Optimism Price Prediction: OP range tightens before 20% rally

- Optimism price has been consolidating below the daily resistance level of $1.86 for nearly seven months.

- A decisive flip of this level into a support floor could kickstart a quick 23% rally to $2.30.

- A daily candlestick close below $1.46 will create a lower low and invalidate the bullish thesis for OP.

Optimism (OP) price has been sitting below a key resistance level for nearly seven months with no signs of breaking out. While many newly listed altcoins are pumping, major altcoins in the Layer 2 sector have not received the memo yet. Like Arbitrum, Optimism price also remains sideways.

Also read: Optimism price slips under critical support as $40 million worth of OP due to flood market Thursday

Optimism price could breakout soon

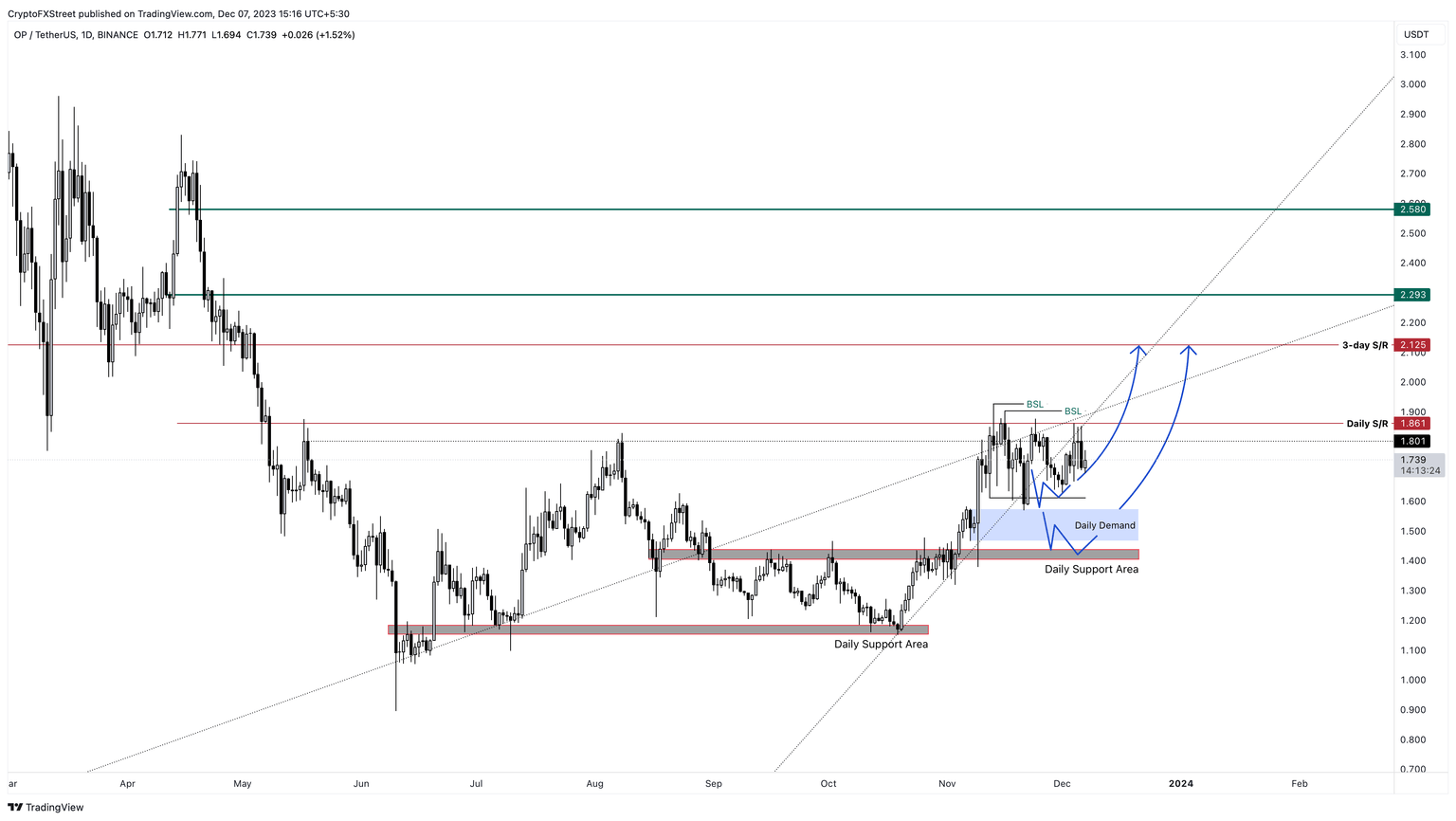

Optimism price has traded below the $1.86 resistance level for nearly seven months and is currently showing signs of breaking out. After creating multiple higher lows below $1.86, it looks like OP is primed for a breakout.

A decisive flip of the $1.86 hurdle into a support floor will confirm a breakout. In such a case, Optimism price could rally 14% and tag the $2.12 resistance level. Beyond this barrier lie two key levels – $2.29 and $2.58.

A retest of the $2.58 level would constitute a 38% gain and is where OP would likely consolidate before eying its next move.

Supporting this outlook are the Relative Strength Index (RSI) and the Awesome Oscillator (AO), both of which have reset at their respective mean levels of 50 and 0. This move suggests a reboot of momentum, giving OP bulls an opportunity to restart their ascent.

OP/USDT 1-day chart

While the outlook for Optimism price is bullish, investors need to be cautious about the flip of the RSI and AO below their mean levels. If this move occurs, it would suggest that the momentum is shifting from bullish to bearish.

If Optimism price flips the $1.45 to $1.57 demand zone into a resistance level, it will create a lower low and invalidate the bullish thesis. In such a case, OP could slide lower and find support around $1.40.

Read more: Optimism price sees 53% increase in two months, but profits remain bleak

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.