PEPE price to drop another 15% as altcoin winter is only halfway finished

- PEPE price is in a rough patch as the sell-off continues.

- PEPE bears will try to enforce another 15% drop from here.

- Expect to see some relentless selling until $0.0010000 is reached.

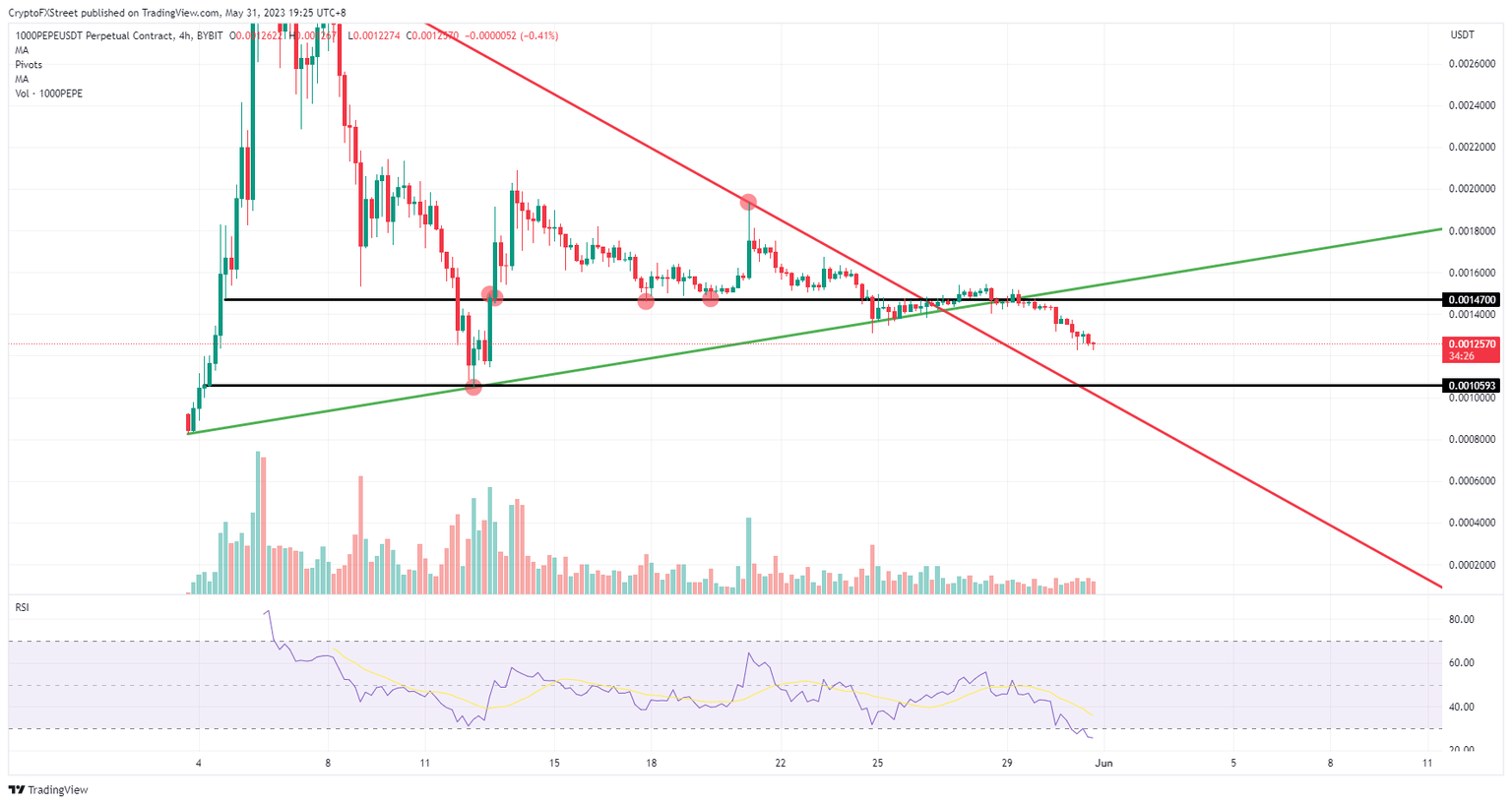

PEPE (PEPE) price is feeling the frost and cold of the altcoin winter that continues with some notable slides in price valuation in the altcoin space. After price action dropped below $0.0014700, traders must have understood that a turnaround would only occur at a high supportive level, which is still another 15% lower from where price action currently resides. Although the Relative Strength Index (RSI) is still low, expect some selling pressure with price action set to hit $0.0010000 before a turnaround emerges.

PEPE price proof that the RSI is not always the right indicator

PEPE price was stuck in a consolidation phase, which it was projected to really ride out until the last possible candle. Although it was a mild bullish breakout as the end result, the bulls did not enjoy their stay above $0.0014700 for long. Once price action started to show blips below that level, it did not take long for bears to come in and push price action below that level.

From a technical point of view, PEPE looks to be fishing for some support but needs to decline lower each time. On the chart only one real supportive area has decent prospects to undergird PEPE price.That is at $0.0010000 with the double bottom from May 12 as proof that it has already done that in the past. That means that bulls need to withstand another 15% decline before finally forcing a turnaround.

PEPE/USD 4H-chart

One element that could scare bears away preemptively is the RSI, which is quite stretched in the oversold area. Expect to see an earlier turnaround once no fresh bearish selling pressure is added to the current situation. Aquick U-turn toward $0.0014700 could appear with a very small possibility of making it up to $0.0016000 should that earlier mentioned level at $0.0014700 witness a bullish pop.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.