- PEPE price surged 25% within the last 24 hours, decoupling from the broader market gloom.

- Whale transactions on the PEPE network hit a weekly peak volume of $121 million on Monday.

- Technical indicators suggest the bullish momentum could weaken as PEPE price approaches the $0.000025 resistance level.

PEPE price surged 25% within the last 24 hours, decoupling from the broader crypto market’s year-end volatility. With whales spotted entering last-minute buying frenzy, can PEPE breach the $0.000025 resistance?

PEPE price decouples from Crypto market dip with 25% rally

PEPE has emerged the standout performer, as global cryptocurrency markets experienced intense volatility in the final trading hours of 2024.

Amid the downtrend, Bitcoin price remains stuck below $95,000, struggling to reclaim key psychological levels, while Ethereum continues to falter around $3,300.

Similarly, memecoins like Dogecoin (DOGE) and Shiba Inu (SHIB) have recorded double-digit losses over the past week.

However, amid this gloomy backdrop, PEPE price has increased considerably on Tuesday.

PEPE Price Action | Source: TradingView

PEPE Price Action | Source: TradingView

According to TradingView data, PEPE's price climbed from a daily low of $0.000017 on Monday to reach $0.000021 during Tuesday's trading session.

This 25% rally makes PEPE the best-performing asset among the top 20-ranked cryptocurrencies in the final trading day of 2024.

With 1,500% yearly timeframe returns, and a market capitalization of $8.3 billion, PEPE is on course to close 2024 as the 3rd largest memecoin project behind DOGE and SHIB.

Whales spotted trading $121M in last-minute frenzy

PEPE’s 25% price surge on Tuesday has left many wondering if this momentum is sustainable or simply a temporary spike driven by short-term factors. On-chain data trends show an unusual spike in whale trading activity on the PEPE network, a move that could have sparked the rally.

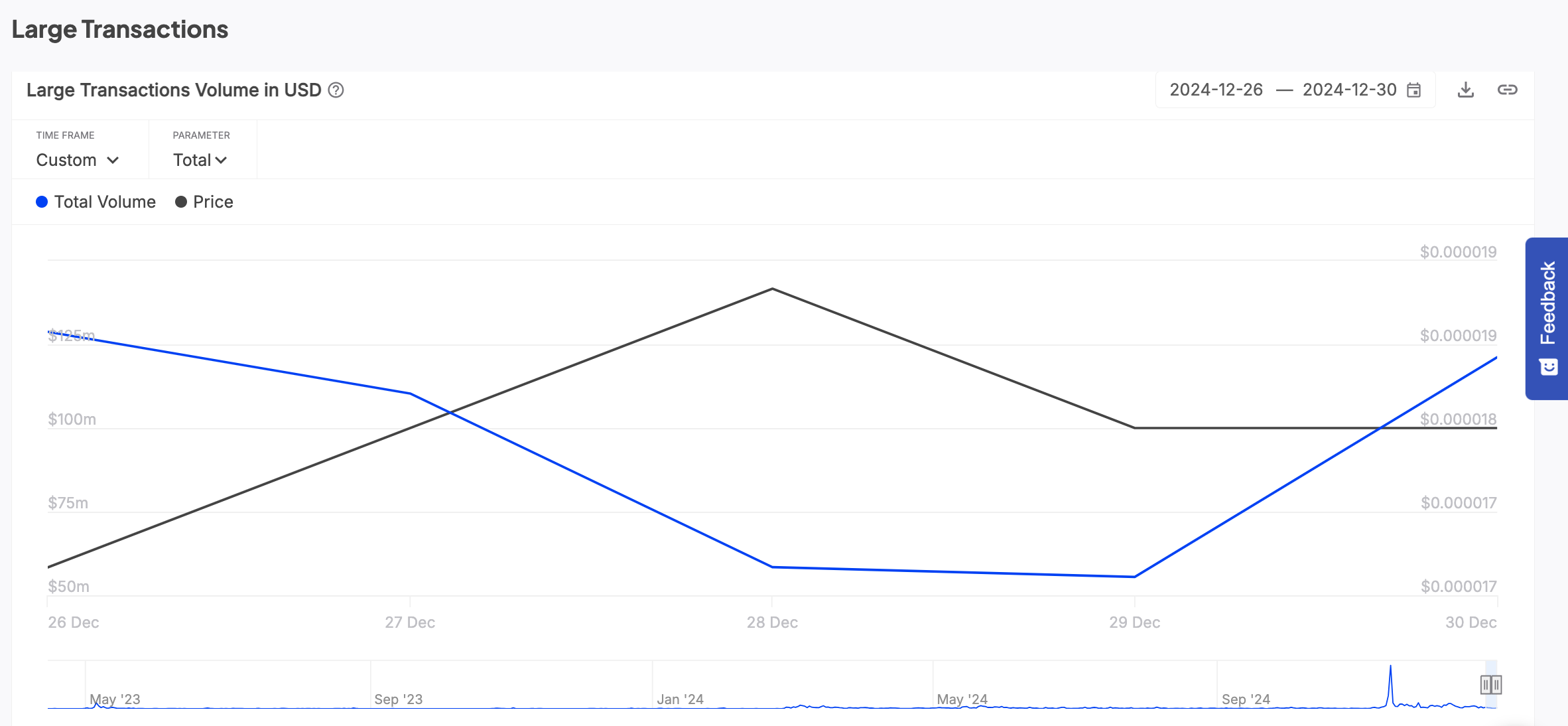

PEPE Whale Transactions | Source: IntoTheBlock

PEPE Whale Transactions | Source: IntoTheBlock

According to on-chain analytics platform IntoTheBlock, PEPE's network recorded a weekly peak volume of $121 million in whale transactions on Monday.

This figure represents the highest level of large wallet activity on the PEPE blockchain in over a month.

The timing of these transactions suggests strategic accumulation by large investors capitalizing on the market dip and thin liquidity to drive prices higher.

While this surge in whale demand on Monday has coincided with PEPE 25% price gains in the last 24 hours, it remains to be seen if the whale demand will persist, or if rally evolves into a bull-trap.

PEPE Price Forecast: $0.000025 Resistance Looms Large

While PEPE’s recent rally is impressive, technical indicators suggest that the bullish momentum could face challenges as the price approaches the $0.000025 resistance level.

Historically, bears mounted a major sell-wall at this price zone when the market crash began in mid-December.

The Moving Average Convergence Divergence (MACD) indicator on the daily timeframe shows limited bullish momentum.

While the MACD line has crossed above the signal line, the histogram's shallow peaks suggest low trading volume and weak demand to sustain further upward movement.

This aligns with the broader market trend, where Bitcoin and Ethereum are struggling to maintain key levels, and other memecoins like DOGE and SHIB remain bearish.

Additionally, the Relative Strength Index (RSI) sits at 53.08, indicating neutral conditions.

While this level leaves room for further upward movement, the RSI has yet to break into overbought territory, suggesting the rally lacks the strong momentum typically needed to breach significant resistance levels.

PEPE Price Forecast | PEPEUSDT

If PEPE price rally successfully breaks above $0.000025, it could ignite a broader bullish trend, with the next target set at $0.000030.

Such a move would likely require renewed whale activity or significant market-wide sentiment shifts.

However, considering the weak MACD momentum and PEPE’s rally against broader market trends, this scenario appears less likely in the near term.

Alternatively, failure to overcome the $0.000025 resistance would likely result in a consolidation phase. A rejection at this level could see PEPE retesting $0.00002006 and potentially dropping further to $0.00001846, where the lower Donchian Channel boundary could act as a safety net.

A break below $0.00001846 would invalidate the current bullish structure and open the door for a decline toward $0.00001441.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: Slow but positive start

Bitcoin edges slightly lower, trading around $96,500 on Friday after an over 2.5% recovery this week, with historical data showing modest average January returns of 3.35%. On-chain metrics suggest the bull market remains intact, indicating a cooling-off phase rather than a cycle peak.

Stellar bulls aim for double-digit rally ahead

Stellar extends its gains, trading above $0.45 on Friday after rallying more than 32% this week. On-chain data indicates further rally as XLM’s Open Interest and Total Value Locked rise. Additionally, the technical outlook suggests a rally continuation projection of further 40% gains.

BTC, ETH and XRP eyes for a rally

Bitcoin’s price finds support around its key level, while Ethereum’s price is approaching its key resistance level; a firm close above it would signal a bullish trend. Ripple price trades within a symmetrical triangle on Friday, a breakout from which could signal a rally ahead.

Could XRP surge to new highs in January 2025? First two days of trading suggest an upside bias

Ripple's XRP is up 7% on Thursday, extending its rally that began during the New Year's Day celebration. If long-term holders (LTH) continue their recent accumulation, XRP could overcome the $2.9 resistance level and aim for a new all-time high.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.