- Polkadot's DOT is boosted by Binance support.

- DOT may retreat to $7 and $5.5 before another bullish wave.

DOT broke the previous all-time high at $7 and jumped above the next psychological resistance of $8. At the time of writing, DOT is changing hands at $8.1, having gained over 12% on a day-to-day basis. The token sits at 6th place in the global cryptocurrency market rating with the current market capitalization of $7.3 billion.

Polkadot rivals ETH

DOT started breaking up on December 28, after Binance briefly featured the token on its homepage instead of ETH. The Chinese cryptocurrency and blockchain reporter Colin Wu was the first to notice the change. However, soon afterward, the company removed DOT from the Binance APP homepage.

Polkadot is considered as one of the main ETH rivals. The project is heavily financed by Binance. On December 27, the cryptocurrency trading platform announced the creation of a $10 million fund to support the development of Polkadot.

In October 2020, the head of Pantera Capital said that Polkadot had an excellent chance to stop Ethereum's domination in the industry of decentralized applications.

According to PolkaProject, there are 325 projects currently deployed on Polkadot blockchain, which is over a 30% increase from September levels.

DOT is ready for a correction

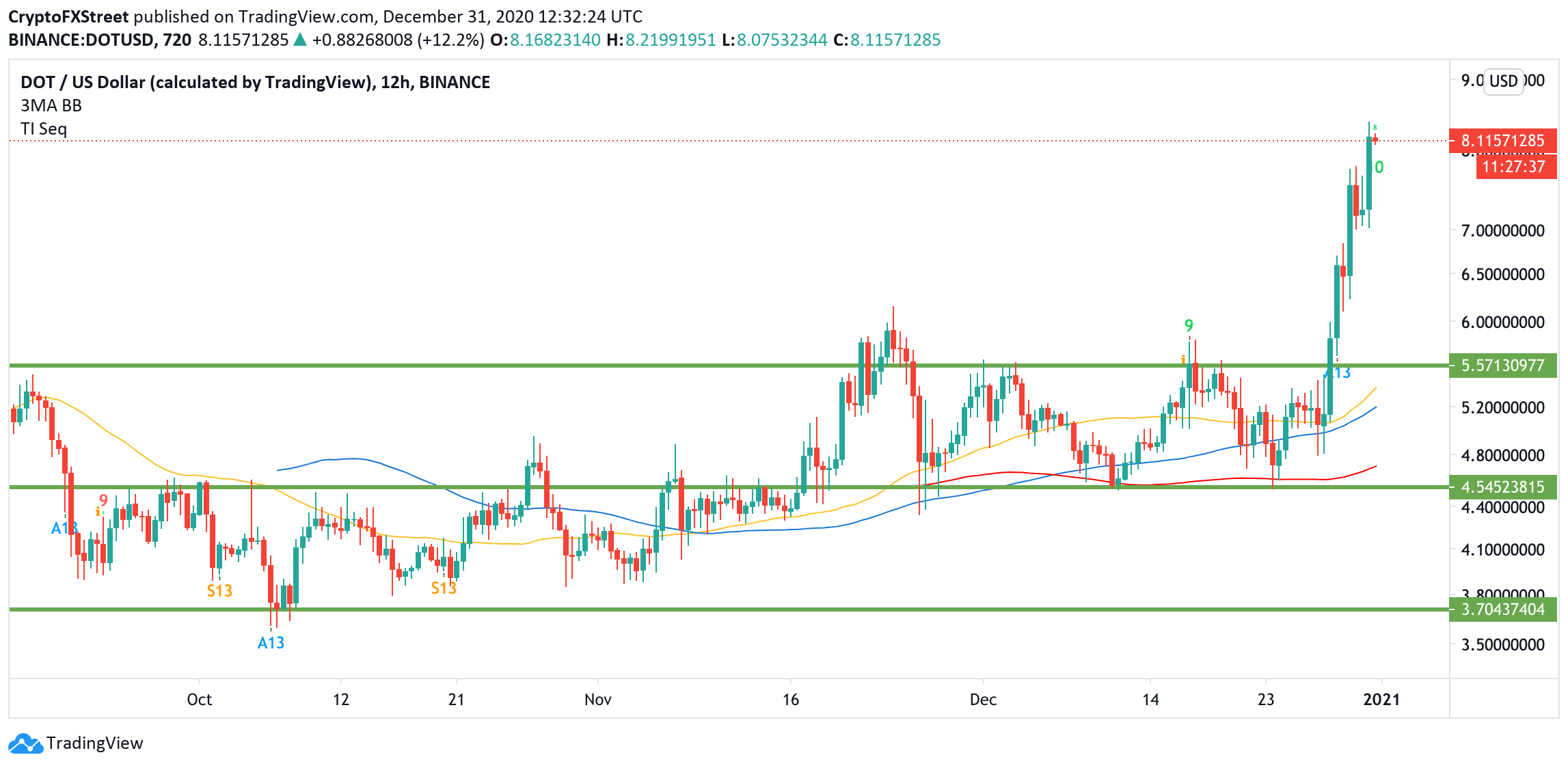

From the technical point of view, DOT broke above the critical resistance of $8. If the upside momentum is sustained, the price may proceed to $10 and potentially $12.

Meanwhile, the TD Sequential indicator is ready to present a sell signal. Currently, it shows a green eight candlestick, meaning that the token may be ripe for a healthy correction. If the signal is confirmed, DOT may retreat towards $7 before the upside is resumed.

DOT, 12-hour chart

On the other hand, if $7 gives way, the sell-off may be extended to the next critical level of $6.1 (November 24 high) and the previous channel resistance of $5.5. If this barrier is verified as a support, the long-term bullish trend will be confirmed.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Bitcoin, Ethereum and XRP steady as China slaps 125% tariff on US, weekend sell-off looming?

The Cryptocurrency market shows stability at the time of writing on Friday, with Bitcoin (BTC) holding steady at $82,584, Ethereum (ETH) at $1,569, and Ripple (XRP) maintaining its position above $2.00.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Bitcoin, Ethereum, Dogecoin and Cardano stabilize on Friday as crypto market capitalization steadies around $2.69 trillion. Crypto traders are recovering from the swing in token prices and the Monday bloodbath.

Can FTX’s 186,000 unstaked SOL dampen Solana price breakout hopes?

Solana price edges higher and trades at $117.31 at the time of writing on Friday, marking a 3.4% increase from the $112.80 open. The smart contracts token corrected lower the previous day, following a sharp recovery to $120 induced by US President Donald Trump’s 90-day tariff pause on Wednesday.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.