Overhyped Linkswap launch sends YFI and LINK soaring

- Another DeFi token is pumped ahead of its platform launch.

- The hype around Linkswap drives LINK to the moon.

Linkswap, a platform for automated market-making, has not been even launched, but its proprietary token YF Link (YFL) jumped by over 30% in the past 24 hours. At the time of writing, YFL is changing hands at $1,030. The coin has doubled in value over the past seven days and topped at $1,050 for the first time since the spike after the launch in September.

YFL chart (source: Coinmarketcap)

Traders believe that the coin is on the verge of a massive pump as many renowned industry experts have been touting it.

Thus, famous crypto-Twitter analyst Josh Rager noted that YFL along with several related tokens to his portfolio. He also pointed out that Linkswap would be launched in three days and he was going to stake on YFL and Linkswap along with GSWAP and LINK.

Keep an eye on this one as it's closely related to $YFL and currently at a $1.2M market cap. With initial targets at $0.60 then beyond.

Linkswap caters to LINK lovers

Linkswap is a decentralized finance (DeFi) platform for an automated market-making (AMM) that will rival Uniswap, SushiSwap and similar venues. The project team announced that they are focusing their products on so-called Link Marines, the hardcore Chainlink supporters.

The developers promised to handle the issues related to the skyrocketing Ethereum gas prices that haunted many DeFi projects. Apart from that, Linkswap will support continuous liquidity pools (CLPs) to reduce the impermanent loss for liquidity providers.

This is especially important for LINK Marines, who would rather HODL their LINK and forgo yield to stack their LINK, if the seeking of this yield could lead to potential losses of the LINK they hold so dear, they wrote in the blog post

LINK capitalizes on Linkswap's launch anticipation

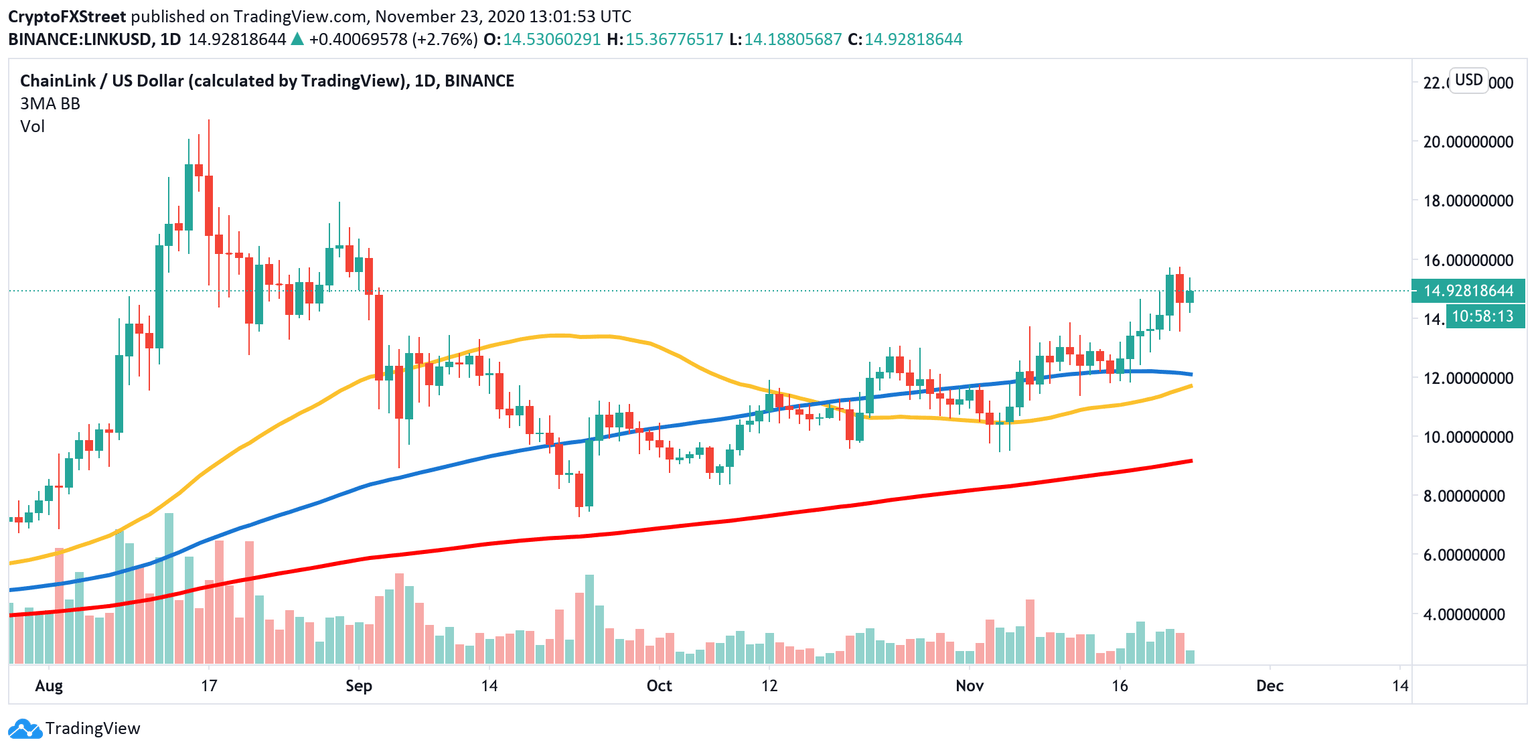

LINK is also supposed to benefit from the FOMO around Linkswap because it will be the part of most of the trading pairs on the platform. At the time of writing, LINK is trading at $15. The token has gained over 7% during the weekend and over 23% in the past seven days. Currently, LINK is the fifth-largest digital asset with a current market capitalization of $5.8 billion.

LINK/USD, daily chart

The Linkswap AMM will be launched on November 25, along with several liquidity mining fields for various less popular tokens. LINK owners will receive big bonuses and remuneration in YFL tokens. Experts believe that the anticipation of the successful start has been driving the market recently.

Recently, Linkswap announced the partnership with UniLayer that offers a new-generation trading infrastructure focused on processing limit orders within AMM systems. The token of the project, LAYER, will be supported by one of the liquidity pools.

Author

Tanya Abrosimova

Independent Analyst

%20price%2C%20marketcap%2C%20chart%2C%20and%20info%20%7C%20CoinMarketCap-637417334968512837.png&w=1536&q=95)