Over half a billion dollars in Ethereum has been burnt in the past month, ETH holders await Spot ETF approval

- Ethereum worth $583.94 million has been burnt in the past thirty days, slashing the altcoin’s circulating supply.

- Ethereum hit a new high at $4,012 on Binance, ahead of the upcoming Dencun upgrade.

- ETH holders await Spot Ethereum ETF approval by the SEC, attorney comments on likelihood of approval.

Ethereum price hit a new high of $4,012 for the first time since late December 2021, marking a key milestone for the altcoin ahead of its key upgrade. Ethereum holders are awaiting the upcoming Dencun upgrade, the most significant development since the altcoin’s migration to Proof-of-Stake.

Also read: Ethereum price tags $4,000 on Coinbase for the first time since 2021

Ethereum burn picks up pace closer to Dencun Hard Fork

Ethereum has been under the spotlight since the altcoin hit a new high on Friday, crossing the $4,000 level, on Coinbase and Binance. The altcoin made a comeback above this level for the first time since late 2021.

Ethereum had a major developmental milestone when it migrated from Proof-of-Work consensus mechanism to Proof-of-Stake, marked by the Merge. The next major milestone is the introduction of proto-danksharding, through EIP-4844, one of the improvement proposals included Dencun Hard Fork, scheduled for March 13.

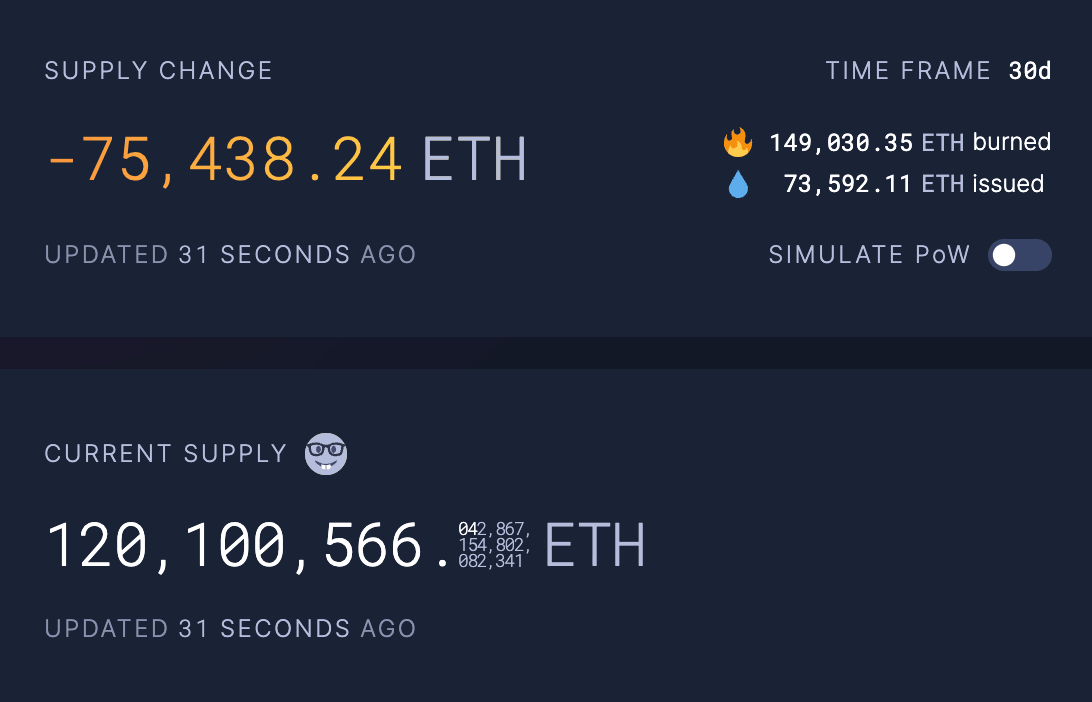

Data from ultrasound.money shows that nearly half a billion dollars in Ether have been burned in the past thirty days. This metric has significance for ETH holders since it supports the reduction of the altcoin’s circulating supply and reduces the selling pressure on Ether.

Ethereum burned in 30 days. Source: Ultrasound.money

Ethereum price gains are supported by the bullish developments in the altcoin. The next target in Ethereum’s uptrend is likely $5,000, close to the December 2021 peak of $4,936. The Moving Average Convergence/ Divergence (MACD) indicator and the Awesome Oscillator (AO) support Ethereum’s uptrend and signal that the altcoin could rally higher.

ETH/USD 1-day chart

A daily candlestick close below the 38.2% Fibonacci retracement of Ethereum’s climb to its 2024 high, at $3,307 could invalidate the bullish thesis for ETH. The altcoin could find support at the psychologically important $3,000 level if a correction ensues.

Spot Ethereum ETF approval likely?

Attorney Jake Chervinsky commented on the status of Ethereum as a commodity. The attorney states that the Securities and Exchange Commission (SEC) is less likely to follow through on its classification of the altcoin as a security, since this would conflict with the Commodity Futures Trading Commission’s authority. The CFTC has labeled Ethereum a commodity and the two entities are less likely to engage in a “civil war” like situation, says Chervinsky.

The status of Ethereum as a security or non-security has a direct impact on whether the SEC approves a Spot Ethereum ETF in May, the last deadline for the applications. Ethereum holders are anticipating an approval, and a similar impact on institutional capital inflow and is likely to act as a catalyst for the second-largest asset by market capitalization.

(This story was corrected on March 10 at 04:33 GMT to say that Ethereum price hit a new high of $4,012, not a new all-time high.)

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.