PancakeSwap reports best quarter ever in trade volume: What it means for CAKE price

- PancakeSwap trade volume hit a record $205.3 billion in Q1 2025, the highest level since the DEX’s launch in 2023.

- The DEX has recorded 81% growth in unique users and over 150% increase in transaction count between Q1 2023 and Q1 2025.

- CAKE is down 3% on the day, but is up 10% when compared to the last seven days.

- CAKE holders await the launch of PancakeSwap Infinity, an update that could act as a catalyst for the DEX token’s price.

PancakeSwap, the native token of the DEX by the same name, hit several key milestones in Q1 2025. Trade volume climbed to a record high of $205.3 billion and the exchange observed a double-digit increase in other key metrics.

CAKE wiped out 3% of its value on Thursday, hovering close to the $2 level at the time of writing.

PancakeSwap’s Q1 2025 and catalysts for gains

PancakeSwap, a decentralized exchange built on multiple blockchain platforms, has $1.644 billion in total value of crypto assets locked (TVL) on its platform. The exchange recently recorded its highest-ever quarter since inception, with $205.3 billion in trade volume and continued growth across metrics like unique user count and transaction count.

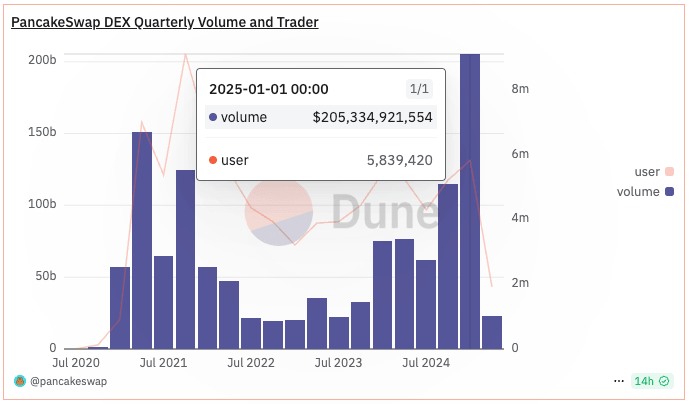

PancakeSwap DEX Quarterly volume and trader count | Source: Dune

In a press release, the DEX said that between Q1 2023 and Q1 2025, PancakeSwap has recorded a 921% increase in trade volume, 81.25% growth in unique users and 159.41% climb in transaction count. The increase in all key metrics is a sign of sustained growth in the DEX, compared to its competitors.

Key catalysts driving CAKE’s growth are:

- PancakeSwap’s position as top DEX on BNB Chain, Base and Arbitrum, Ethereum wherein cumulative trade volume is $1.14 trillion, $21.10 billion, $20.28 billion and $20 billion, as of April 24, respectively.

- The launch of recent upgrades in PancakeSwap v3 and the upcoming release of PancakeSwap Infinity, a project that aims to improve the efficiency and performance of the DEX.

CAKE price forecast

CAKE hovers around the $2 level at the time of writing on Thursday. CAKE could rally 15% and test resistance at R1, $2.256, the upper boundary of a Fair Value Gap (FVG) on the daily price chart.

Two key momentum indicators, Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), are neutral and suggest an underlying positive momentum in CAKE price trend. RSI reads 50, a neutral reading.

The $3.079 level is a key resistance for CAKE and $3.416 is the 2025 peak for the native token of the DEX.

CAKE/USDT daily price chart

CAKE could find support at $1.857, the upper boundary of the FVG between $1.857 and $1.833, if there is a crypto market crash or Bitcoin flash crash in the short term.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.