International payments giant PayPal has proposed to make sustainable Bitcoin (BTC $66,375) mining more economically attractive by rewarding miners through incentives layered on top of the Bitcoin network.

PayPal’s Blockchain Research Group, in collaboration with Energy Web and DMG Blockchain Solutions, has proposed using "cryptoeconomic incentives" to encourage Bitcoin miners to use low-carbon energy sources, according to an April 22 blog post.

The firm hopes that the experimental incentive contributes to further discussion and innovation around Bitcoin and is seeking industry feedback on potential improvements.

Under the proposal, “green miners” who use sustainable energy sources would be accredited with special “green keys,” which are associated with their public keys.

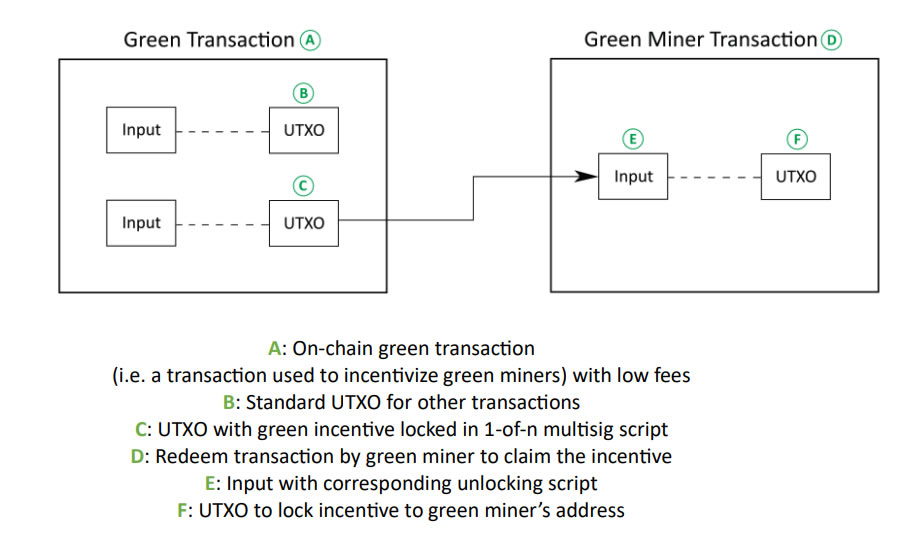

Bitcoin transactions would be preferentially routed to these green miners by attaching lower fees but with an additional locked BTC reward in a multisig payout address that only the green miners can claim.

“Green miners will be incentivized to mine these transactions since they will be the only ones eligible for the additional “locked” BTC reward,” it explained,

This incentivizes rational profit-driven miners to operate with low-carbon sources to get the extra BTC rewards.

Green miner transactions. Source: PayPal Blockchain Research Group

According to the paper, the proposed solution will leverage Energy Web’s “Green Proofs for Bitcoin” platform for miners to get certified based on their clean energy and grid impact scores.

The green miners can register and share their green keys on the platform as participants of the incentive program.

PayPal BRG said that it has successfully tested the proposed solution with Bitcoin miner, DMG Blockchain Solutions Inc.

During the test, it broadcasted multiple low-fee transactions to observe effectiveness under different levels of on-chain transaction volume.

Depending on transaction volume, “these transactions would either take a long time to confirm or eventually be dropped by the network,” it observed before adding: “This would increase the chances for green miners to pick up these transactions.”

An alternative approach would involve exploring private channels such as the Lightning Network or smart contracts, but there would be trade-offs such as more complex implementation, it added.

“The solution outlined here aims to achieve a good degree of decentralization, ease of implementation and trust independence while distributing incentives,” PayPal BRG concluded.

Cointelegraph contacted PayPal for further details on potential implementation but did not receive an immediate response.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Ripple update: XRP shows resilience in recent crypto market sell-off

Ripple's XRP is up 6% on Tuesday following a series of on-chain metrics, which reveals investors in the remittance-based token held onto their assets despite the wider crypto market sell-off last week.

Floki DAO floats liquidity provisioning for a Floki ETP in Europe

Floki DAO — the organization that manages the memecoin Floki — has proposed allocating a portion of its treasury to an asset manager in a bid to launch an exchange-traded product (ETP) in Europe, allowing institutional investors to gain exposure to the memecoin.

Six Bitcoin mutual funds to debut in Israel next week: Report

Six mutual funds tracking the price of bitcoin (BTC) will debut in Israel next week after the Israel Securities Authority (ISA) granted permission for the products, Calcalist reported on Wednesday.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.