Options market signals sharp decline in Bitcoin, Ethereum prices while meme coins see gains

- Bitcoin and Ethereum’s large-scale liquidations on Binance and on retail-heavy exchanges likely ushered the recent price decline.

- Nearly $157 million in derivatives positions were liquidated within an hour on Tuesday.

- Solana-based meme coins Book of Meme, Catwifbag and Tombili the Fat Cat posted double-digit gains.

The crypto options market is known to provide early signals to corrections in the spot market. Analysts at the crypto trading firm QCP Broadcast said on Tuesday that the liquidations in the derivatives market signaled the recent Bitcoin (BTC) price decline below $66,000 and Ethereum (ETH) price drop to $3,320.

Meanwhile, Solana-based meme coins yielded gains in the past day despite the market-wide correction.

Options market predicts correction in BTC, ETH prices

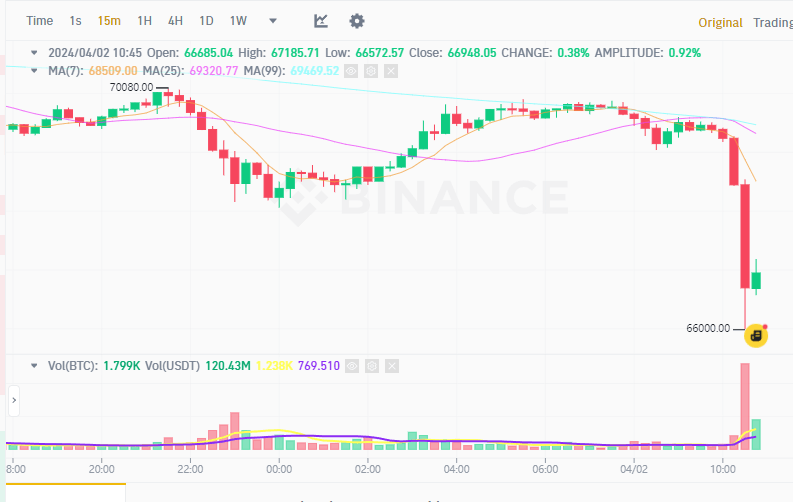

Bitcoin price declined to as low as $66,000 early on Tuesday on Binance, one of the largest centralized exchanges. Ethereum, the second largest cryptocurrency by market capitalization, briefly dropped to $3,319, and cryptocurrencies suffered $157 million in liquidations.

Analysts at QCP Broadcast said in a Telegram post that the speed of Bitcoin and Ethereum’s price decline on Tuesday was due to large-volume liquidations on retail-heavy exchanges. Further, the perpetual funding rate on platforms like Binance dropped from as high as 77% to flat, stressing asset prices in the spot market.

BTC/USD 15-minute price chart

QCP Broadcast analysts expect Bitcoin and Ethereum prices to trade sideways after the correction.

Meme coins gain from whiplash in Bitcoin and Ethereum

The correction in Bitcoin and Ethereum prices was followed by likely capital rotation into meme coins as Solana-based assets noted double-digit gains on Tuesday. Data from CoinGecko shows Tombili the Fat Cat (FATCAT), catwifbag (BAG), BaoBaoSol (BAOS), Cat in a dogs world (MEW) and Book of Meme (BOME) prices rallied between 10% and 52% in the past 24 hours.

Solana-based meme coins

In the ongoing market cycle, meme coins have yielded consistent gains for traders during corrections in large assets. However, they have also registered sharp corrections afterwards. Meme coins are typically more speculative than other cryptocurrencies and investors need to be careful of rug pulls, pump and dump schemes and mass sell-offs when trading these tokens.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.