PEPE hits new all-time high, meme coin could extend gains

- PEPE hit a new all-time high at $0.00001725 on Monday, May 27.

- The frog-themed meme coin noted a surge in active addresses and social dominance amidst rising price.

- PEPE extended gains by over 4% on Monday and added 81% to its value in the past seven days.

PEPE, a frog-themed meme coin, hit a new all-time high early on Monday, rallying to a peak of $0.00001725. The asset rallied 81% in the past seven days on Binance.

Meme coins have consistently extended gains in the ongoing cycle, alongside a rally in Bitcoin, Ethereum and other cryptocurrencies in the top 20 assets by market capitalization. Dogecoin (DOGE), Shiba Inu (SHIB), Pepe (PEPE) and Solana-based meme coins have rallied on several occasions since the approval of Spot Bitcoin Exchange Traded Funds (ETFs) early in 2024.

PEPE currently ranks as the 19th largest cryptocurrency by market capitalization on Coinmarketcap.

PEPE hits new all-time high alongside bullish on-chain metrics

Data from crypto intelligence tracker Santiment shows that there has been a massive spike in PEPE’s active addresses and social dominance between May 20 and 27. Active addresses nearly doubled in the timeframe, and social dominance, a metric that measures the share of PEPE’s mentions in crypto discussions on social media platforms, climbed from 0.81% to 3.55% in the same period.

PEPE active addresses and social dominance

Santiment data reveals that PEPE supply on exchanges is nearly at the same level as May 20, posting a 0.3% increase between May 20 and 27. This implies that there is less likelihood of higher selling pressure on PEPE, and the meme coin could extend gains further.

PEPE price could extend gains by nearly 25%

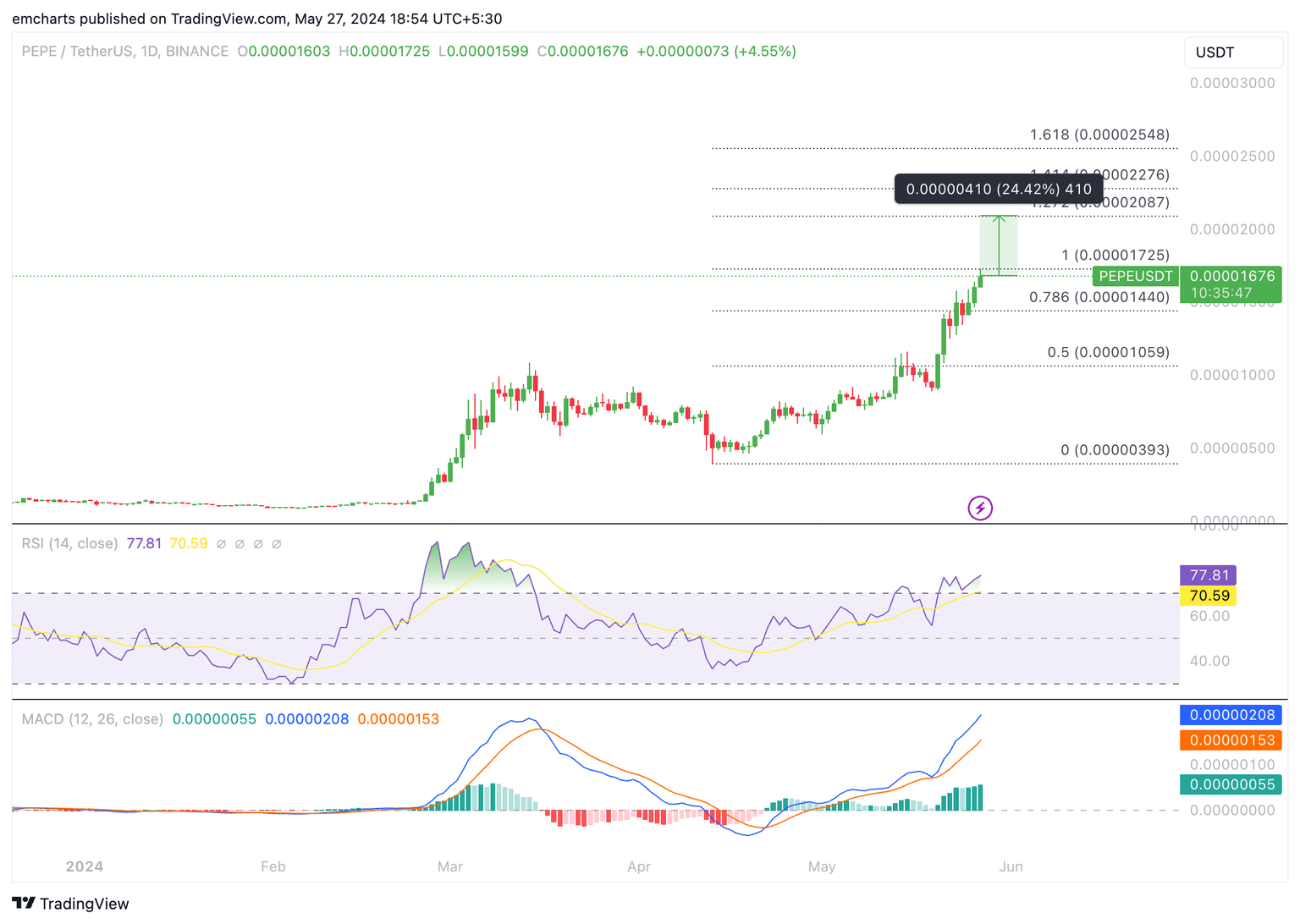

PEPE has been in an uptrend since April 14. The meme coin has formed higher highs and higher lows with an impulsive upward move noted on May 20 and 21. PEPE rallied to its new all-time high of $0.00001725 on Binance early on Monday.

The momentum indicator, the Moving Average Convergence Divergence (MACD), supports PEPE price gains with green histogram bars above the neutral line. This suggests positive underlying strength in the meme coin’s price uptrend.

The Relative Strength Index (RSI) reads 77.81, well above the neutral boundary at 70. While PEPE is in the overbought zone, the positive underlying momentum implies the asset could extend gains further.

Traders opening a long position need to be cautious while RSI is in the overbought zone on the 1-day timeframe.

PEPE could extend gains by nearly 25% to 127.2% Fibonacci extension of the rally from the April 13 low of $0.00000393 to the May 27 peak of $0.00001725.

PEPE/USDT 1-day chart

PEPE could find support at the May 23 low of $0.00001276 in the event of a correction in the asset’s price.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.

%2520%5B18.31.53%2C%252027%2520May%2C%25202024%5D-638524152375923126.png&w=1536&q=95)