- Pepe price is up 30% on the day, reclaiming all the ground lost in the Monday trading session.

- Nevertheless, the altcoin remains trapped below a downtrend line, casting doubt on the current bullish outlook.

- The falling momentum suggests PEPE could soon fall, raking in losses for investors.

Pepe (PEPE) price has recorded a stunning rally over the previous day, restoring all the ground lost during the Monday trading session. While a first looker may see this as a bull market signal for the sensational meme coin, other fundamentals indicate that the rally will not sustain.

Also Read: PEPE supply on exchanges hits all-time high as SEC's regulatory crackdown widens

Pepe (PEPE) price shows a bullish bias in the short term after rising over 30% in the last 24 hours. The stunning move has seen the sensational meme coin reclaim the losses made during the May 6 trading session. While this looks bullish, fundamental indicators show a lack of momentum to sustain the rally.

Based on the four-hour chart below for PEPE/USDT, Pepe price remains under the foothold of the multi-month downtrend line without clear signs of a breakout. The attempts made on May 13 and 20 proved premature as the meme coin's price was rejected almost immediately.

At the current price of $0.00000119, Pepe price is facing overhead pressure from the supplier congestion zones presented by the 50-, 100-, and 200-day Simple Moving Averages. Selling pressure from these zones could repel PEPE south, suppressing the meme coin under the downtrend line.

The falling Relative Strength Index (RSI) tipping south suggests a falling momentum and therefore backs this bearish outlook. Similarly, the Moving Average Convergence Divergence (MACD) and Awesome Oscillator (AO) indicators are below the midline, indicating the presence of bears in the market.

PEPE/USDT 4-hour chart

On-chain metrics bolster the bullish case

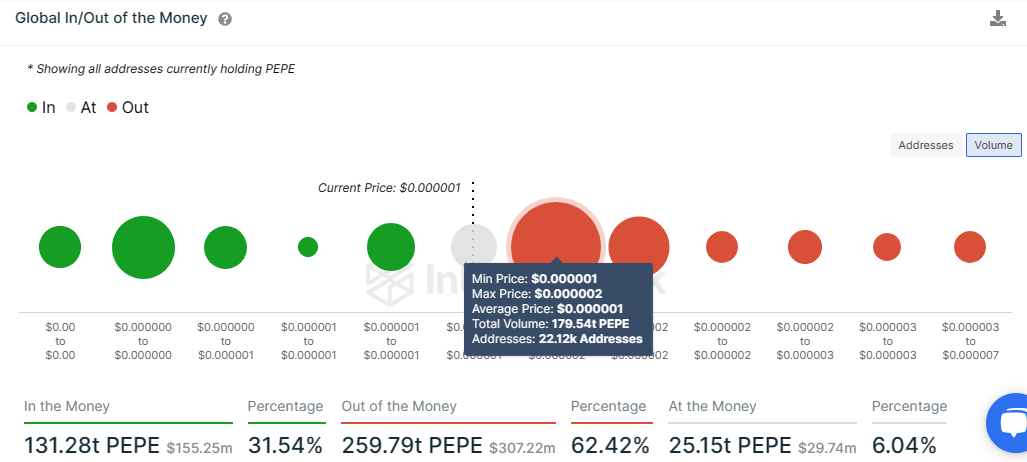

On-chain metrics from IntoTheBlock also bolster the case for the bears, showing robust resistance around the $0.00000100 and $0.00000200 range, where sellers abound. Therefore, any attempts by the bulls to raise Pepe price higher would be challenged by approximately 22,120 addresses who bought approximately 179.54 trillion PEPE at an average price of $0.00000100.

With them looking to break even, hopes for a breakout for Pepe price remain slim.

On the flip side, if selling pressure increases, Pepe price could fall toward the $0.00000090 support floor, or in the dire case, fall lower to collect buy-side liquidity underneath.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ripple update: XRP shows resilience in recent crypto market sell-off

Ripple's XRP is up 6% on Tuesday following a series of on-chain metrics, which reveals investors in the remittance-based token held onto their assets despite the wider crypto market sell-off last week.

Floki DAO floats liquidity provisioning for a Floki ETP in Europe

Floki DAO — the organization that manages the memecoin Floki — has proposed allocating a portion of its treasury to an asset manager in a bid to launch an exchange-traded product (ETP) in Europe, allowing institutional investors to gain exposure to the memecoin.

Six Bitcoin mutual funds to debut in Israel next week: Report

Six mutual funds tracking the price of bitcoin (BTC) will debut in Israel next week after the Israel Securities Authority (ISA) granted permission for the products, Calcalist reported on Wednesday.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.