Optimism price remains an outlier as altcoins trade higher with OP missing out on recovery

- Optimism shows more downside moves, while competitors like Altcoin or Lido Dao print higher numbers for the week.

- OP sees selling pressure build as price action tanks again this Tuesday.

- Expect to see a slide below $1.50, bearing a 10% loss.

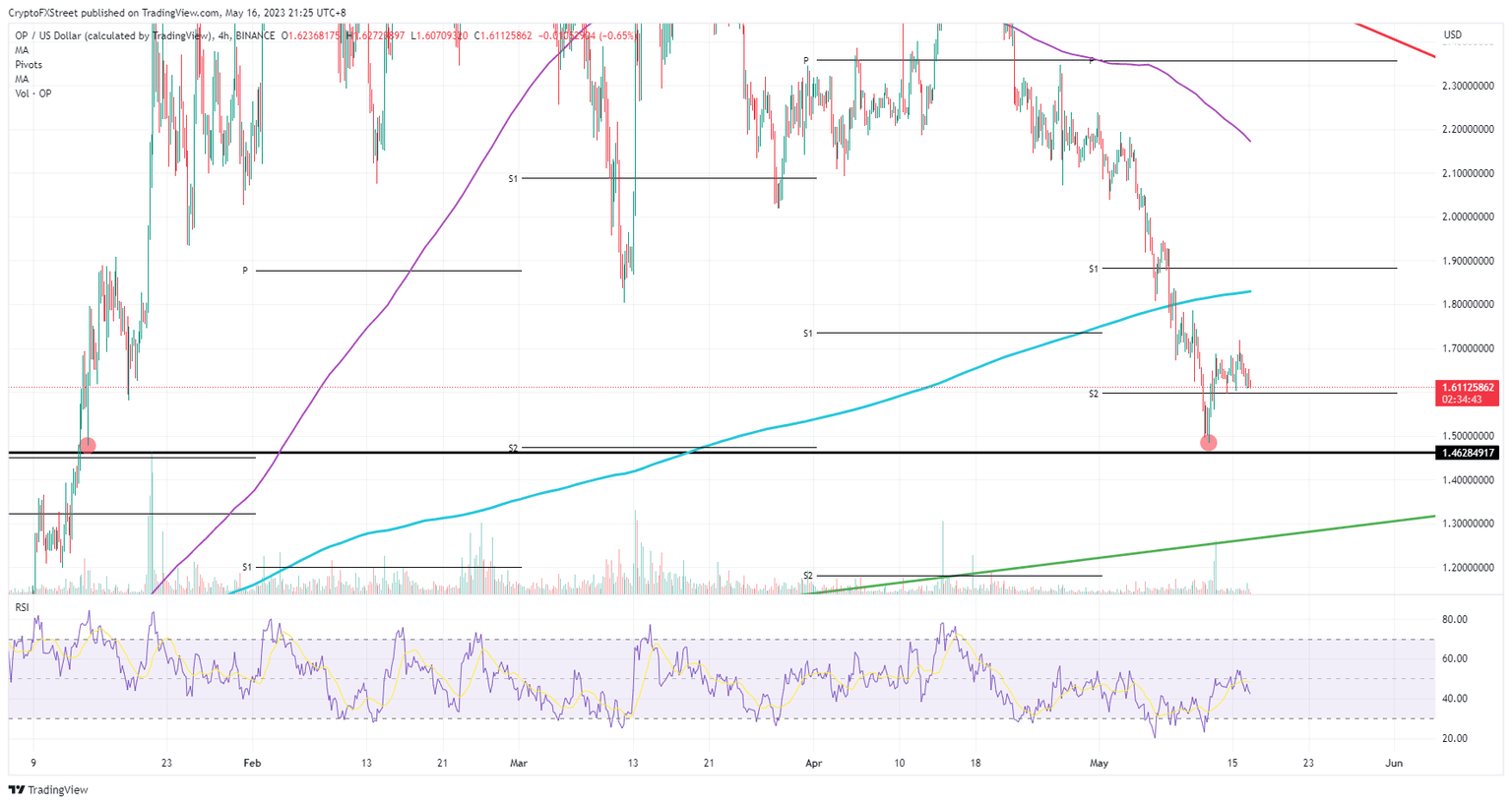

Optimism (OP) price is an outlier in the altcoin space where siblings like Altcoin or Lido Dao print staggering performances for the week with strong recoveries and a paring back of incurred losses from earlier this month. OP is rather looking further to the downside as bears are banging again on the monthly S2 support at $1.61. Should the support give way under the relentless selling pressure, more downside room points to $1.46 with a new low for May at hand.

Optimism continues to offer more downside prospects

Optimism price was bound to head higher with other altcoins to make a recovery this week after the steep decline since the beginning of May. Unfortunately, a small peak at $1.70 is the only notable element as from then on price action has been moving back to the downside. The Relative Strength Index (RSI) looks to confirm this outlook as it slips below 50 and still has room to move toward the oversold area.

OP is thus not bearing a positive outlook for this week as a 10% loss is projected, while some altcoins bear a positive outlook of 20% or even 60% to the upside. Between the current price near $1.61 and the price target to the downside at $1.46, the forecast holds a 10% loss. By that time, the RSI will have touched the oversold barrier but will have printed a new low since mid-January of this year.

OP/USD 4H-chart

A bounce could still come in a delayed effect as altcoins would pick up the red lanterns in their performance. The monthly S2 support could head higher once $1.70 gets challenged to the upside. From there, $1.80 looks to be the next candidate with the 200-day Simple Moving Average (SMA) as the cap on the topside.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.