Over 50% of Ethereum’s ERC-20 tokens listed on DEXes show characteristics of pump and dump

- Ethereum-based ERC-20 tokens on DEXes with characteristics of pump and dump schemes climbed to 53.6%, according to a report.

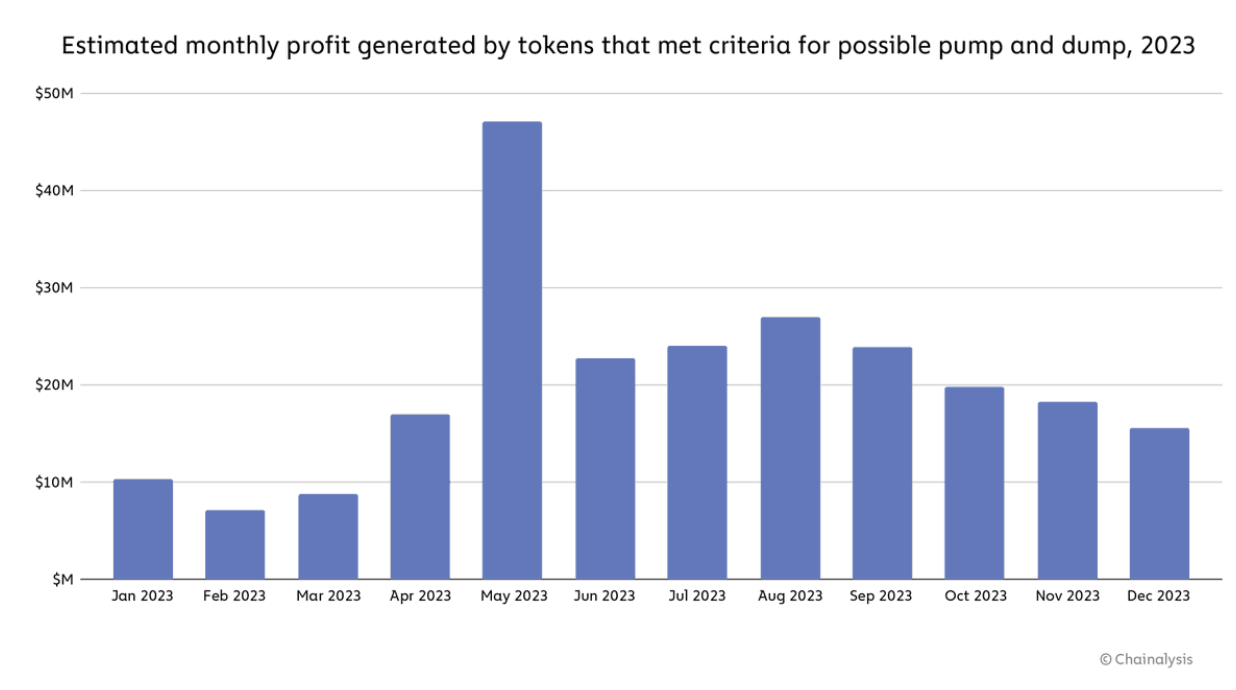

- Chainalysis report reveals that entities made approximately $241.6 million in profit in 2023 from the sales of these tokens.

- Victims of the pump and dump schemes suffer a steep decline in the value of their asset holdings.

Crypto research firm Chainalysis recently concluded research on “pump and dump” schemes that have plagued the crypto ecosystem. Pump and dumps have made a resurgence with rug pulls on Coinbase’s Base chain and Solana ecosystem’s meme coins.

The report reveals that nearly 53.6% of ERC-20 tokens on DEXes have characteristics of possible “pump and dump” schemes, according to the firm’s criteria.

Also read: Solana-related meme coins face massive price correction as initial euphoria wanes

Ethereum’s ERC-20 tokens qualify as “pump and dump” schemes

A pump and dump scheme is a scenario where an entity or a group of individuals artificially inflate the price (pump) of an asset to subsequently dump their holdings at a significant profit. The intention is to hype up the token and attract a large volume of trades from market participants, only to shed their holdings on traders when their prices rise, leaving several traders “holding their bag.”

Chainalysis used on-chain data and identified these tokens using detailed criteria like whether the token was purchased five times or more by a DEX user with no on-chain connection to large wallet holders, whether a single address removed over 70% of the token’s liquidity from DEX’s liquidity pool and whether it currently has a liquidity of $300 or less.

Number of ERC-20 tokens that meet criteria for possible pump and dump. Source: Chainalysis

The tokens identified as near scams account for just 1.3% of all DEX trading volume on Ethereum. Actors who launched their tokens, meeting the aforementioned criteria collectively amassed $241.6 million in profit in 2023 from the sale of these tokens.

Estimated monthly profit from tokens that met pump and dump criteria in 2023. Source: Chainalysis

This information is relevant to market participants as meme coins are on the rise on the Solana blockchain. Find out more about this here.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.