PEPE Price Forecast: PEPE reenters accumulation zone as smart money await 70% rally

- PEPE price embarked on a downtrend, shedding 44% between July 4 and August 7.

- A breakout from this bearish trend resulted in a 33% rally as it entered a key accumulation zone.

- The frog-themed cryptocurrency provides another opportunity to buy, before a 70% move kickstarts.

PEPE price has reentered a key accumulation zone that will likely allow sidelined buyers to buy the meme coin at a discount. The resulting spike in buying pressure could extend the 33% rally that began on August 7.

Also read: Ethereum, Dogecoin, PEPE note millions in sudden liquidation owing to potential Binance FUD

PEPE price sets up investors for profits

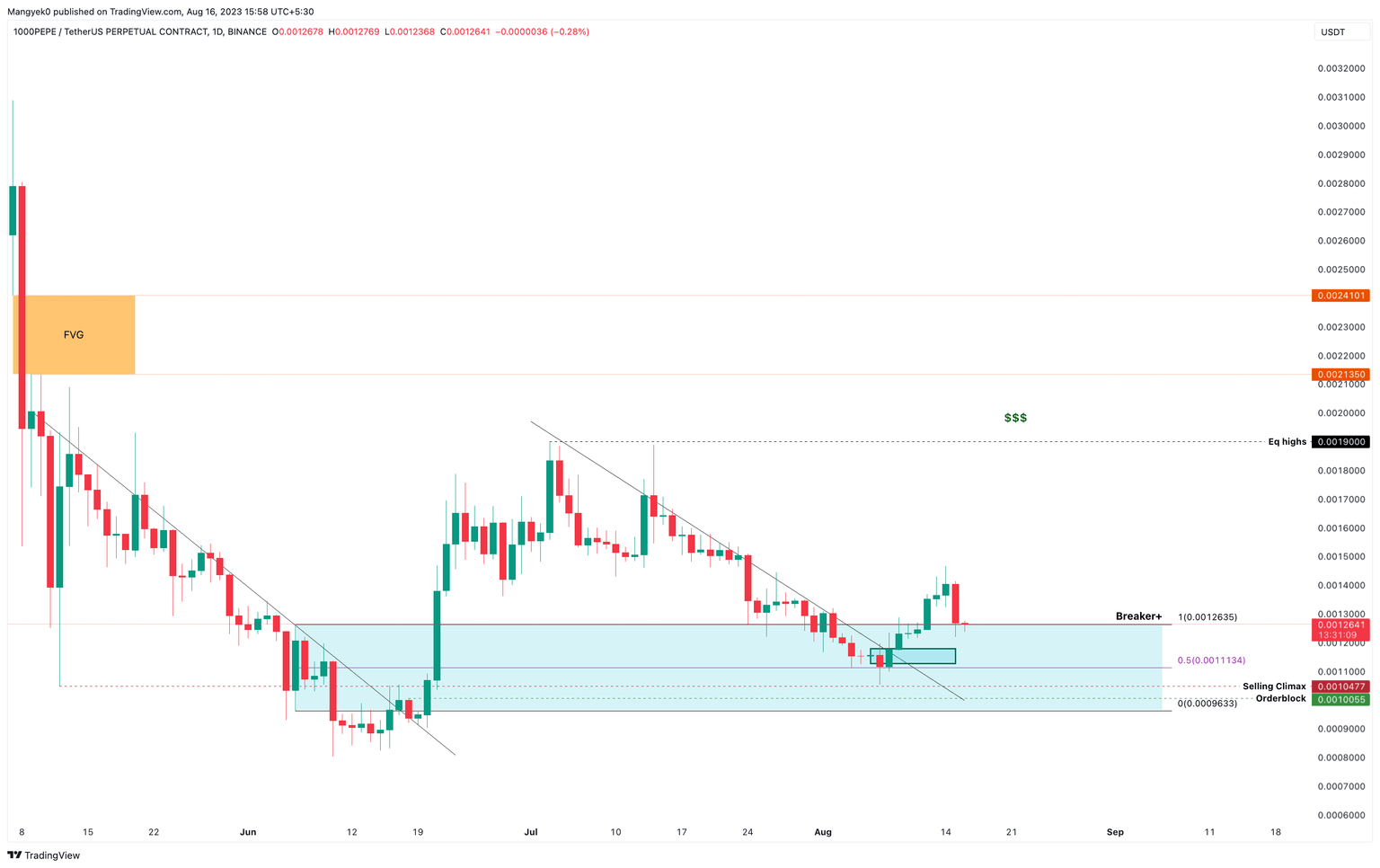

PEPE price noted a massive 106% rally after it breached the 40-day downtrend on June 19. As the bullish momentum exhausted, the altcoin slowly retraced into a bullish breaker, extending from $0.000000963 to $0.00000126.

A bullish breaker is the set of up candlesticks formed between two lower lows. As the underlying asset rallies and produces a higher high, these candlesticks are collectively called a bullish breaker.

In this scenario, traders can then wait for a retracement of this uptick to retest the formed breaker and open long positions. PEPE price dipped as low as $0.00000104 inside the breaker, but found support at its midpoint of $0.00000111. Although the initial spurt of buying pressure pushed the meme coin up by 33%, a subsequent retracement is retesting the breaker, allowing sidelined investors an opportunity to accumulate PEPE tokens.

The rally that kickstarts could propel PEPE price by 50% to the next key level at $0.00000190. Beyond this hurdle, the frog-themed crypto could eye a retest of the $0.00000213 level. This move, however, would constitute a nearly 70% gain from the current position.

PEPE/USDT 1-day chart

With Bitcoin’s volatility dipping to all-time lows, altcoins– especially on-chain tokens – are getting all the attention. Should BTC restart its upward move, these profits are likely to rotate back to altcoins like PEPE. But if Bitcoin price crashes, ending its dry volatile spell, then altcoins could take a serious hit.

In such a case, if PEPE price produces a daily candlestick close below $0.000000963 level, it would create a lower low and invalidate the bullish outlook. Such a development could see the altcoin crash another 16% and retest the June 10 swing low at $0.000000803.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.