- Optimism price has been in a downtrend since the beginning of August, with no recovery noted recently.

- Whale addresses in the same duration have seen a significant increase in their OP holdings.

- The short-term traders have also risen in terms of concentration, making the altcoin vulnerable to minimal growth.

Optimism price, unlike the rest of the market, did not note any recovery in the past couple of days and has instead been stuck in a downtrend for August and September. Interestingly, this price action did not induce any bearishness in the investors’ behavior but did make it slightly difficult to note a recovery.

Optimism price holds a bearish stance

Optimism price trading at $1.28 at the time of writing has been stuck under the 50-, 100- and 200-day Exponential Moving Averages (EMA) for nearly the entire September. At the moment, the 50-day EMA is in confluence with the resistance level of $1.36, suggesting that it might be difficult for OP to break this bearish stance.

This makes OP more likely to continue its drop since the Relative Strength Index (RSI) is also below the neutral line of 50.0. In such a case, a drawdown to $1.06 is not too far-fetched. However, losing this support level might prove to be rather devastating for the altcoin investors.

OP/USD 1-day chart

Nevertheless, a bounce back could lead to a recovery in Optimism price, potentially even pushing the altcoin to breach the aforementioned resistance levels. Should OP flip $1.3 into a support floor, the bearish thesis would be invalidated.

Whales bank on the low prices

Optimism whales have been making the most of the current market conditions, stacking up OP for the past two months. The addresses holding between 10,000 OP and 10 million OP have observed an increase of 150 million OP between August 1 and the time of writing. Up from 546 million OP, the addresses collectively hold about 696 million OP presently, which is a sizeable accumulation.

Optimism whale holdings

These whales are bound to make some significant profits once the price rises beyond $1.36. But another challenge for Optimism price before it can make the rise is the increase of short-term traders.

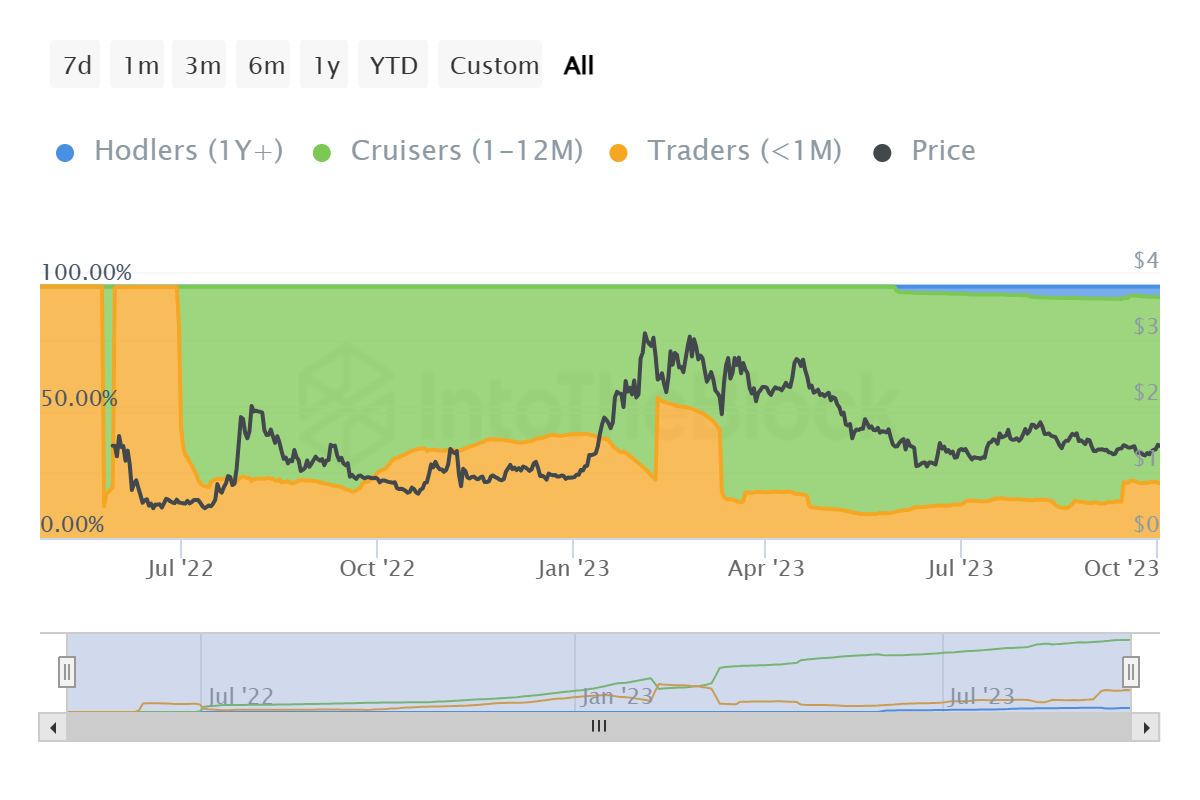

Between September and October, short-term traders (those who hold assets for less than a month) have seen an 8% increase in their domination among OP holders. Usually, the increase in this investor type is not the best thing for an altcoin since it makes the asset vulnerable to a price decline caused by sudden selling.

Since presently, short-term traders amount for 21% of all the OP holders, it does make Optimism price susceptible to an unprecedented swing.

Optimism investor distribution

Thus, investors looking to jump in like the whales to make profits off the low prices are advised to watch out for the short-term traders' behavior.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Could a Solana ETF debut in 2025? Expert weighs in

Solana (SOL) made the rounds across crypto communities on Friday as key executives from VanEck and BlackRock gave contrasting views on the possibility of a SOL exchange-traded fund (ETF) launching in the US.

Cardano Price Prediction: ADA soars 18%, eyes $0.8104 following increased buying pressure and recent rumors

Cardano (ADA) is up 18% on Friday following rumors of the federal government leveraging its blockchain to build a blockchain-based election voting system.

Ethereum Price Forecast: ETH could stage 60% rally despite recent decline

Ethereum (ETH) is trading near the $3,000 psychological level on Friday, as its rising exchange reserve and declining network fees hint at potential reasons for its recent price decline.

EU’s strict screening measures signal a regulatory shift in crypto

The European Banking Authority (EBA) has released guidelines to enhance compliance for financial institutions, payment service providers (PSPs) and crypto asset service providers (CASPs) in the European Union (EU).

Bitcoin: New high of $100K or correction to $78K?

Bitcoin surged to a new all-time high of $93,265 in the first half of the week, followed by a slight decline in the latter half. Reports highlight that Bitcoin’s current level is still not overvalued and could target levels above $100,000 in the coming weeks.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.

%20[06.40.06,%2004%20Oct,%202023]-638319809934966901.png)