- Pepe coin price has shot up by nearly 900% in the last three days since its launch.

- Whales holding about 30 trillion PEPE has accrued millions of dollars in profit following the rally.

- PEPE still presents a threat to investors as a potential pump-and-dump token akin to the likes of Squid Games token, Metaverse Miner, Viking Swap, etc.

PEPE, the newest addition to the crypto meme coin token list, is reinvigorating the meme coin discourse. The regurgitated discussions surrounding Dogecoin and Shiba Inu were diminishing the sector’s popularity, which is seeing a resurgence thanks to PEPE. However, this does not mean one should not practice caution when investing in this coin, given its whales’ recent behavior.

What PEPE really is

Pepe coin (PEPE), put simply, is just another meme coin that uses “Pepe The Frog” as its mascot. Since its launch on April 16, it has found popularity to become a hot topic in the crypto community. Feeding on the popularity of meme coins and Elon Musk, the token operates a total supply of 420.69 trillion PEPE, which are funny numbers associated with the Twitter CEO’s tweets from the past.

PEPE rally in the last three days is reminiscent of the Shiba Inu and Floki Inu rallies, which surged after the meme coin narrative gained strength. This also led to other small-cap meme coins, such as Dogelon Mars and Baby Doge Coin, exploding for a short period of time before returning to their nominal values.

Valued at $0.0000003441 at the time of writing, the meme coin has observed a nearly 900% rally in the span of just three days.

PEPE/USD 1-day chart

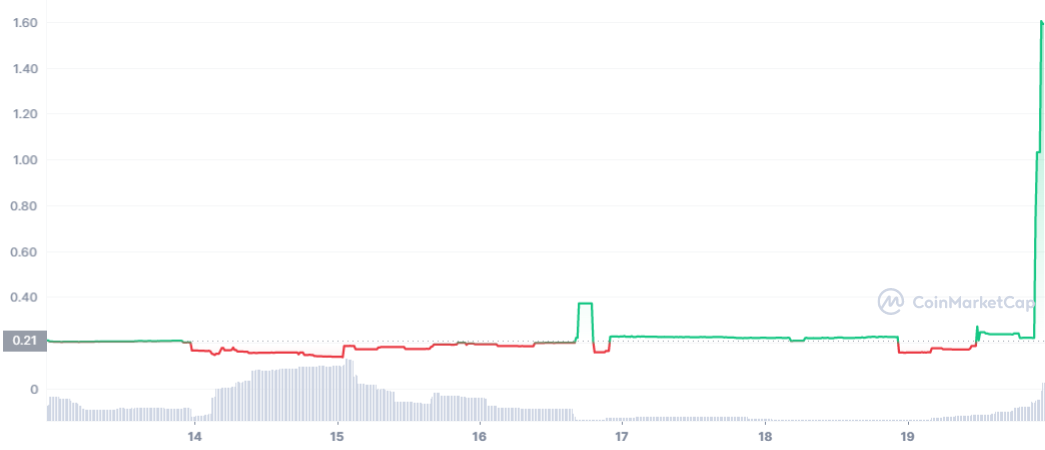

The sudden popularity of the Pepe meme, which is the reason behind this massive rally, also extended to another crypto token called Memetic / PepeCoin (MEME). At the time of writing, MEME could be seen trading at $1.59, up from $0.245 less than eight hours ago, marking a 911% rally.

MEME/USD 1-day chart

Rallies like the ones noted on PEPE and MEME reinforce the stereotype that the crypto market is suffering from of crypto simply being a fad bubble. At the same time, it also raises questions about the lack of maturity in this space in comparison to other investment options such as stocks, commodities, Forex, etc.

PEPE whales accrue incredible gains

While on the surface, PEPE may seem like just another meme coin pumping out of hype, the in-depth on-chain analysis points out some interesting development. As noted by analyst An Ape’s Prologue, the meme coin’s mysterious whales have been making enormous gains thanks to the price rise. Across 13 wallets, whales have amassed close to 30 trillion PEPE worth a little over $10 million.

$PEPE: Mysterious Whales

— An Ape's Prologue (@apes_prologue) April 19, 2023

The memecoin surged by 1000x in just 4 days, making some users go from rags to riches.

We've spotted a few wallets that, with an average cost of 0.61 $ETH ($1210), managed to make over $9M - a 7500x return.

However, the timing of the buys is curious: pic.twitter.com/zw0C5TB0Se

While the whales’ holding isn’t relatively massive, the concern arises when this holding is held up against the total liquidity of PEPE in the market. Despite rising significantly, the total liquidity at the moment is a third of whales’ holdings. This opens the meme coin up to the fears of a potential pump and dump. As noted by the analyst, even if the whales sell off 10% of their balance, the token could take a serious hit.

PEPE liquidity

However, there is some incentive to these whales even if they are insiders/members of the development team of PEPE, as the project is gaining traction despite low liquidity. If this bullishness persists, the meme coin could observe some more green candles, which would, in return, benefit the whales too.

Nevertheless, investors should wait out the PEPE hype before throwing any money on it, as such trend-based tokens can turn out to be a scam at any time.

The best examples of this can be found in the likes of the Squid Game token, which rallied significantly following the hype of the TV show Squid Games. In the past, many more such tokens have resulted in investors losing their money, including cryptocurrency Viking Swap and Metaverse hyped Metaverse Miner.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

XRP soars upon announcement that SEC will drop its appeal against Ripple

Ripple CEO Brad Garlinghouse announced that the SEC will drop its appeal against Ripple. The victory follows rumors of Ripple's lawyers negotiating more favorable terms than the company got in Judge Torres' ruling last August.

Dogecoin on-chain metrics signal a potential turning point once the crypto market stabilizes

Dogecoin price hovers around $0.168 on Wednesday after bouncing off its 200-week EMA last week. Santiment’s data shows that DOGE’s utility and whale wallets are rising, hinting at a potential rally for the dog-themed memecoin.

Bitcoin stabilizes below key resistance, risk-off sentiment persists

Bitcoin (BTC) trades around $83,300 at the time of writing on Wednesday after facing resistance around its 200-day Exponential Moving Average (EMA) at $85,500 since last week, with a break above this level suggesting a potential recovery.

Ripple's XRP futures signals increased bearish sentiment despite long-term holders seeing strong gains

XRP open interest and funding rates have remained largely negative in recent weeks. Investors remained calm despite the high bearish sentiment in the futures market, likely due to their large profits.

Bitcoin: BTC at risk of $75,000 reversal as Trump’s trade war overshadows US easing inflation

Bitcoin price remained constrained within a tight 8% channel between $76,000 and $84,472 this week. With conflicting market catalysts preventing prolonged directional swings, here are key factors that moved BTC prices this week, as well as key indicators to watch in the weeks ahead.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.