Over 1 million Ethereum tokens leave exchanges as investors grow confident of new uptrend to $3,000

- A massive exodus of Ethereum tokens from exchanges last week is a bullish signal.

- Holders of Ethereum prefer to hold rather than sell at a profit in anticipation of a bull run to $3,000.

- The TD Sequential indicator's sell signal on the 4-hour chart brings to light the increasing bearish pressure.

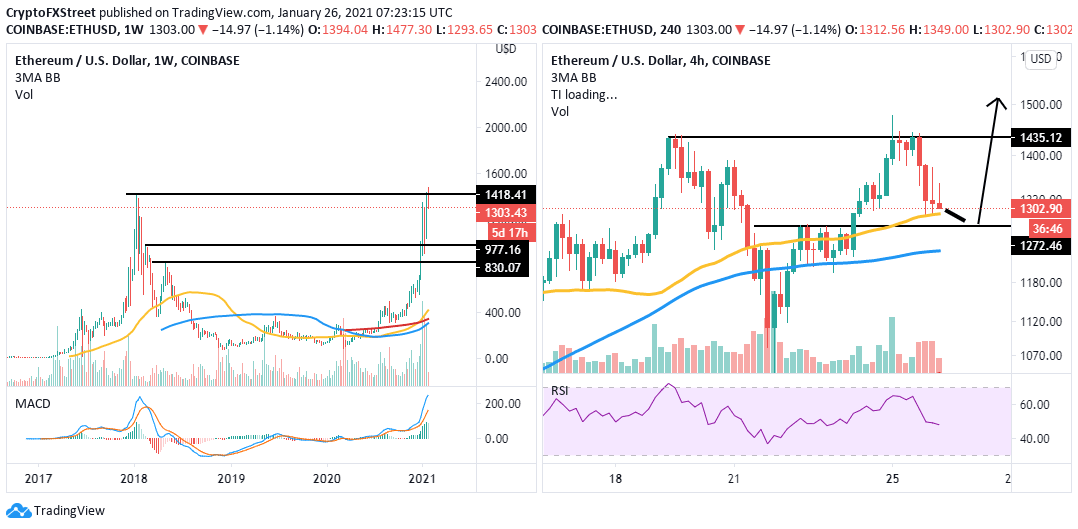

Ethereum recently rebounded from critical support at $1,000 and hit a new all-time high of around $1,477 (Coinbase). The spike in the price occurred despite a snarl-up in Bitcoin price recovery following the drop under $30,000.

Meanwhile, Ether is trading above $1,300 amid the bulls' push to resume the uptrend eying $3,000 in the medium-term. According to Glassnode, holders withdrew ETH in large numbers. This suggested that the decision to hold is in anticipation of another significant liftoff.

Ethereum exchange withdrawals soar as bullish outlook improves

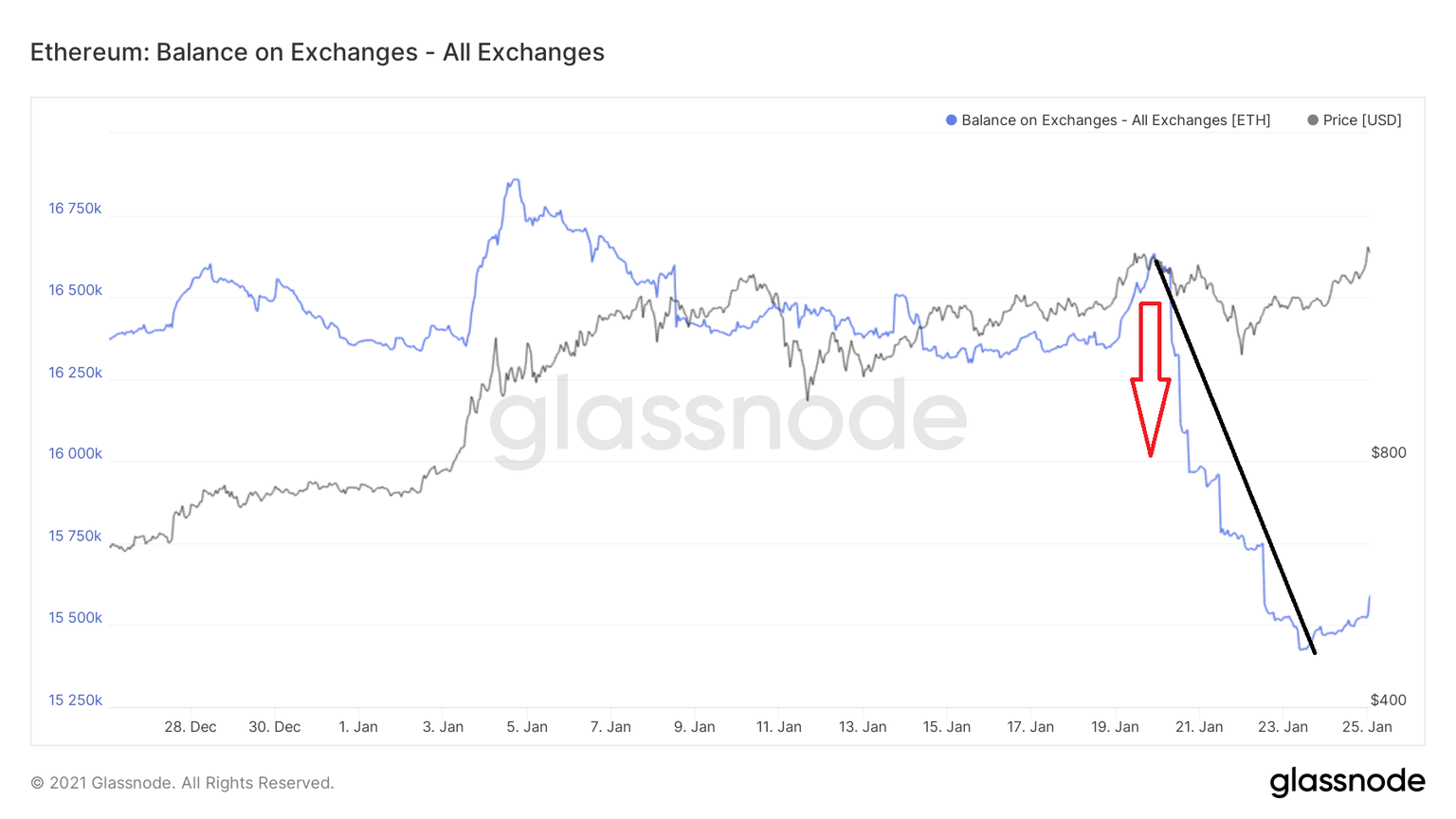

On-chain metrics provided by Glassnode show that Ethereum had large amounts of exchange withdrawals in the previous week. Roughly 1 million Ether left the exchanges amid improving investor sentiment for holding long term.

An exodus of tokens from exchanges is usually a bullish signal for a cryptoasset. Therefore, as investor confidence shoots up, it is likely that Ethereum will resume the uptrend in the near term.

Ethereum exchange withdrawals

Ethereum must defend this crucial support to sustain the uptrend

ETH is settling slightly above the 50 Simple Moving Average on the 4-hour chart. The buyer congestion at $1,300 has reinforced this support. Realize that Ether must defend this level at all costs to sustain the uptrend in the short term.

However, it is essential to realize that short-term analysis seems bearish, especially if support at the 50 SMA caves. The short term losses could retest the support at $1,272 before resuming the uptrend (4-hour chart).

A bounce from this support may see Ethereum complete the leg to new record highs. An increase in buying pressure, boosted by the desire to hold, could see Ethereum hit price levels around $3,000.

ETH/USD price chart

Looking at the other side of the fence

The TD Sequential indicator recently presented a sell signal on the 4-hour chart. The call to sell took the form of a green nine candlestick. If the overhead pressure continues, Ethereum may overshoot the support at $1,272 and revisit the anchor at the 100 SMA.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren