- PancakeSwap DAO has noted 70% of the CAKE holder community voting in favor of controlling inflation and reducing block rewards.

- The proposal is intended to benefit long-term CAKE stakers with a sustainable inflation rate for the token.

- CAKE price has nosedived 5.3% overnight, as holders wait and watch the results of the proposal.

PancakeSwap DAO community members are voting on a proposal to “aggressively reduce inflation” in the token. As of press time, nearly 70% of votes are in favor of the move since it supports long-term CAKE stakers.

CAKE emissions on PancakeSwap’s main liquidity pool would drop by 94% once the proposal is voted in.

Also read: Top 3 cryptos with most active developers: Cardano, Polkadot and Kusama

PancakeSwap DAO community in favor of aggressive reduction in CAKE inflation

The team behind PancakeSwap carefully considered the dialogue surrounding the unsustainable inflation rate of CAKE that required the token to see higher adoption and capital inflow for stakers to earn higher yields. A proposal to aggressively reduce inflation and transform CAKE’s tokenomics to generate higher real yield and favor long-term CAKE stakers was put forward.

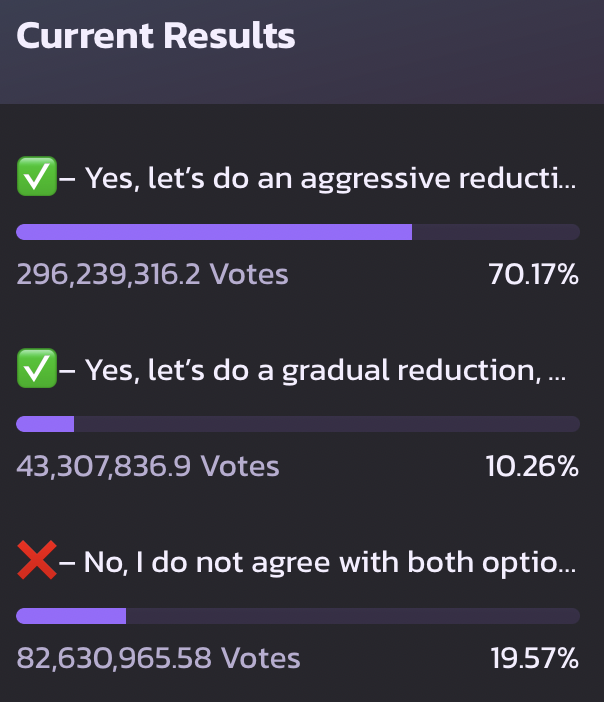

At press time, 70.17% of voters were in favor of the proposal, 10.26% agreed to a gradual and not aggressive reduction in inflation and 19.57% rejected both models.

PancakeSwap DAO vote

The proposal states that greater than 50% support for Option 1 or 2 would result in a reduction in CAKE inflation and the benefits associated with CAKE staking would continue for community members.

The response to the PancakeSwap DAO proposal is overwhelmingly positive and the development is likely to act as a bullish catalyst for CAKE price, fueling bullish sentiments among holders. Voting on the proposal ends on April 28, Friday.

What to expect from CAKE price

CAKE recently broke out of its short-term uptrend that started in July 2022 after a definitive close below the trendline as seen in the chart below.

Experts believe CAKE price is close to its buy zone, and technical analyst BlockchainSanta set a buy order for the token at $2.5. The expert recommends scooping up the DeFi token and opening long positions on CAKE, as the token is expected to recover from the recent decline and target closest resistance at $3.2.

CAKE/USDT 1D price chart

The expert is scooping up more CAKE at $2.57, until $2.5, awaiting a recovery in the asset’s price. A decline below support at $2.5 could invalidate the bullish thesis for the DeFi token and make further correction likely.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

US SEC may declare XRP a 'commodity' as Ripple settlement talks begins

The US Securities and Exchange Commission (SEC) is considering classifying XRP as a commodity in its ongoing settlement talks with Ripple Labs. The SEC is considering classifying XRP as a commodity in its ongoing settlement talks with Ripple Labs.

Ethereum developers delay Pectra mainnet launch with new testnet Hoodi

Ethereum developers announced on Thursday that they will launch a new testnet, "Hoodi," to enable validators and infrastructure providers to adequately test the upcoming Pectra upgrade before mainnet deployment, according to Tim Beiko, who runs Ethereum's core protocol meetings.

Cardano Price Prediction: ADA could hit $0.50 despite high probability of US Fed rate pause

Cardano price stabilized above $0.70 after posting another 5% decline in its 3rd consecutive losing day. Multiple ADA derivatives trading signals are leaning bullish, but the US trade war impact outweighs the positive shift in inflation indices.

Stablecoin regulatory bill receives green light during Banking Committee hearing

The US Senate Banking Committee voted on Thursday to advance the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act, which aims to establish proper regulations for stablecoin payments in the country.

Bitcoin: Will Trump's Strategic Bitcoin Reserve and White House Crypto Summit support BTC recovery?

Bitcoin price extends its decline on Friday, falling over 5% so far this week. BTC uncertainty and volatility spikes liquidated $1.67 billion as the first-ever White House Crypto Summit takes place on Friday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.