Over 80% of 2022 crypto startups are still kicking despite market chaos

More than 80% of early-stage startups that raised funds in 2022 are active today despite high-profile crypto collapses that caused the markets to plunge, according to a new report from venture capital firm Lattice Fund.

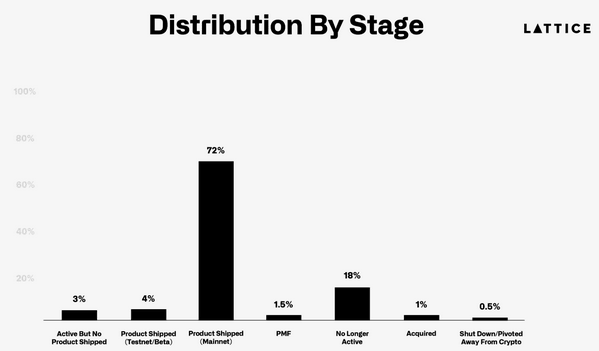

In an Oct. 1 report on startup funding, analysts from Lattice Fund said that of the more than 1,200 crypto startups that raised a collective $5 billion in funds in 2022, 76% managed to launch a product on the mainnet, although 18.5% are no longer active or have shut down.

Over 80% of startups are still active after raising funds. Source: Lattice Fund

Ethereum re-staking protocol Eigenlayer was the most successful, Lattice said, though Eigenlayer’s success in executing its go-to-market strategy and delivering a multibillion-dollar product by 2023 is a rare story among the 2022 cohort.

Only 1.5% of startups managed to find what Lattice dubbed “Product Market Fit” (PMF) and only 12% of projects managed to secure additional rounds of funding.

Infrastructure and centralized finance (CeFi) proved the most successful sectors for investment, with 80% of CeFi and 78% of infrastructure projects launching products on mainnet.

Meanwhile, gaming and the metaverse proved to be more hype than substance, with the highest failure rates among any sector.

“Chasing narratives can get you rekt,” said Lattice co-founder Regan Bozman in an accompanying post on X.

$700M went into gaming seeds rounds but Gaming & Metaverse had some of the highest fail rates and likelihood to be active without anything shipped.

Ethereum leads and Bitcoin outlasts

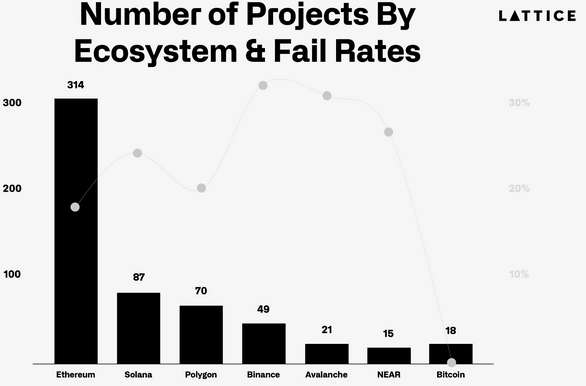

Meanwhile, data shows that Ethereum remained the preferred layer-1 ecosystem for new projects, while Bitcoin-based projects showed the highest resilience to failure.

About $1.4 billion was invested in 314 Ethereum-based projects — 18% of which failed long-term.

Ethereum dominated seed rounds, while 100% of Bitcoin projects are still active. Source: Lattice

Meanwhile, of the 18 Bitcoin-based startups that raised funds, all are still active and developing today.

The story was different for Solana. While $350 million was invested in 87 Solana-based startups, due to several external factors, including the collapse of FTX and a massive crunch in the price of the native SOL (SOL) token, 26% of projects failed to make it to 2024.

Notably, teams on Solana and Ethereum were just as likely to secure follow-on funding. In contrast, no projects building on Near, StarkNet or Flow were able to raise follow-up rounds.

Challenges ahead for the “2022 vintage”

Despite the solid performance of the 2022 cohort, Lattice analysts said the “2022 vintage” is technically in a more challenging position than firms that raised funds in 2021.

A flat market without much in the way of new retail participation can pose a challenge to startups looking to find product market fit, while an increase in the overall number of new seed-stage startups and a “tighter token launch market” means more teams will struggle to bring tokens to market and reward their investors, according to the report.

“Compounding all of those problems is that investors have moved on to the hotter sectors (e.g. DePIN & Ai) and ecosystems (e.g. Base & Monad) of today,” the report said.

This highlights that returns come not from chasing what is hot right now but from asking what will be hot in 1-2 years.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.