Pepe 15% surge could restart meme coin mania

- Pepe price has flipped the $0.00000807 resistance level into a support floor.

- Investors can expect PEPE to kick-start another rally for the broader meme coins sector.

- A breakdown of the $0.00000807 could hamper the uptrend.

Pepe (PEPE) price shows strength in Thursday’s early Asian session, with a 15% uptick in the last four hours. This surge in PEPE could kick-start the second phase of the meme coin rally.

Read more: Meme coin season ends abruptly

PEPE price sets the stage for next leg

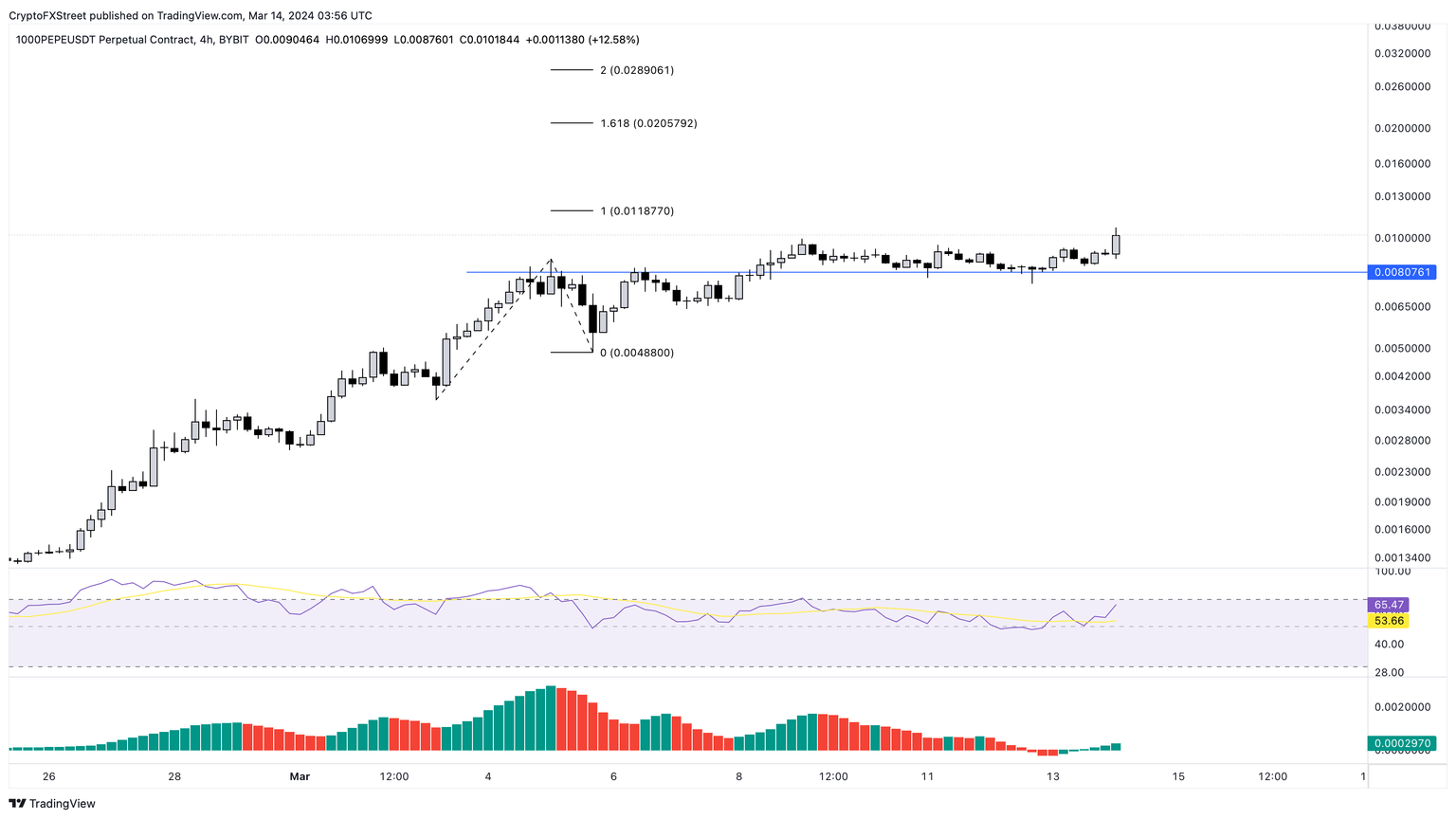

Pepe price has been in a tight consolidation stage since the local top formation on March 5. However, the recent flip of the $0.00000807 resistance level into a support floor has increased buying pressure, pushing PEPE up by 15%.

Moreover, popular analysts and influencers have mentioned how Pepe price could lose another zero, which is another way of saying that a massive rally is in the works for the frog-based crypto token.

time to slice off another 0 pic.twitter.com/nQNyS1Sua6

— Hsaka (@HsakaTrades) March 13, 2024

Hence, investors can expect Pepe price to enter price discovery mode soon and tag the next key Fibonacci extension level at 161.8% of $0.0000205. This move would roughly constitute a 100% gain.

During its ascent, Pepe's price could take a breather at around $0.0000118 before ascending to $0.0000205.

The Relative Strength Index (RSI) has bounced off the 50 mean levels, suggesting a momentum reset favoring bulls. The Awesome Oscillator (AO) also suggests a potential reset.

PEPE/USDT 4-hour chart

On the other hand, if Pepe price breaches the $0.00000807 support floor and flips it into a resistance level, it would suggest that a short-term spike in buying pressure was a fluke. In such a case, Pepe price could slide 40% and revisit the March 5 swing low at $0.00000488.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.