- Optimism, Yield Guild Games, and Singularity NET have cliff token unlocks scheduled this week, posing bearish clouds on prices.

- Large token unlocks typically free up liquidity, thereby increasing selling pressure on assets within two weeks of the unlock event.

- OP, YGG, and AGIX have noted similar token unlock events, with nearly complete recovery of asset prices post two weeks.

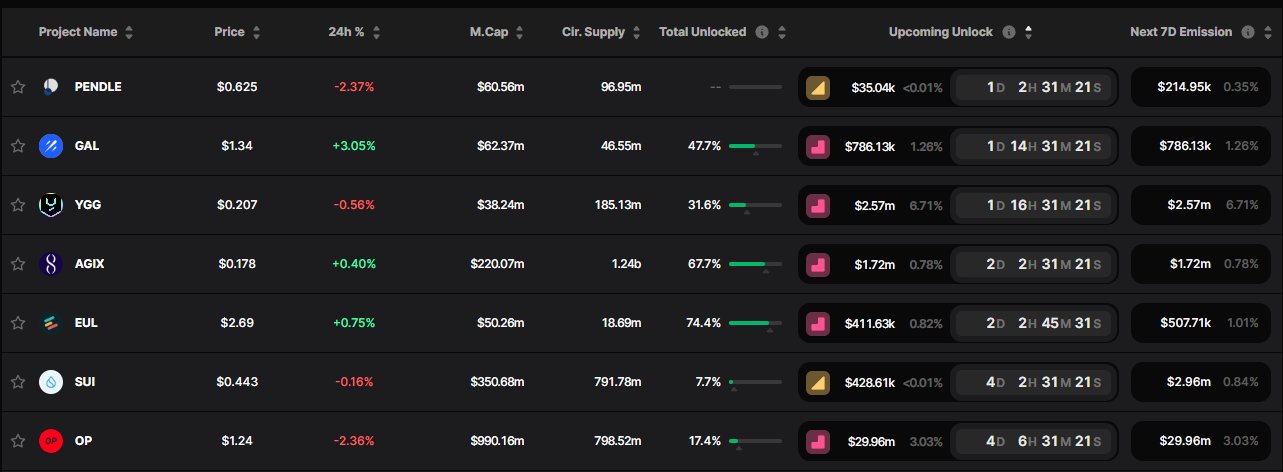

This week will see cryptocurrency token unlocks worth approximately $40 million unleashed to the market after their individual vesting periods. Out of these, almost $30 million will be from the Optimism (OP) network, while $2.56 million and $1.72 million will be from the Yield Guild Games (YGG) and SingularityNET (AGIX) networks respectively.

OP, YGG, AGIX prices brace for impact as millions of tokens set for unlocks

Optimism, Yield Guild Games, and SingularityNET ecosystems have massive token unlocks slated for later this week. Up to 12.42 million YGG tokens will be unlocked on September 27, a day before 9.68 million AGIX tokens are unleashed to the market. On September 30, 24.16 million OP tokens will flood the market. These constitute 6.7%, 0.8%, and 3.0% of their individual circulating supplies.

The events are expected to impact the tokens’ prices because their allocations are likely to inspire seller momentum as recipients look for a quick profit. For the Optimism network, the tokens will be split between core contributors and investors, while for the AGIX ecosystem, the tokens will go toward the AGIX/ADA liquidity.

Regarding the YGG project, tokens will be allocated to the community, investors, treasury, and founders. For the latter, while the treasury and founders may not be eager to sell, the community and investors are likely to pull the trigger as they look to escape being trapped in exit liquidity.

Potential impact on price

With token unlocks typically presenting as bearish catalysts, the events underline the anticipated slump in prices. For the Optimism token, previous cliff unlocks recorded an average of 15% in price shifts, with a run-up countered by a quick correction.

OP/USDT 1-day chart

On the Yield Guild Games camp, a similar outlook was presented, with YGG price losing all the ground covered ahead of the unlocks as the increased supply provoked massive exits with token holders looking to escape more losses.

YGG/USDT 1-day chart

As regards the SingularityNET price, AGIX suffered just as much, with an almost immediate fallout.

AGIX/USDT 1-day chart

Meanwhile, other networks also have unlock events slated for some time in the week, starting with Pendle, expected to give liquidity incentives in a few minutes from now, constituting up to 56,720 PENDLE tokens. On October 1, the 1Inch network also has an unlock event planned, that will see 15,000 1INCH tokens worth approximately $3,930. This will be a day after the Acala network unleashes 27.43 million ACA tokens worth around $1.35 million to the market.

Huge token unlocks this week

Data by The Tie, a crypto intelligence tracker, shows a steady and sustained increase in trading volumes around token unlocks dates, pointing to volatility. This leaves the onus on traders to exercise caution to avoid being caught on the wrong side of the wave.

Cryptocurrency metrics FAQs

What is circulating supply?

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. Since its inception, a total of 19,445,656 BTCs have been mined, which is the circulating supply of Bitcoin. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

What is market capitalization?

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value. For Bitcoin, the market capitalization at the beginning of August 2023 is above $570 billion, which is the result of the more than 19 million BTC in circulation multiplied by the Bitcoin price around $29,600.

What is trading volume?

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

What is funding rate?

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin (BTC) price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot Exchange Traded Funds (ETFs) in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.