Over 70k LINK holders await Chainlink price to rally by 20% in order to gain profits

- Chainlink price has noted an increase of more than 8% in the last two days to trade at $5.56.

- However, investors seem highly bearish at the moment, opting to tap out while still facing losses over waiting for a rally.

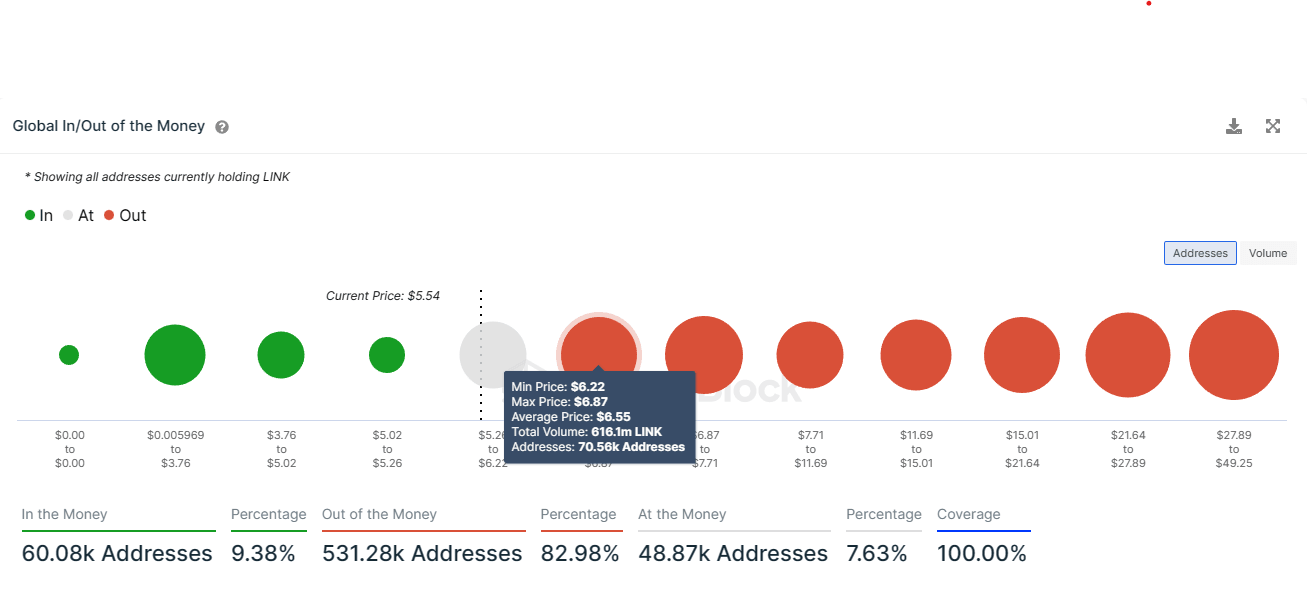

- LINK faces a demand wall at $6.55 breaching, which would turn $3.4 billion worth of tokens into profitable supply.

-637336005550289133_XtraLarge.jpg)

Chainlink price is slow in its recovery, which is impacting its investors as well, whose sentiment is turning more and more negative to the point where they chose to sell at a loss. Even now, for a chunk of the LINK holders to gain profits, they might have to wait for a while longer as a significant rally is required for it to occur.

Chainlink price rally instills hope

Chainlink price is currently trading at $5.56, having risen by more than 8% in the past two days. The altcoin is mostly primed for a further increase as the price indicators are signaling a bullish momentum building up.

The Moving Average Convergence Divergence (MACD) already observed a bullish crossover a few days ago. However, a confirmation of a bounce in price would likely be achieved when the Relative Strength Index (RSI) tests the neutral line at 50.0 and turns into a support floor.

LINK/USD 1-day chart

This would bring back the investors’ bullishness that has been lost in the bear market, as observed in their sentiment as well. Except for a few spikes early on in June, by and large, LINK holders have maintained a pessimistic outlook.

Chainlink weighted sentiment

As a result, they have taken steps that would have been less likely had they been holding out hope of a recovery. Earlier last week, LINK holders sold more than 16 million tokens worth $88 million in a day as Chainlink price traded at $5.20. This supply would have been worth more at the moment had they held on.

Chainlink supply on exchanges

But now that Chainlink price has rallied, some confidence has been restored, and investors will now wait for a rally in order to book profits. Thus the next bout of selling could come if the altcoin successfully manages to breach the $6.55 mark.

The reason behind this is the demand wall that stands at this price level, where 616 million LINK tokens were purchased by more than 70k addresses. This supply, worth about $3.4 billion at the current price, would certainly be a trigger for profit booking.

Chainlink GIOM

However, LINK holders would need to maintain their patience for a little bit longer as $6.55 stands more than 18% away. If the recovery slows down, reclaiming this price level would become significantly difficult.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B06.17.33%2C%252022%2520Jun%2C%25202023%5D-638229930330393712.png&w=1536&q=95)

%2520%5B05.54.59%2C%252022%2520Jun%2C%25202023%5D-638229930511277026.png&w=1536&q=95)