higher levels after its short-lived breach below $16.95. Bulls were very quick to push back, and since then, DOT has been making new intraday highs in consecutive moves. If US indices, with Nasdaq upfront, can continue the positive momentum from yesterday, expect Polkadot price to breach $20.50 and hit $25.19 by the end of the week.

Polkadot price in search for new tailwinds

Polkadot price is knocking on the door of the $20.50 level in completing a perfect swing trade that started to return to higher highs for the past four trading sessions. With the Nasdaq in the green, uplift has accelerated and DOT is currently set to attack the $20.50-level once the US session kicks in. Expect pressure to mount on this level, and once the Nasdaq ties in with +1% gains, expect bulls to bring out the jackhammers and break down the resistance wall around $20.50, to open another can of profits.

DOT price could see an accelerated inflow of buyers, and with that, the demand for buy-side volume could blow up, which would see an accelerated move up towards $22.20, hitting the new monthly pivot for February. In the process, the Relative Strength Index (RSI) would see a lift above the 50-level but still hold some grounds for further gains. The real test will be later this week towards $25.19 as this historical level coincides with the 55-day Simple Moving Average (SMA) and would return around 22% of gains to investors.

DOT/USD daily chart

The risk with the current value of Polkadot coins is that a rejection could trigger an inflow of bears and push the price back towards $16.95. Should global markets roll over and start selling off again, DOT could slip towards $15.00 as those headwinds weigh. Considerable risk is set to test $13.00, which is the fresh monthly S1 support level for February.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.