Decentralized exchange GMX has evolved as a serious competitor to established industry players like Uniswap in the wake of FTX's collapse.

On Monday, GMX earned $1.15 million in trading fees, surpassing Uniswap's $1.06 million for the first time on record, according to data tracked by Delphi Digital.

The decentralized exchange, which allows users to trade perpetuals or futures with no expiry without an intermediary using smart contracts, is perhaps benefitting from a broader shift toward perpetual-focused decentralized platforms triggered by the recent fall of centralized giant FTX.

GMX went live on Ethereum layer 2 solution Arbitrum in September 2021 and debuted on Ethereum-competitor Avalanche early this year. The platform offers relatively low transaction fees and zero price impact or the influence of a single trade over the market price.

Crypto perpetuals trading was first launched by centralized exchange BitMEX in 2016 and later dominated by its rivals Binance and the now-insolvent FTX.

Sam Bankman Fried's exchange FTX filed for Chapter 11 bankruptcy protection on Nov. 11, denting investor confidence in centralized exchanges.

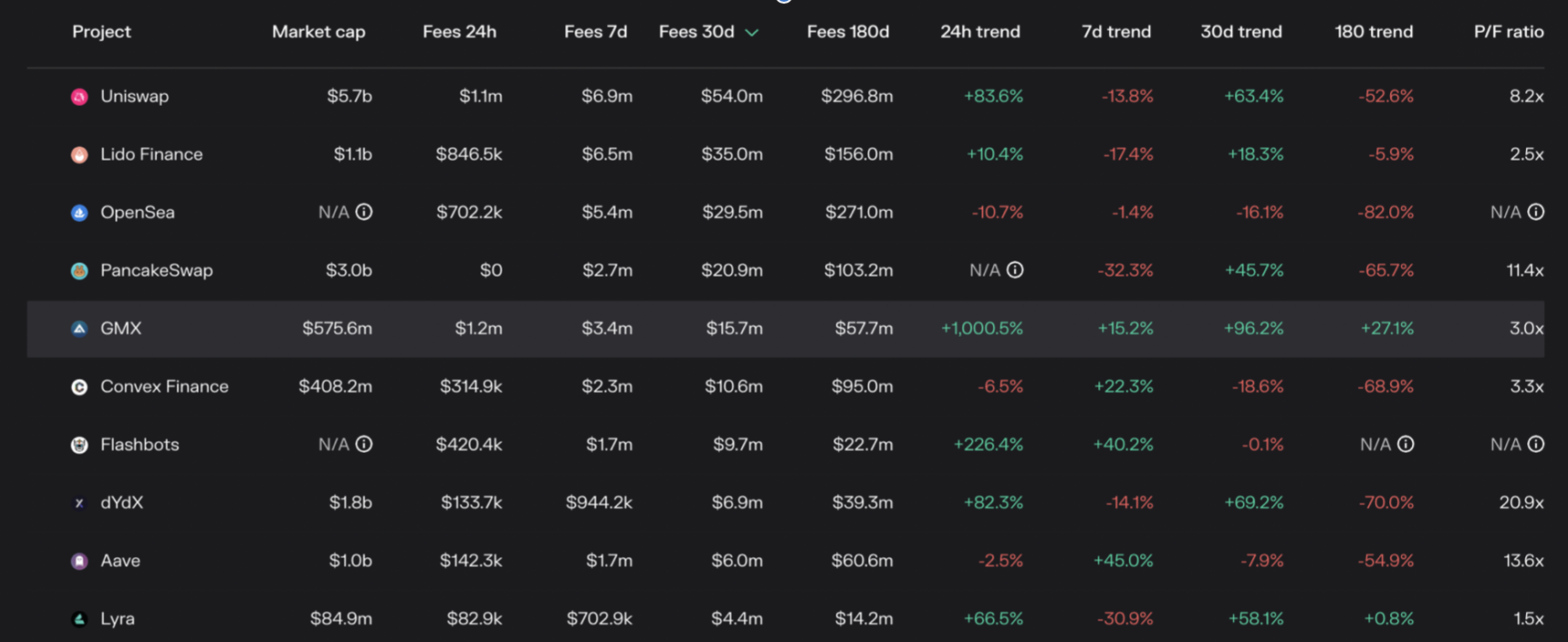

GMX is the fifth largest decentralized application in terms of fees earned in the past 30 days. (Token Terminal)

GMX has pocketed $15.7 million in trading fees in four weeks, becoming the fifth-largest decentralized application, ahead of prominent players like dYdX and AAVE, according to data source Token Terminal.

GMX's hosts, Arbitrum and Avalanche, have earned $985,600 and $540,500 in trading fees in 30 days. Uniswap has collected $54 million in trading fees, retaining the industry leadership.

Yet, Uniswap's UNI token has declined by 16% this month, while GMX has gained by 4%.

GMX's outperformance probably stems from the fact that the GMX token holders receive 30% of all the trading fees, while the UNI token holders do not receive a share in trading fees.

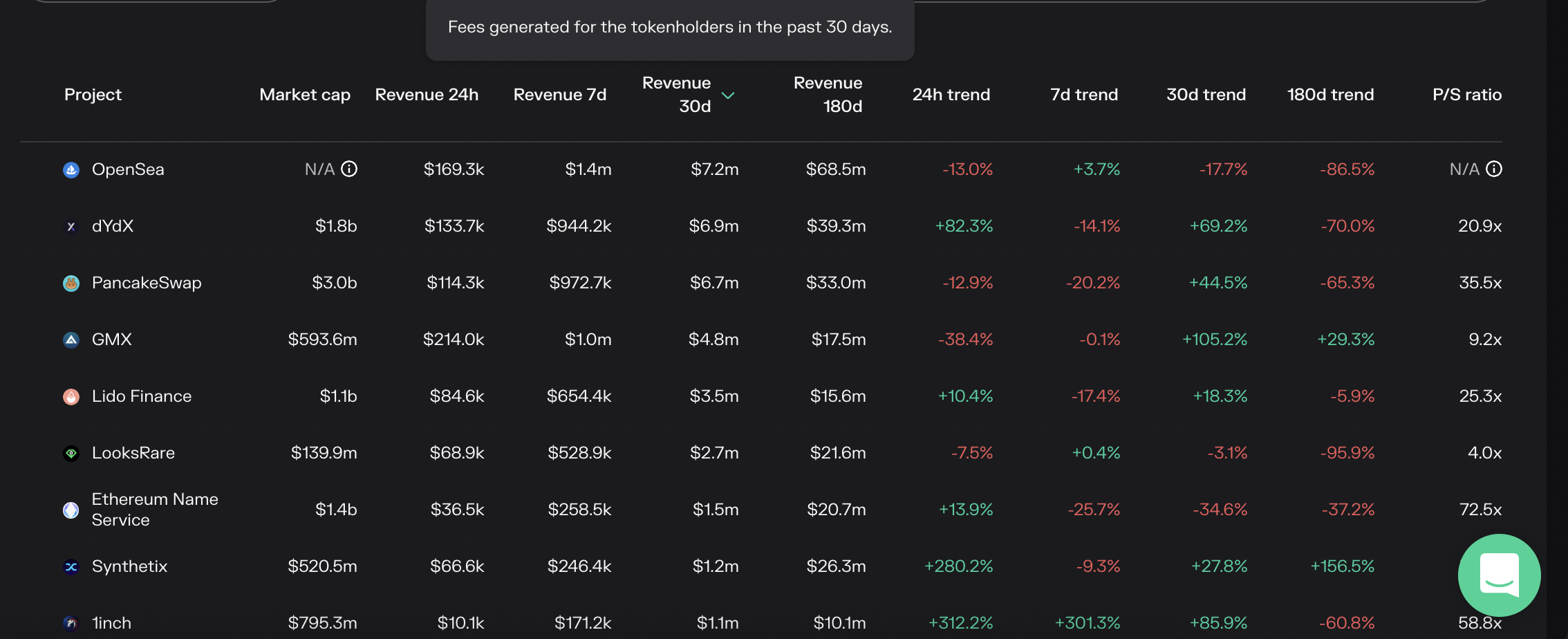

GMX has distributed $4.7 million to its token holders in 30 days. (Token Terminal) (Token Terminal)

GMX has distributed $4.7 million to the token holders in the past 30 days, the fourth-largest payout among all decentralized applications.

All writers’ opinions are their own and do not constitute financial advice in any way whatsoever. Nothing published by CoinDesk constitutes an investment recommendation, nor should any data or Content published by CoinDesk be relied upon for any investment activities. CoinDesk strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.

Recommended Content

Editors’ Picks

SHIB whale demand plunges as Solana memes dominate

Shiba Inu price opened trading at $0.000026 on Wednesday, its lowest opening price in 20 days dating back to November 29. On-chain data shows SHIB token struggling to attract whale demand as Solana memes dominate social channels.

Bitcoin edges down ahead Fed decision

Bitcoin price edges slightly down, trading around $104,100 ahead of the US Fed decision on interest rates on Wednesday. Ki Young Ju, founder of CryptoQuant, highlights that BlackRock’s Bitcoin spot ETF nearly doubled the Asset Under Management of its Gold ETF in under a year.

Altcoins Cardano and Avalanche poised for double-digit correction

Cardano and Avalanche prices continue to trade down on Wednesday after correcting more than 7% and 8%, respectively, so far this week. The technical outlook and on-chain metrics for both altcoins suggest the continuation of the pullback.

Ripple's XRP struggles near $2.58 resistance as investors realize $1.5 billion in profits

Ripple is up 3% on Wednesday after witnessing significant profit-taking among its investors following the launch of the RLUSD stablecoin. Whales have soaked up the selling pressure from profit-takers as XRP struggles near the $2.58 resistance level.

Bitcoin: BTC reclaims $100K mark

Bitcoin briefly dipped below $94,000 earlier this week but recovered strongly, stabilizing around the $100,000 mark by Friday. Despite these mixed sentiments this week, institutional demand remained strong, adding $1.72 billion until Thursday.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.