PEPE price pulls back as tokens worth $46M hit exchanges

- PEPE tokens worth $46.37 million have been deposited to exchange wallets in the past 24 hours, increasing the selling pressure on the meme coin.

- PEPE’s price has plunged 30% overnight, losing more than $200 million in market capitalization

- PEPE holders are back to break-even levels after a 2,000% price increase since the meme coin’s all-time low of $0.0000000551.

PEPE, the third largest meme coin by market capitalization, has witnessed massive swings in its price in a matter of days. PEPE hit an all-time high of $0.00000431 on May 5 but has since then fallen sharply, trading at $0.00000127 at the time of writing.

The meme coin gears up for more price volatility ahead as there has been an increase in PEPE deposits across cryptocurrency exchanges.

Also read: Lido DAO could begin its recovery as staking yield of stETH hits historical high

PEPE battles intense selling pressure

PEPE, a meme coin inspired by “Pepe the Frog meme”, faces increasing selling pressure. Experts at Scope Protocol monitored on-chain activity and said that 33 trillion PEPE tokens, worth $46.37 million, were deposited by 1,176 addresses.

In the past 24 hours, a large amount of $PEPE has been deposited into exchanges:

— 0xScope ( . ) (@ScopeProtocol) May 12, 2023

33T $PEPE worth $46.37M, with a net deposit of $22.94M from 1,176 addresses.

Beware of MEME coin drop risks pic.twitter.com/443wqMCTTJ

Analysts at Scope Protocol have warned the crypto community of risks associated with massive swings in meme coins like PEPE. Typically, a large increase in deposits of the token to exchanges is considered bearish for the asset.

PEPE price fell by a sharp 21% in the past 24 hours, according to data from CoinGecko. With the rising exchange wallet balances of PEPE tokens, the price of the meme coin is likely to experience a further correction

PEPE holders break-even, what’s next for the meme coin?

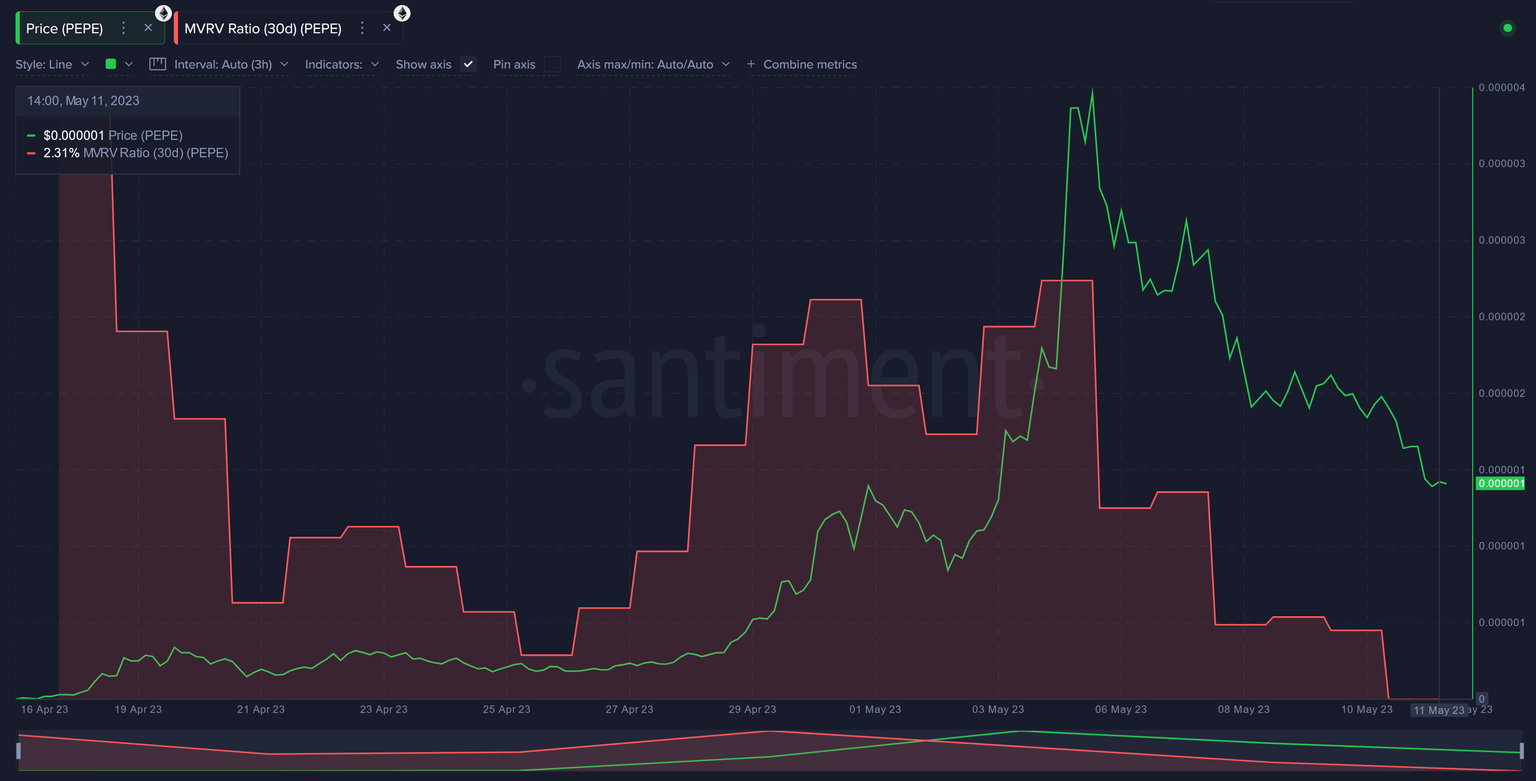

On-chain analysts at Santiment released a report on PEPE coin, examining on-chain metrics to find out where the meme coin is headed. Within the past 24 hours, the 30-day market-value-to-realized-value MVRV (a ratio of an asset's market capitalization versus its realized capitalization) shows that holders are currently at break-even.

PEPE MVRV chart

A decline in PEPE price below $0.00000126 could push it into negative territory, making it an “opportunity zone” for whales and traders to buy at a relatively low price.

Still, It's important to note that PEPE’s price, similar to other meme coins, is largely influenced by speculation and crowd expectations. Meme coins typically suffer a pullback when traders engage in large volume of profit-taking by holders, like it’s happening currently with PEPE. PEPE holders are therefore likely to witness a correction in the short-term.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.