Optimism, Sui, Hedera prices brace for over $138 million worth in token unlocks

- Optimism, Sui and Hedera will collectively unlock tokens worth over $138 million this week, with DYDX and 1INCH also on the line.

- Large token unlocks typically free up liquidity and increase selling pressure on assets within two weeks of the unlock event.

- OP, HBAR and DYDX have noted similar token unlock events in the past, with nearly complete recovery of asset prices post two weeks.

Crypto tokens worth more than $150 million are set to be unlocked this week, $138 of them from projects such as Sui (SUI), Optimism (OP) and Hedera (HBAR), according to data from Token Unlocks. Prices of both OP and HBAR slid ahead of this week’s cliff token unlocks, which could increase the selling pressure as they will release more than 3% of the assets’ circulating supply.

Token unlocks are typically considered as bearish events for the assets involved. bBased on the price charts of OP, HBAR and dYdX (DYDX), the upcoming unlocks accentuate the existing downward trend in prices.

Also read: Crypto token unlocks in August: SAND, WLD, AVAX, OP, INJ

Scheduled cliff unlocks lined up for OP, HBAR, SUI this week

Token unlocks are scheduled and staggered releases of assets that were frozen previously to protect early investors from sell-offs. Cliff unlocks involve the unfreezing of tokens immediately after a fixed period of time.

OP, HBAR and SUI tokens total to $138 million in cliff unlocks this week. Other notable unlocks will come from DYDX, 1INCH. Meanwhile, Aptos (APT), and ApeCoin (APE) are lined up for September.

OP, HBAR and DYDX have registered similar token unlock events in the past giving some clues about the expected reaction from market participants and the impact on the asset’s price.

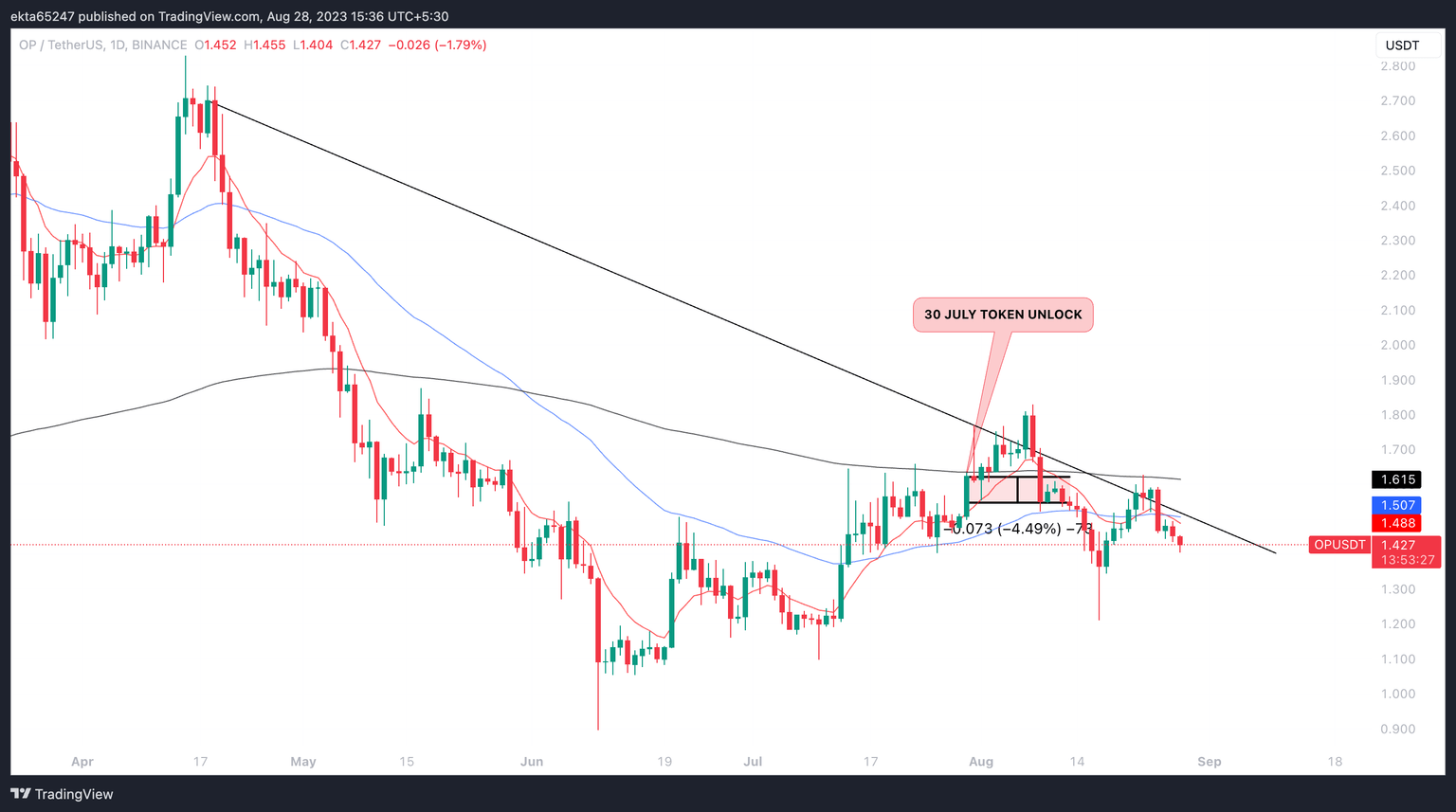

On July 30, Optimism unlocked 24.16 million tokens, or 3.37% of the circulating supply, and distributed it to core contributors and investors of the project. OP price did not decline in the first week following the unlock, but it did during the second one, yielding nearly 5% losses for holders. In the days leading up to the next OP unlock due Wednesday , OP price is in a downward trend.

OP/USDT one-day price chart on Binance

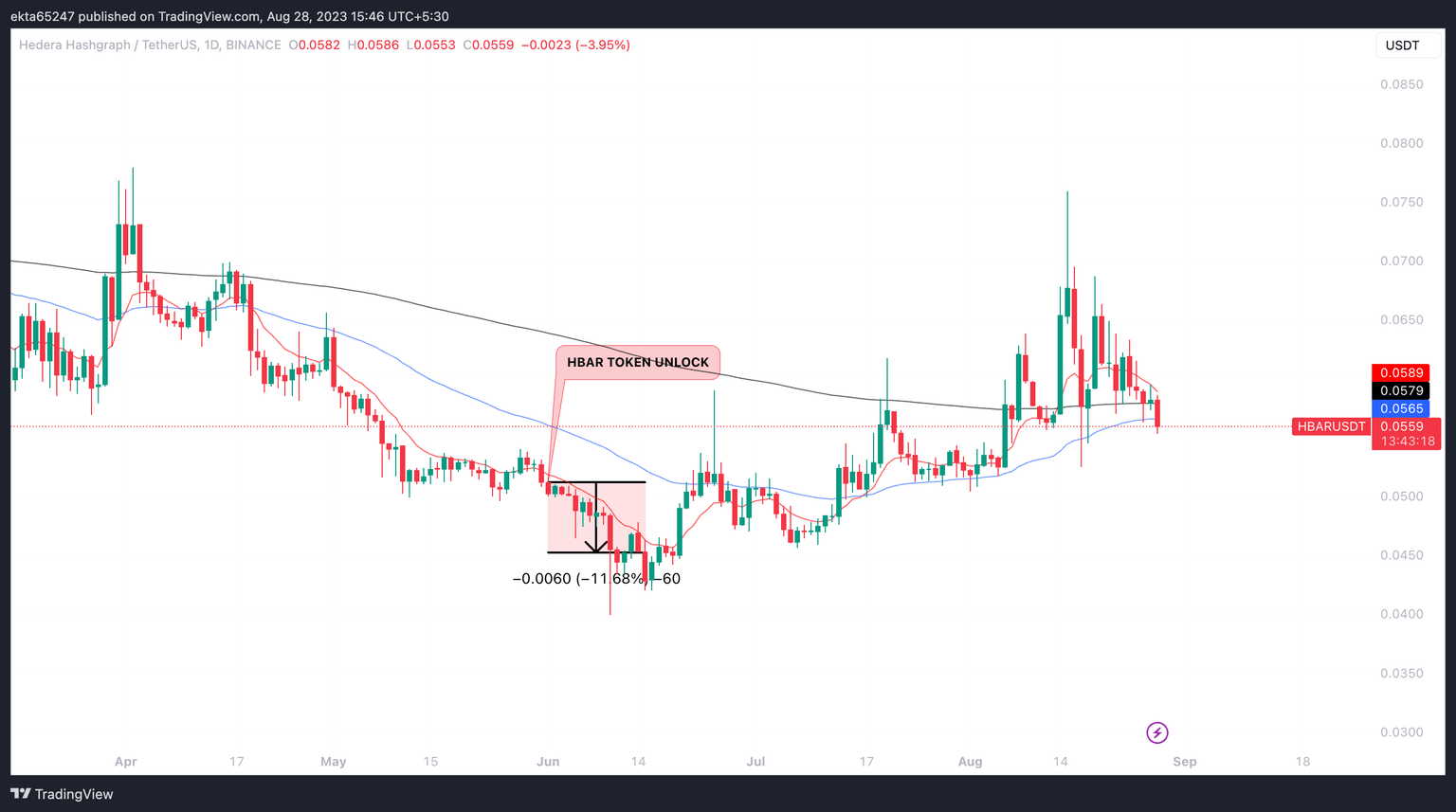

On June 1, HBAR unlocked 1.27 billion tokens, a similar distribution as the one scheduled for September 1. The September unlock will release 1.15 billion HBAR tokens worth $64.2 million, or 3.48% of the circulating supply. HBAR price declined nearly 12% in the two weeks that followed June’s token unlock.

In the week leading up to the September 1 unlock, HBAR price is in a downward trend and the unlock could increase selling pressure on the asset, driving prices lower.

HBAR/USDT one-day price chart on Binance

For DYDX, the token’s price remained nearly unchanged in the two weeks following the August 1 unlock. A similar impact can be expected from Tuesday’s unlock of 6.52 million tokens. dYdX has plans to fully operate on the Cosmos blockchain before the end of September, with a fully decentralized version 4 of the exchange platform. Find out more about the release here.

SUI unlock, scheduled for Thursday, is a key milestone for the project as 1 million tokens are added to staked subsidies. SUI’s total value locked on the blockchain (TVL) has doubled from $11.82 million at the start of July to $24.17 million.

Other notable unlocks: APE, APT, 1INCH

ApeCoin (APE), Aptos (APT) and 1inch Network (1INCH) token unlocks are lined up for September 17, September 12 and August 31 respectively. For 1INCH and APT, less than 3% of the circulating supply is set to be unlocked. These lower releases are less likely to hit prices. However, in September APE will unlock 4.54 million APE tokens worth $57.25 million, or 11.02% of the circulating supply, an event that has the potential to move prices. A similar event occurred on August 17, unlocking 4.23% of the token’s supply, and APE price dropped by 17.3% in the next 11 days, driving prices lower. However, the distribution of the unlocked tokens was slightly different.

APE token unlock event on August 17 and the upcoming unlock on September 17

The difference between the allocations is one group of launch contributors is added in the upcoming event. Still, If the pattern repeats, the September 17 unlock could drive APE price lower in the two weeks after the event.

According to research from crypto intelligence tracker The Tie, there is an increase in trade volume during token unlocks This implies increased volatility, so traders need to be cautious before opening new positions in these assets and take note of the price impact of previous unlocks.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Like this article? Help us with some feedback by answering this survey:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.