- ApeCoin price has been unable to mark a recovery despite the broader market supporting altcoin recovery in general.

- The decline below the $2.00 mark this week has left over 60 million APE tokens vulnerable to losses.

- Retail investors also seem to be losing their patience now as the cohort holding 10,000 to 100,000 APE dumped half a million APE tokens in 48 hours.

ApeCoin price is a saga of disappointing red candlesticks followed by some stability that eventually turned into another set of red candlesticks. The altcoin has been unable to note a recovery in the past few weeks, and the consequences are beginning to show.

ApeCoin price decline might lead to larger losses

ApeCoin price is trading at $1.87, moving sideways for the past week after losing the support of the crucial psychological support of $2.00. Even though the cryptocurrency has been stuck under the 50-day Exponential Moving Average (EMA) since mid-April, the situation is much more concerning now since a significant portion of supply is close to facing absolute losses.

APE/USD 1-day chart

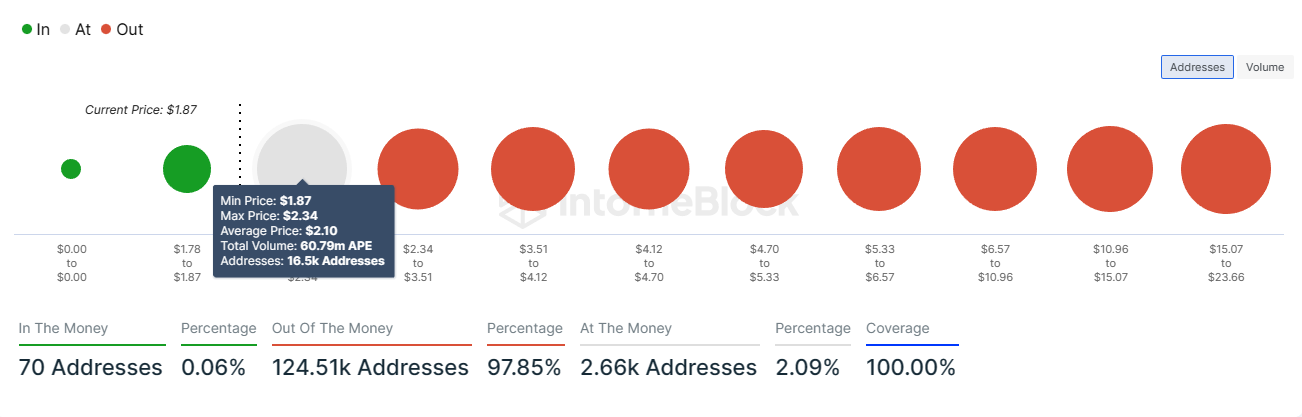

According to the Global In/Out of Money indicator, at the moment, about 60.79 million APE tokens are on the verge of being pushed to losses. The tokens bought at an average of $2.10 constitute APE that was bought at the lowest price of $1.87, i.e., the trading price. Thus a decline will result in these $109 million worth of tokens being underwater for good.

ApeCoin GIOM

Consequently, investors could sell their assets in order to offset any further losses since the altcoin is far from exhibiting any signs of recovery. As it is, retail investors’ skepticism has been evident in their behavior over the past few days.

The cohort holding between 10,000 APE to 100,000 APE sold off over 500,000 APE tokens worth nearly a million dollars over the last 48 hours, bringing their supply to 12.05 million APE.

ApeCoin supply distribution

A further decline would lead to more selling since APE is currently only dependent on broader market cues for a recovery. It is receiving no support from the NFT market despite being based on the Bored Ape Yacht Club (BAYC) NFT collection.

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ethereum Price Forecast: ETH plunges 6% following Fed rate decision, eyes a bounce at the $3,550 level

Ethereum is down 6% after the Federal Reserve hinted that it will reduce its rate cut frequency in 2025. The hawkish news has sent ETH's Weighted Sentiment to lows last seen in December 2023.

Crypto Today: Bitcoin holds $104K as XRP, AVAX and Solana traders take profits

The cryptocurrency sector valuation declined 4% on Wednesday, dropping toward $3.8 trillion. While Bitcoin price dipped 2% to consolidate around the $104,600 mark, top altcoins like XRP, AVAX and SOL suffered excess of 5% losses on the day.

Bitcoin, crypto market set for massive dump following Trump's inauguration: Arthur Hayes

Bitcoin and the crypto market could face a massive sell-off as expectations for Donald Trump's administration of pro-crypto policies could be short-lived, according to Arthur Hayes.

Shiba Inu Price Prediction: SHIB whale demand plunges as Solana memes dominate

Shiba Inu price opened trading at $0.000026 on Wednesday, its lowest opening price in 20 days dating back to November 29. On-chain data shows SHIB token struggling to attract whale demand as Solana memes dominate social channels.

Bitcoin: BTC reclaims $100K mark

Bitcoin briefly dipped below $94,000 earlier this week but recovered strongly, stabilizing around the $100,000 mark by Friday. Despite these mixed sentiments this week, institutional demand remained strong, adding $1.72 billion until Thursday.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.

%20[06.53.44,%2011%20Aug,%202023]-638273179220719338.png)