PEPE supply on exchanges hits all-time high as SEC's regulatory crackdown widens

- PEPE supply on exchanges climbed to 160.02 Trillion, a fresh all-time high, as market participants sent their holdings to exchange wallets.

- PEPE price fell 6.4% since Monday amid the regulatory crackdown on Binance and Coinbase.

- PEPE price is $0.00000109 at the time of writing, 75% below its all-time high of $0.00000431.

Pepe (PEPE), one of the largest meme coins in the crypto ecosystem, registered a massive spike in its supply on cryptocurrency exchange platforms, in a possible sign of renewed selling pressure as the US Securities and Exchange Commission (SEC) steps up its clampdown against crypto exchanges.

PEPE’s spike in its supply on exchanges could be a bad omen for its price, which has dropped sharply in recent weeks. Meanwhile, supply for large cryptocurrencies such as Bitcoin and Ethereum held steady.

Also read: SEC triggers crypto bloodbath as Coinbase, Kraken brace for token delistings after Binance lawsuit

PEPE whales shed holdings at a loss

Some large-wallet investors in the meme coin’s network are shedding their PEPE holdings at a loss, according to data from on-chain analytics platform Lookonchain. At least two whales sold their holdings at a considerable loss of $142,000 and $35,000, respectively.

Whales/SmartMoneys are selling $PEPE.

— Lookonchain (@lookonchain) June 5, 2023

A whale deposited 649B $PEPE($761K) 1 hr ago.

0x4614 who made 1,182 $ETH($2.2M) on $PEPE sold 375.8B $PEPE($306K) at a loss of 76 $ETH($142K) 1 hr ago.

0x6544 who made $352K on $PEPE sold 257.9B $PEPE($306K) at a loss of $35K 4 hrs ago. pic.twitter.com/w8crgva6S0

Typically, when whales shed their holdings at a loss it is considered bearish for the asset.

The bearish thesis is also supported by an increase in PEPE supply across exchanges. Based on data from crypto intelligence tracker Santiment, the supply on exchanges has climbed steadily throughout May, reaching a peak of 160.02 trillion as of Tuesday.

PEPE supply on exchanges

The rising supply on exchanges is indicative of increasing selling pressure on the asset and it could negatively influence PEPE price in the short term.

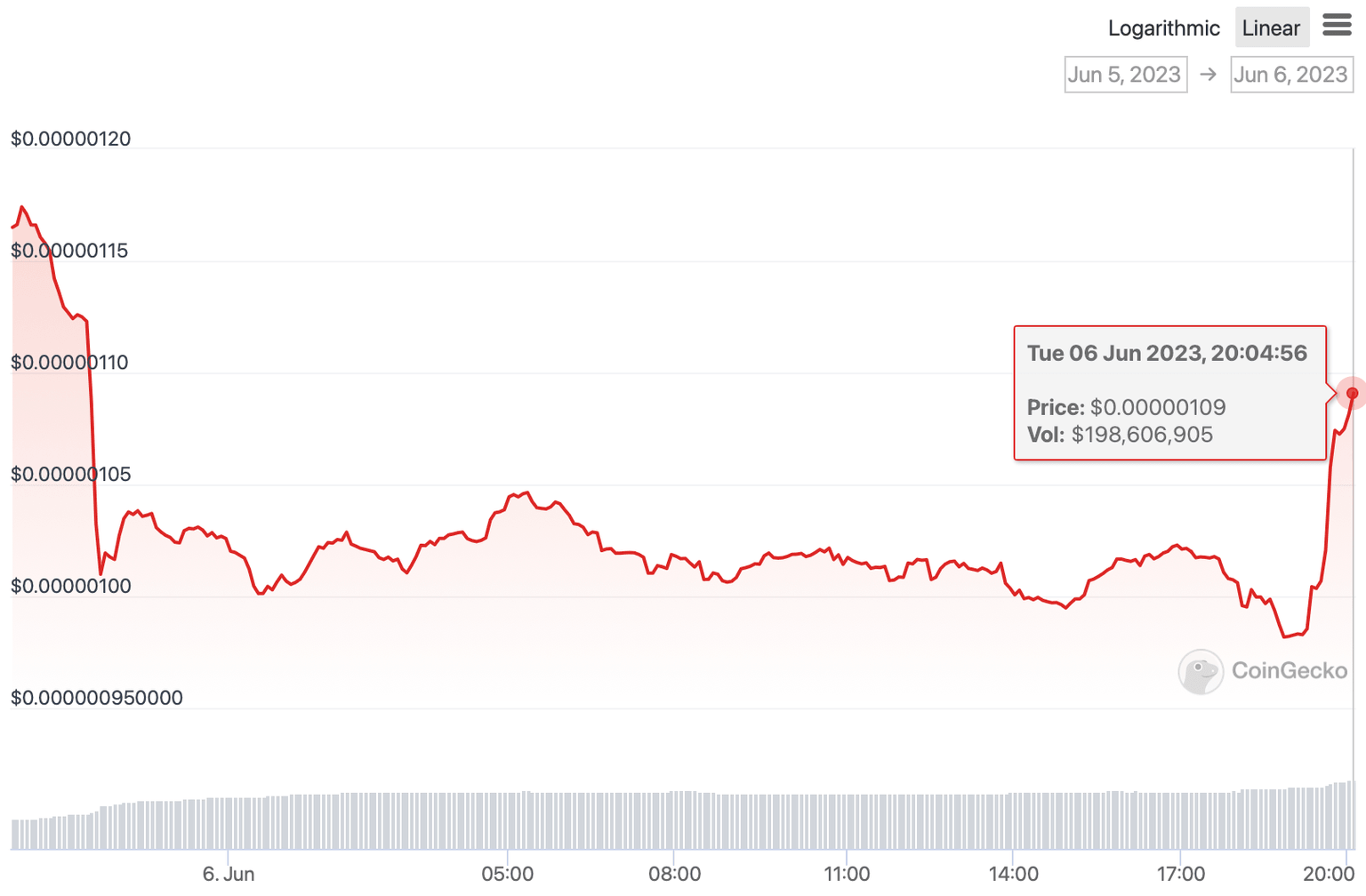

PEPE price chart from CoinGecko

PEPE price declined from $0.00000116 on Monday to $0.00000109 at the time of writing. The SEC’s regulatory crackdown on cryptocurrency exchanges like Binance and Coinbase shaved off $34 million from PEPE’s market capitalization, according todata from CoinGecko.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.