Optimism price rally gets boost from OP token accumulation

- Crypto wallet associated with a digital asset firm scooped up nearly $10 million in OP tokens from Binance.

- Optimism trade volume climbed to its highest level in three months, early on Monday.

- OP price rallied nearly 20% over the past week.

Optimism, a Layer 2 protocol, noted a spike in its accumulation by digital asset firm, Amber Group. The token’s on-chain metrics support a bullish thesis for the asset. The token’s price climbed 50% over the past 30 days, yielding gains for the Layer 2 token’s holders.

Also read: Cardano could face downward correction as whale activity signals increasing selling pressure

Optimism accumulation by institutions and traders

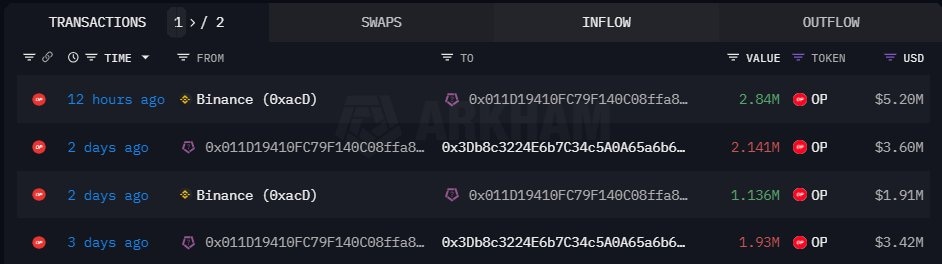

The Layer 2 token noted accumulation by both institutional investors and traders. Based on data from on-chain tracker Data Nerd, a wallet address associated with the Amber Group, withdrew 2.84 million OP tokens from Binance. The Amber Group has accumulated a total of 5.37 million OP tokens, worth $9.37 million in the past three days.

OP token accumulation

Typically, removal of OP tokens from crypto exchanges is bullish for the asset, as it reduces the selling pressure on Optimism. The Layer 2 blockchain token’s on-chain metrics support a bullish outlook on OP price.

Traders in three different segments, 1,000 to 10,000, 10,000 to 100,000 and 1 million to 10 million, added OP to their holdings, as seen in the chart below. Accumulation by these three tiers of OP token holders supports the token’s price gains.

OP token accumulation

Bullish on-chain metrics support OP price gains

The trade volume of OP climbed consistently over the past three months, based on data from crypto intelligence tracker, Santiment. OP trade volume nearly doubled since August. From 128.84 million in August to 259.48 million, early on November 13, the trade volume has increased two fold.

OP trade volume (MA30) and price

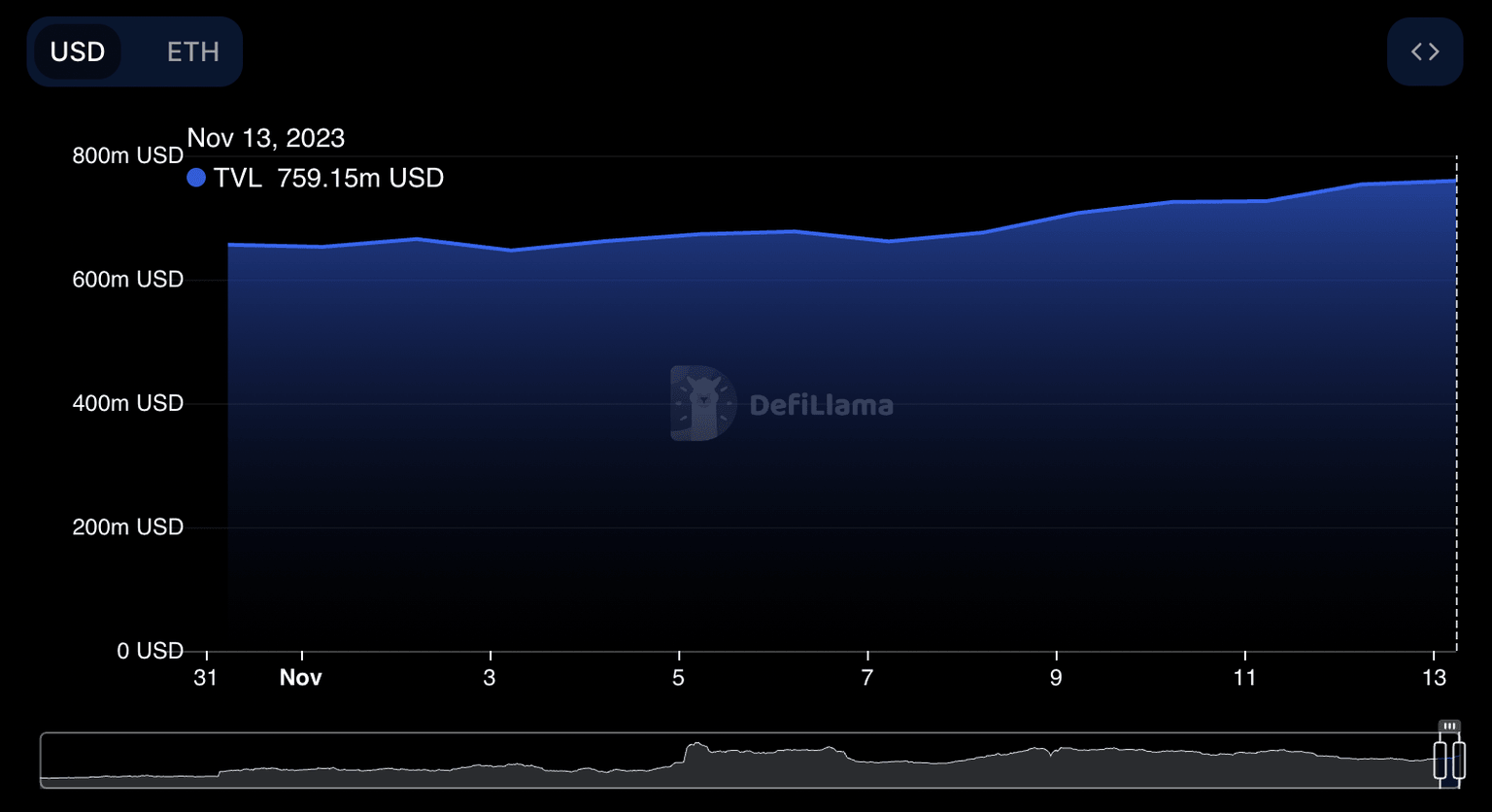

The Total Value Locked in Optimism climbed 16.81% between November 1 and 13, according to data from DeFiLlama. This signals rising demand and relevance of the token, among market participants.

OP TVL on DeFiLlama

At the time of writing, OP price is $1.843, yielding 1% gains on the day. The token’s weekly gains of nearly 20% are likely sustainable.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.

%2520%5B10.46.55%2C%252013%2520Nov%2C%25202023%5D-638354513894114570.png&w=1536&q=95)

%2520%5B10.37.17%2C%252013%2520Nov%2C%25202023%5D-638354514285697243.png&w=1536&q=95)