Options markets show less enthusiasm on BTC halving

Key takeaways

-

Options traders seem constructed some less bullish setups for the upcoming halving.

-

At the same time, traders seem willing to pay higher premiums to bet on a price drop on BTC.

-

Traders seem to focus more on hedging downside risks rather than speculate.

Overview

Bitcoin reward halving has been one of the most anticipating events in the crypto space this year. Market watchers have been counting down forthe reduction of the block reward from 12.5 BTC per block to 6.25 BTC per block. One of the most common narratives in the market is that halving could fuel the next bull run. How can traders play such an event?What kind of information thatoptions market data could revealin terms of the possible price actions and the market sentiment during the pre/post-halving periods?

Medium-dated, slightly ITM options in favor

It is interesting to observe how options traders have been structuring their trades because their setups could reveal valuable information on how they see the markets, as well as what strategies they have been applied. This information could be helpful even for individual market participants.

What we can see now is that,seems like options traders have been taking a more conservative stance on the upcoming halving. Data from Skew shows that traders seem mostly using June contracts as their instrument to speculate BTC prices during the halving period.

While contracts that expire in mid-May with the same strike price may provide higher leverage and lower cost than contracts that expire in June, however, traders seem willing to pay a higher premium to get into the market. This phenomenon could indicate that options traders may not be as bullish on the BTC prices during this halving period.

Figure 1: BTC Options OI by Expiry (as of Apr 28) (Source: Skew)

Figure 2: BTC Options OI by Strike (as of Apr 28) (Source: Skew)

This cautious view may also reflecton how traders pick their options strike price. Figure 2 shows that most of the options open interest were with a strike price of around 7000.

Traditionally, an investor that wanted to have less risk exposure might pick for a call option with a strike price at or below the spot price of the underlying. Meanwhile, a trader with higher risk tolerance may favor a strike price above the spot price of the underlying.Likewise, a put option strike price at or above the spot price is more conservative than a strike price below the spot price.

So, from a call buying perspective, a call option with a strike price at 7000 is a slightly ITM option, which may able to capture the potential upsides when the BTC prices go up. However, a more bullish trader may prefer an OTM option with a higher strike price, which able to give higher leverage. Though, it seems that this is not the case here.

From a put writing perspective, a put option with a strike price at 7000 is an OTM option contract, which may have a higher risk nature than ITM puts. However, traders seem still willing to expose to some higher risksto bet on BTC prices will go down in the medium-term. Of course, there could be some other reasons behind it. For example, traders wanted to hedge the BTC long positions, or even hedging with their long-dated OTM calls.

To summarize, the expire date and strike price data seems painted a picture that 1.) options traders have been taking a relatively conservative approach when it comes to the possibility of having a short-term halving fuelled BTC rally. 2.) options traders seem to have slightly more confident that BTC prices could drop in the time frame of about two months.

Hedge rather than speculate

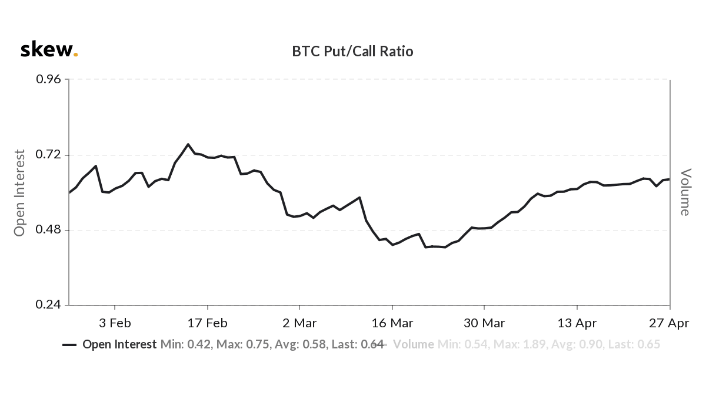

Another piece of data that market watchers do not want to miss is the BTC put/call ratio, and that could be another indication pointing to a not so bullish direction.

Data from Skew shows that BTC put/call open interest ratio has been rising since mid-March. Although it has been slowing down, it has been getting closer to the pre-selloff levels in February.

The put/call open interest ratio gauges the number of put options open relative to call. A rising ratio could suggest that options traders seem to have been focusing on hedging the downside risk of BTC prices, rather than setting up for speculative trades.

Figure 3: BTC Put/Call Ratio (as of Apr 28) (Source: Skew)

Figure 4: BTC ATM Implied Volatility (as of Apr 28) (Source: Skew)

Implied volatility could be another piece of data that could give us a glimpse of how options traders see the market.

The level of the implied volatility signals how traders may be anticipating future movements of the underlying, in this case, BTC. Options that have a rising IV could indicate that investors have been expecting the underlying to experience higher price fluctuations relative to their historical range. Likewise,contracts with decreasing IV could mean that investors have been expecting the underlying to have lower price volatility.

Figure 4 shows thatIV of BTC has been broadly decreasing since late March and has been continuing that way. We believe that this decrease was partly because the market has been recovering from the March selloff, as the prices started to stabilize, the expectations of having more significant price swings lowered. However, halving also did not bring up traders’ expectations of having some big moves in price either. The lowering IV seems reinforcing the case of halving becoming a "non-event."

Conclusion

Many of the data from the options market seem to show that traders were not very bullish on BTC prices during this halving period.Their strategy seems more focus on hedging the downside risks, rather than betting on higher BTC prices. However, the option data may not be able to provide a complete picture in terms of market sentiment, that is because many investors also have been using options as part of their hedging strategy.

Author

Cyrus Ip

OKEx

Cyrus Ip has the privilege to work with OKEx as a Research Analyst, where he found some of the brightest talents in the crypto space.